What is Cardamon?

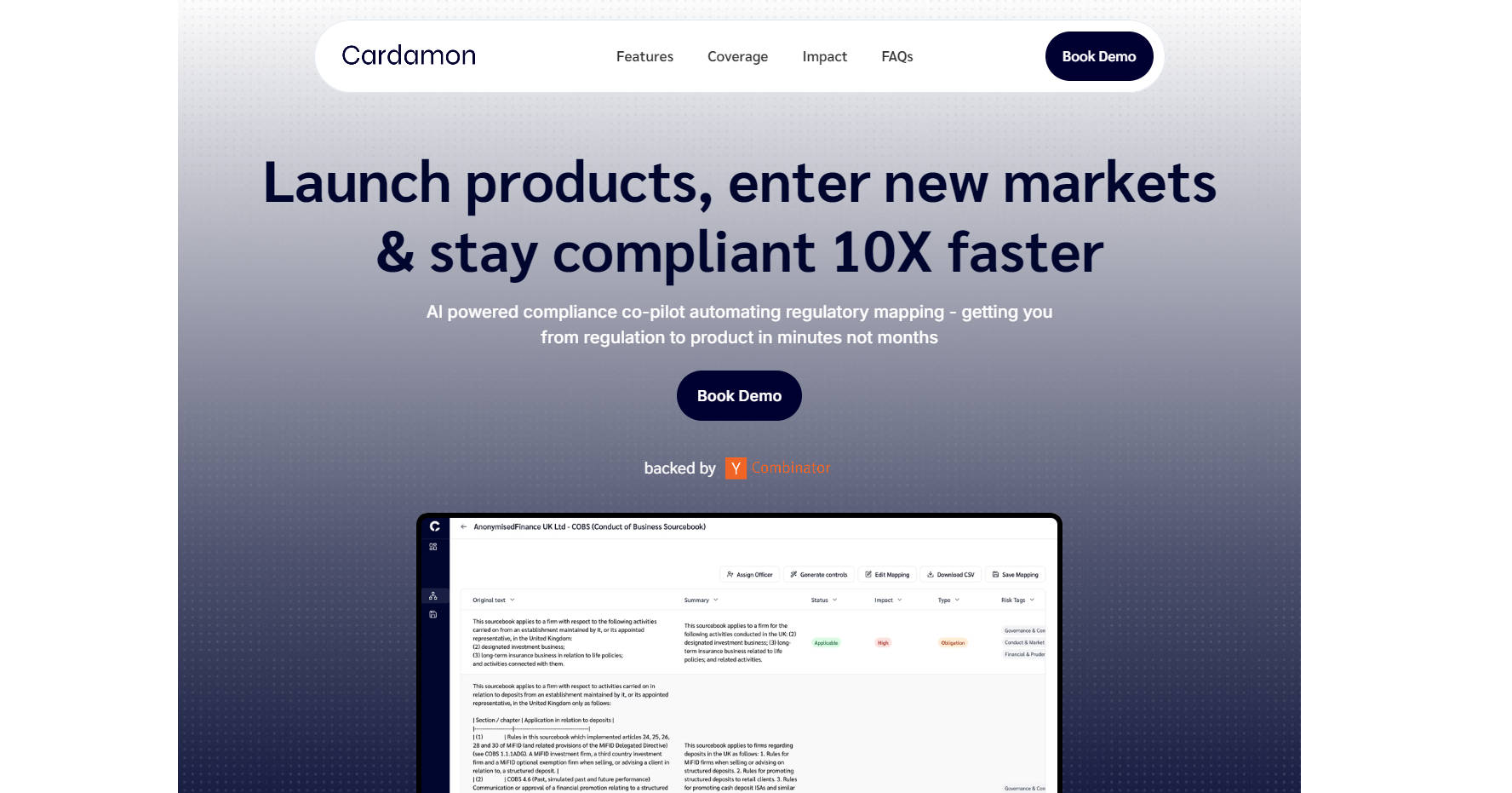

Navigating the intricate landscape of financial regulations often poses significant challenges for firms launching new products or entering new markets. Cardamon is an AI-driven compliance assistant designed to simplify this process, enabling regulated financial institutions to achieve faster market entry while maintaining full compliance. By automating manual and repetitive compliance tasks, Cardamon helps firms reduce both time and costs associated with regulatory adherence.

Key Features:

Efficient Obligation Mapping: Convert complex regulatory text into clear, actionable obligations in minutes. Cardamon’s AI analyzes regulations to identify specific compliance requirements for your firm.

Instant Obligation Evaluation: Leverage AI-powered evaluation to quickly understand the requirements of each obligation, providing actionable insights in seconds.

Rapid Impact Assessment: Gain a clear understanding of how each obligation affects your business. Cardamon’s impact assessment tool helps prioritize and plan effectively.

Automated Risk Tagging: Organize obligations with risk tags tailored to your firm’s risk taxonomy, ensuring better categorization and management.

Control Generation: Beyond identifying obligations, Cardamon generates necessary controls to ensure ongoing compliance.

Regulatory Coverage:

Cardamon simplifies compliance across multiple jurisdictions:

UK: FCA, MLR, and more.

Europe: MiFID, MiCA, and more.

US: SEC, FINRA, and more.

If your regulation isn’t listed, request it, and we’ll add it.

Use Cases:

New Product Launch: A fintech startup launching an investment app uses Cardamon to map relevant FCA regulations, identify obligations, and generate necessary controls, reducing compliance workload by weeks and accelerating time to market.

Market Expansion: A European bank entering the UK market leverages Cardamon to navigate differences between EU and UK regulations, ensuring a smooth and compliant entry.

Regulatory Change Management: When new regulations like MiCA are introduced, financial institutions use Cardamon to quickly understand obligations and update internal policies, avoiding penalties and maintaining compliance.

Impact:

Time Savings: Save over 500 hours annually per compliance officer on manual tasks.

Cost Reduction: Cut costs by an average of $100k by reducing inefficiencies and outsourcing.

Centralized Management: Manage all regulations, obligations, and controls from a single platform.

Conclusion:

Cardamon provides a robust solution for financial firms aiming to expedite product launches and navigate regulatory complexities. By automating time-consuming tasks and delivering clear, actionable insights, Cardamon enables your team to focus on innovation and growth while maintaining the highest compliance standards.

More information on Cardamon

Top 5 Countries

Traffic Sources

Cardamon Alternatives

Cardamon Alternatives-

Kodex AI automates regulatory workflows with specialized AI. Simplify compliance, reduce risk, and stay ahead of complex global changes.

-

Minerva helps leading compliance teams get ahead of financial crime with an AML platform that proactively identifies client risk from onboarding to exit.

-

The Open Source Drata & Vanta alternative that does everything you need to get compliant with frameworks like SOC 2, ISO 27001 & GDPR - in weeks, not months.

-

AI Digital Workers are pre-trained with years of AML experience to quickly automate compliance operations to mitigate risk.

-

Parcha is an AI-driven compliance platform. Accelerate onboarding, enhance efficiency. Automate document verification & global compliance checks. Customize workflows. Real-time analytics. Ideal for financial institutions & e-commerce.