What is Parcha?

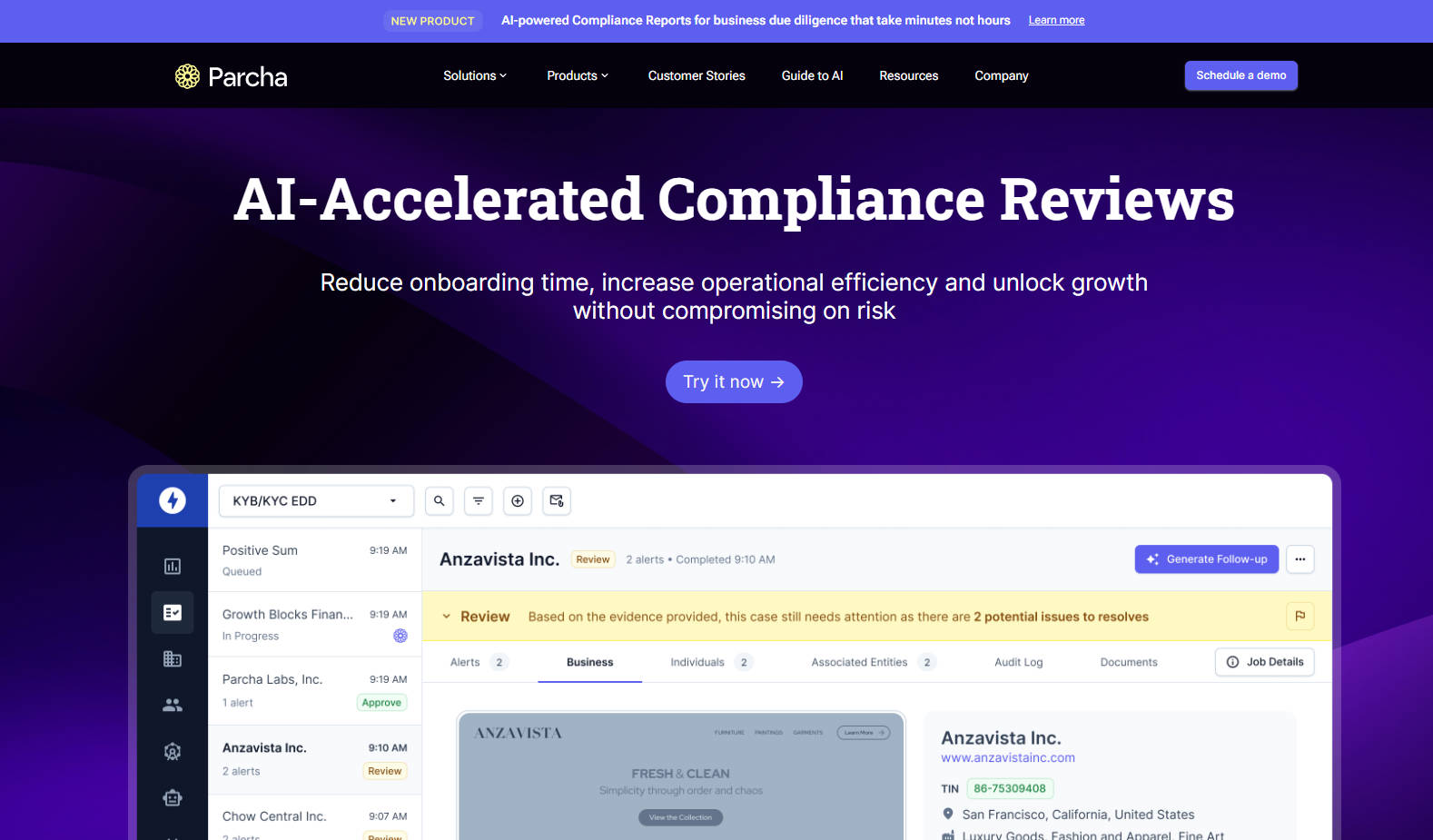

Parcha is an advanced AI-driven compliance platform designed to accelerate customer onboarding and enhance operational efficiency without sacrificing risk management. It automates document verification, business due diligence, and global compliance checks, allowing businesses to approve more customers faster while maintaining strong compliance with regulations like AML and KYC.

Key Features:

📄 AI-Accelerated Document Verification

Verify incorporation documents, ownership details, and addresses in over 60 languages with high accuracy.🌍 Global Compliance Screening

Automatically screen businesses against sanctions lists, adverse media, and high-risk countries to ensure compliance with international regulations.🔍 In-Depth Business Due Diligence

Conduct comprehensive online research to uncover a business’s customers, industry, and operational countries for thorough due diligence.🛠️ Configurable Compliance Workflows

Customize compliance checks and workflows to match your risk policies and thresholds without needing any coding.📊 Real-Time Analytics & Reporting

Access real-time analytics to monitor compliance outcomes across your portfolio, enabling better decision-making and operational efficiency.

Use Cases:

Financial Institution Onboarding

A bank is struggling with lengthy customer onboarding due to manual compliance checks. By integrating Parcha, they automate KYB and KYC processes, reducing onboarding time from days to minutes while ensuring compliance with AML regulations.Global E-Commerce Platform

An e-commerce platform wants to expand into high-risk countries but needs to ensure its merchants comply with international regulations. Parcha helps them automatically cross-check merchants against sanctions lists and watchlists, ensuring compliance without manual intervention.Legal Tech Startup

A legal tech company needs to verify the business registration and ownership details of its clients across multiple jurisdictions. With Parcha, they automate this process, easily adapting to various languages and legal requirements, allowing them to scale without hiring additional compliance staff.

Conclusion:

Parcha is the go-to solution for businesses looking to streamline their compliance processes while maintaining strong risk management. By leveraging AI to automate document verification, due diligence, and global compliance checks, Parcha helps you accelerate customer onboarding, reduce operational costs, and ensure regulatory compliance with ease.

FAQs:

What types of documents can Parcha verify?

Parcha can verify incorporation documents, ownership documents, proof of address, government IDs, and tax identification numbers across multiple jurisdictions and languages.How does Parcha handle high-risk countries and industries?

Parcha automatically cross-checks businesses against lists of high-risk countries and industries, helping you identify and mitigate potential risks in line with regulatory requirements.Can I customize compliance checks with Parcha?

Yes, Parcha allows you to configure and customize compliance checks to match your specific risk policies and thresholds without needing any coding.What kind of analytics does Parcha provide?

Parcha offers real-time analytics on compliance outcomes across your portfolio, enabling better decision-making and operational efficiency.How quickly can Parcha onboard new customers?

Parcha reduces customer onboarding time significantly by automating compliance checks, allowing decisions in minutes rather than days.

More information on Parcha

Top 5 Countries

Traffic Sources

Parcha Alternatives

Parcha Alternatives-

Drata's AI-native platform helps you automate compliance, manage risk, and accelerate security reviews – so your business can grow faster.

-

The Open Source Drata & Vanta alternative that does everything you need to get compliant with frameworks like SOC 2, ISO 27001 & GDPR - in weeks, not months.

-

Transform document handling with Klippa's AI automation. Extract data accurately, prevent fraud, and streamline workflows to boost efficiency & cut costs.

-

Vanta: The AI Trust Management Platform. Automate GRC, achieve SOC 2, HIPAA, ISO 27001 faster, & continuously prove your security.

-

Secure records with RecordsKeeper.AI. Blockchain-backed compliance, AI automation, & smart search. Get organized & audit-ready today!