What is Cleo?

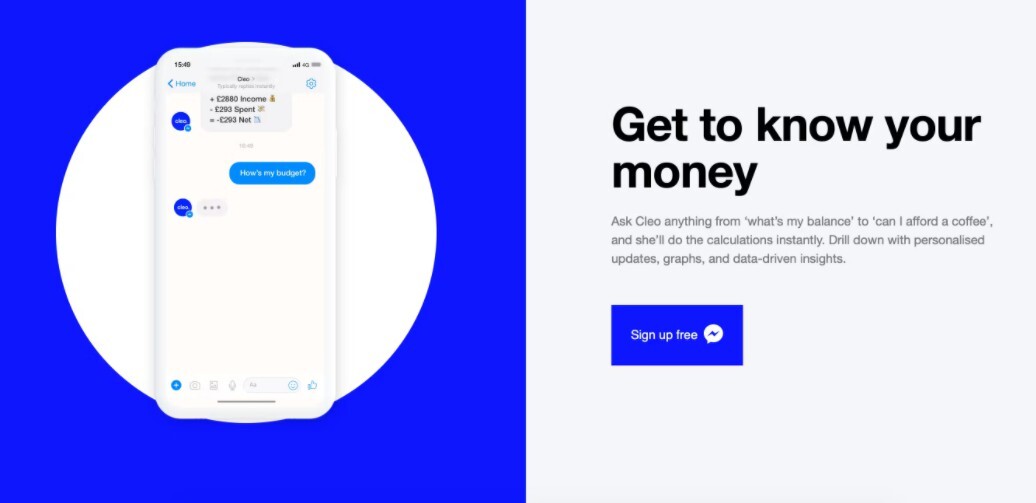

Meet Cleo, the world's first AI assistant dedicated to personal finance. With Cleo, managing money becomes easier and more engaging. From building credit to escaping overdrafts, Cleo offers practical solutions tailored to individual financial needs.

Key Features:

💰 Personalized Financial Insights: Cleo analyzes spending habits and provides personalized insights and recommendations to help users make informed financial decisions.

📊 Budgeting Tools: Cleo offers effective budgeting tools, including customizable budgets and expenditure tracking, empowering users to take control of their finances.

🛡️ Security and Privacy: Cleo prioritizes security, employing 256-bit encryption to protect users' bank login details. Additionally, Cleo operates in read-only mode, ensuring that no transactions can be initiated without user consent.

Use Cases:

Budget Optimization: Cleo helps users optimize their budgets by identifying unnecessary expenses and providing actionable recommendations to cut costs, such as reducing frequent fast-food visits.

Financial Goal Achievement: With Cleo's personalized insights and budgeting tools, users can set and achieve financial goals, whether it's building credit or saving for a vacation.

Financial Education: Cleo serves as a financial mentor, offering educational resources and guidance to improve users' financial literacy and empower them to make informed financial decisions.

Conclusion:

Experience the convenience and efficiency of Cleo in managing your finances. From personalized insights to budgeting tools and enhanced security, Cleo streamlines financial management with ease. Take control of your finances today and embark on a journey towards financial well-being with Cleo.

More information on Cleo

Top 5 Countries

Traffic Sources

Cleo Alternatives

Cleo Alternatives-

Rolly, the AI Money Tracker, automates expense tracking, offers multiple wallets & smart features. Set goals, get insights, enjoy moods. Download for stress-free money management.

-

Cut financial confusion with Steve, your AI financial coach. Get proactive guidance to build wealth, achieve independence, and reach your money goals.

-

Peek’s AI-powered companion offers proactive check-ins—analyzing your spending patterns and refining your habits subtly and positively. Zero judgment, zero guilt. It’s like having a financial Spotify Wrapped, tuned to your goals and daily life.

-

Balance puts your personal finance on autopilot. Connect accounts, track spending, and get AI insights for a complete, clear financial picture.

-

Discover wallet.AI, the AI-powered software that revolutionizes personal finance management. Get personalized insights and real-time monitoring to make informed financial decisions.