What is EasyFin?

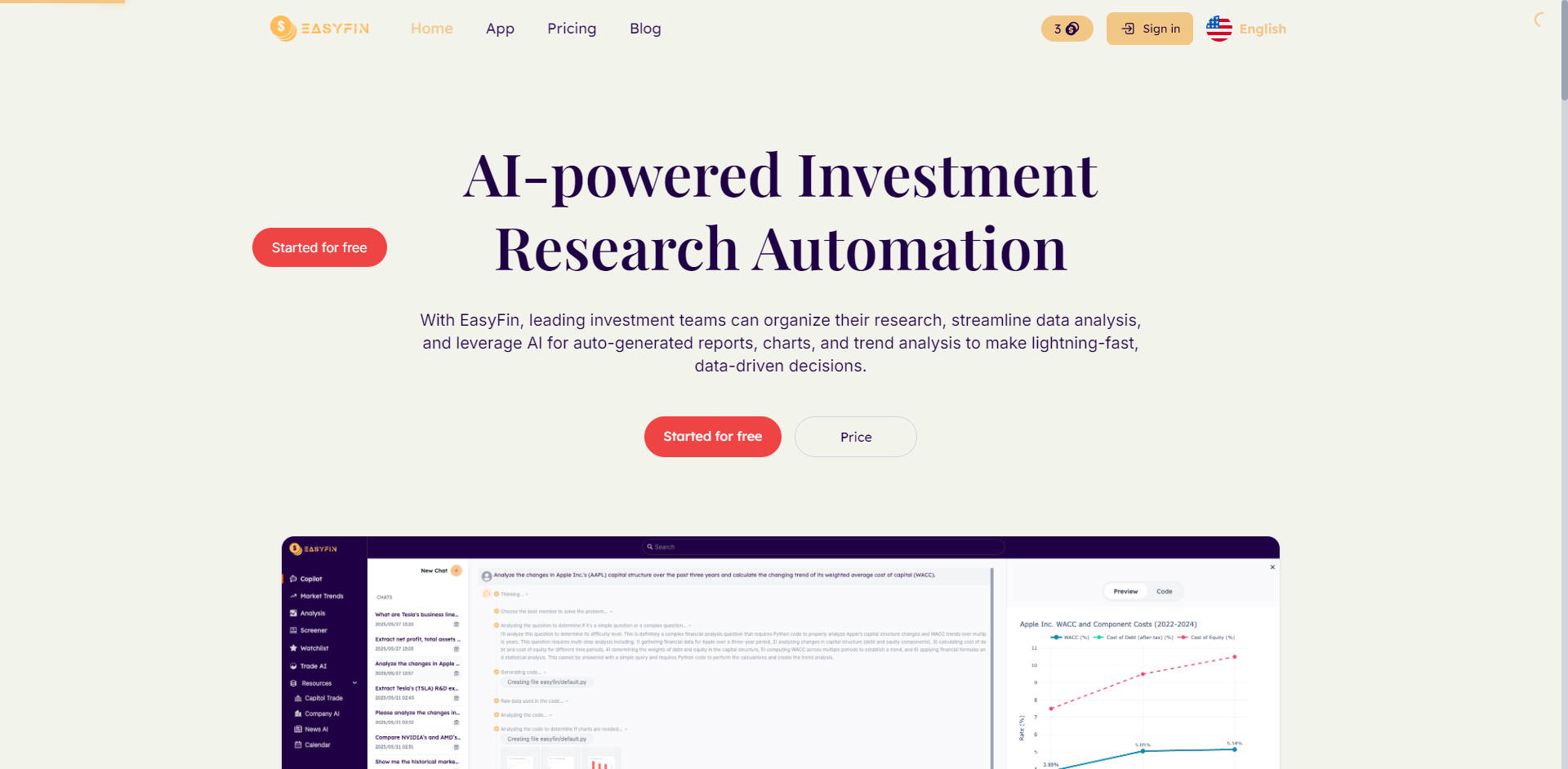

EasyFin is your comprehensive AI-powered stock analysis platform designed to transform complex financial data into clear, actionable insights. It equips investment teams and individual investors alike with institutional-grade data, advanced analytics, and intelligent automation to streamline research and enhance decision-making.

How EasyFin Solves Your Problems

Navigating the vast and complex world of financial markets requires significant time and resources for data gathering, analysis, and strategy development. EasyFin directly addresses these challenges by automating key processes, providing integrated access to critical data, and offering powerful tools that help you:

Reduce Manual Effort: Eliminate time-consuming data collection and preparation tasks.

Gain Deeper Insights: Access advanced analysis and curated research typically reserved for large institutions.

Make Faster Decisions: Leverage AI-powered analysis and clear visualizations for rapid understanding.

Develop Sharper Strategies: Utilize data-driven tools for portfolio construction and risk management.

Key Features

EasyFin provides a robust suite of tools powered by artificial intelligence to elevate your investment approach:

🤖 AI-Powered Financial Analysis: Automatically processes financial statements, market trends, and economic indicators to deliver predictive insights. This eliminates manual data queries and preparation, allowing you to focus on strategic planning and investment decisions that can enhance portfolio performance.

📊 Comprehensive Corporate Financial Intelligence: Gain access to detailed financial reports and earnings call transcripts for the entire U.S. stock market. EasyFin also curates daily research from top investment banks, providing balanced market perspectives and objective news to support your data-driven strategies.

📈 Advanced Data Visualization & Analysis: Combine quantitative analysis with interactive visualization tools. Analyze stocks, options, futures, and bonds in real-time using statistical methods and machine learning. Transform complex data into actionable insights with customizable dashboards and advanced charting for clearer decision-making.

🧠 Smart Portfolio Construction & Strategy Analysis: Extract proven investment strategies through advanced data mining and algorithmic modeling. EasyFin tracks institutional moves, congressional trades, and hedge fund filings, applying factor analysis and modern portfolio theory to provide insights that can help inform strategy development and potentially outperform benchmarks.

Use Cases

See how EasyFin can be applied in real-world investment scenarios:

Rapid Company Deep Dive: Quickly pull up a U.S. company's complete financial history, earnings call transcripts, and relevant analyst ratings within minutes. Use AI analysis to pinpoint key performance drivers and potential risks without sifting through countless documents manually.

Strategy Backtesting: Evaluate the potential effectiveness of a new investment strategy by backtesting it against historical market data using EasyFin's simulation tools. Refine parameters based on performance metrics before committing capital.

Identifying Market Trends & Opportunities: Leverage AI trend analysis and curated market insights to identify emerging sector opportunities or potential shifts in market sentiment, supported by comprehensive data and expert perspectives.

Why Choose EasyFin?

EasyFin stands out by combining the power of AI automation with broad access to critical data, including insights derived from institutional filings. This unique blend helps democratize access to sophisticated analysis methods, giving you a powerful edge in navigating market complexities and refining your investment strategies efficiently.

Conclusion

EasyFin empowers you with the tools and insights needed to make smarter, faster investment decisions based on solid data and advanced analysis. By automating research and providing a comprehensive view of the market, EasyFin helps you focus on what matters most: building and managing a successful portfolio.

Learn more about how EasyFin can enhance your investment research.