What is Composer?

Composer is an advanced, automated trading and investment platform designed to democratize sophisticated quantitative finance. It transforms your investment concepts into fully functional, end-to-end trading algorithms—known as "symphonies"—without the need for coding expertise. By integrating AI-powered strategy creation, robust backtesting tools, and automated execution into a single platform, Composer removes complexity, allowing individual investors, family offices, prop traders, and educators to implement complex, rules-based strategies with confidence and precision.

Key Features

Composer provides a comprehensive toolkit for building, validating, and executing automated investment strategies across multiple asset classes.

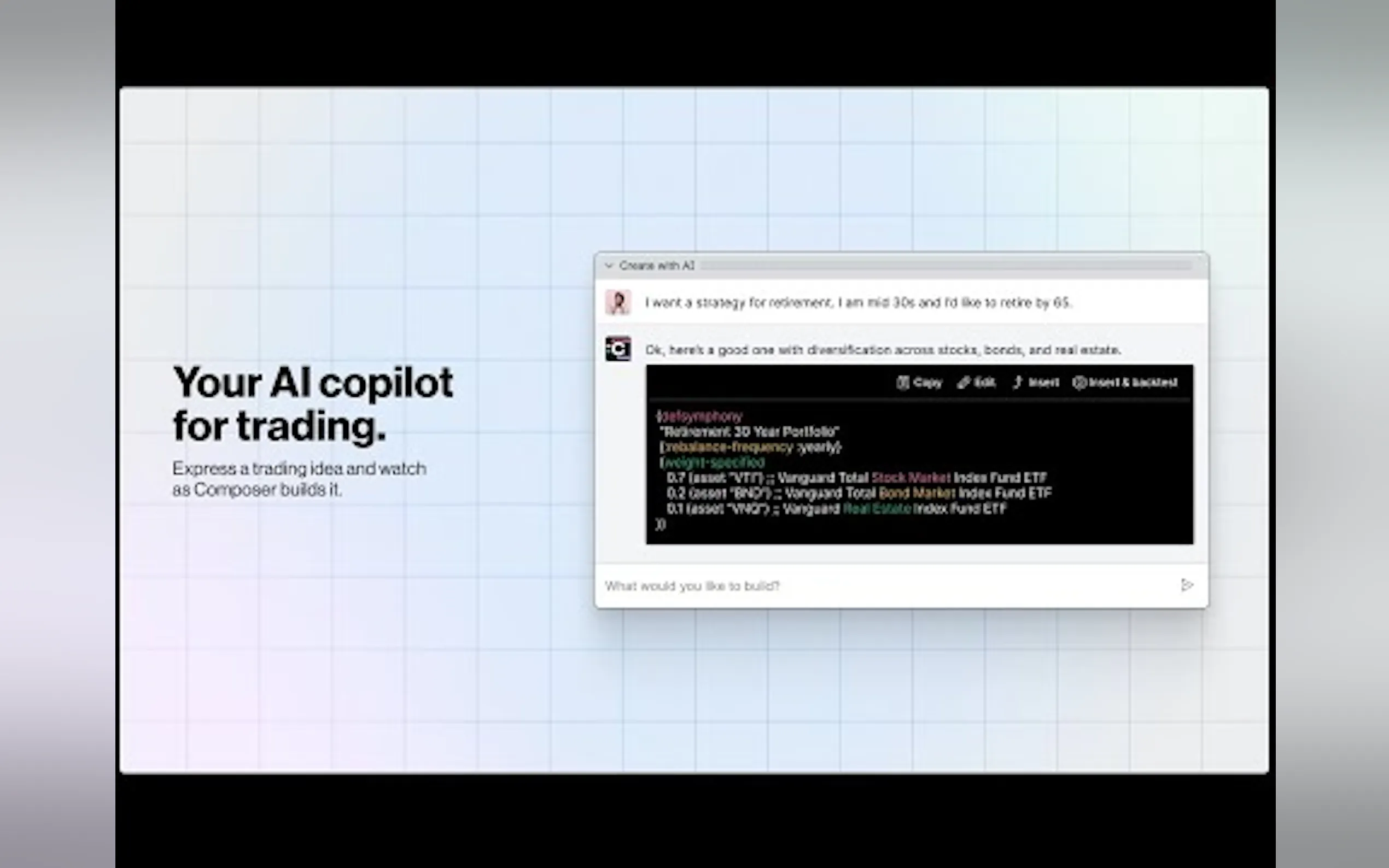

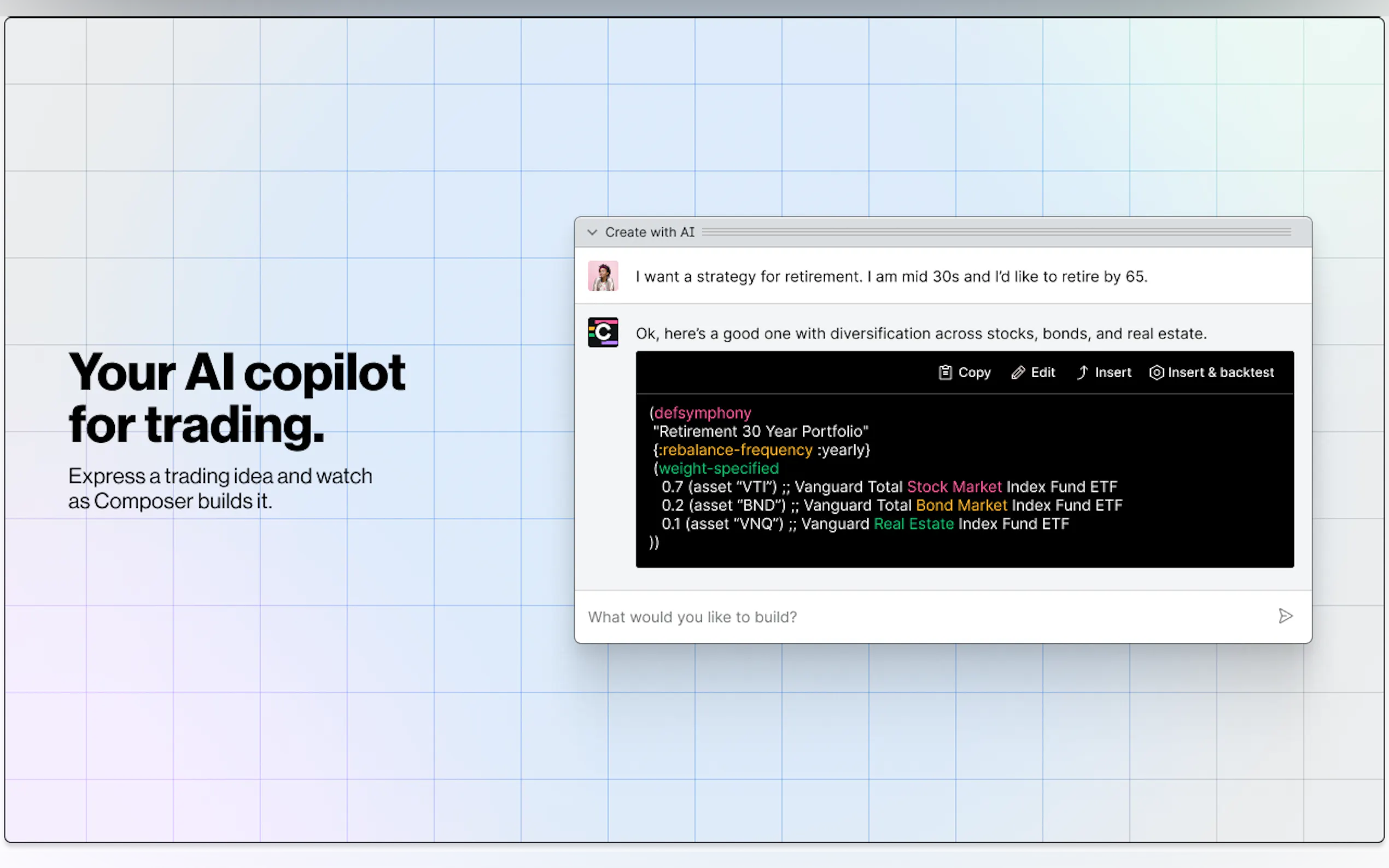

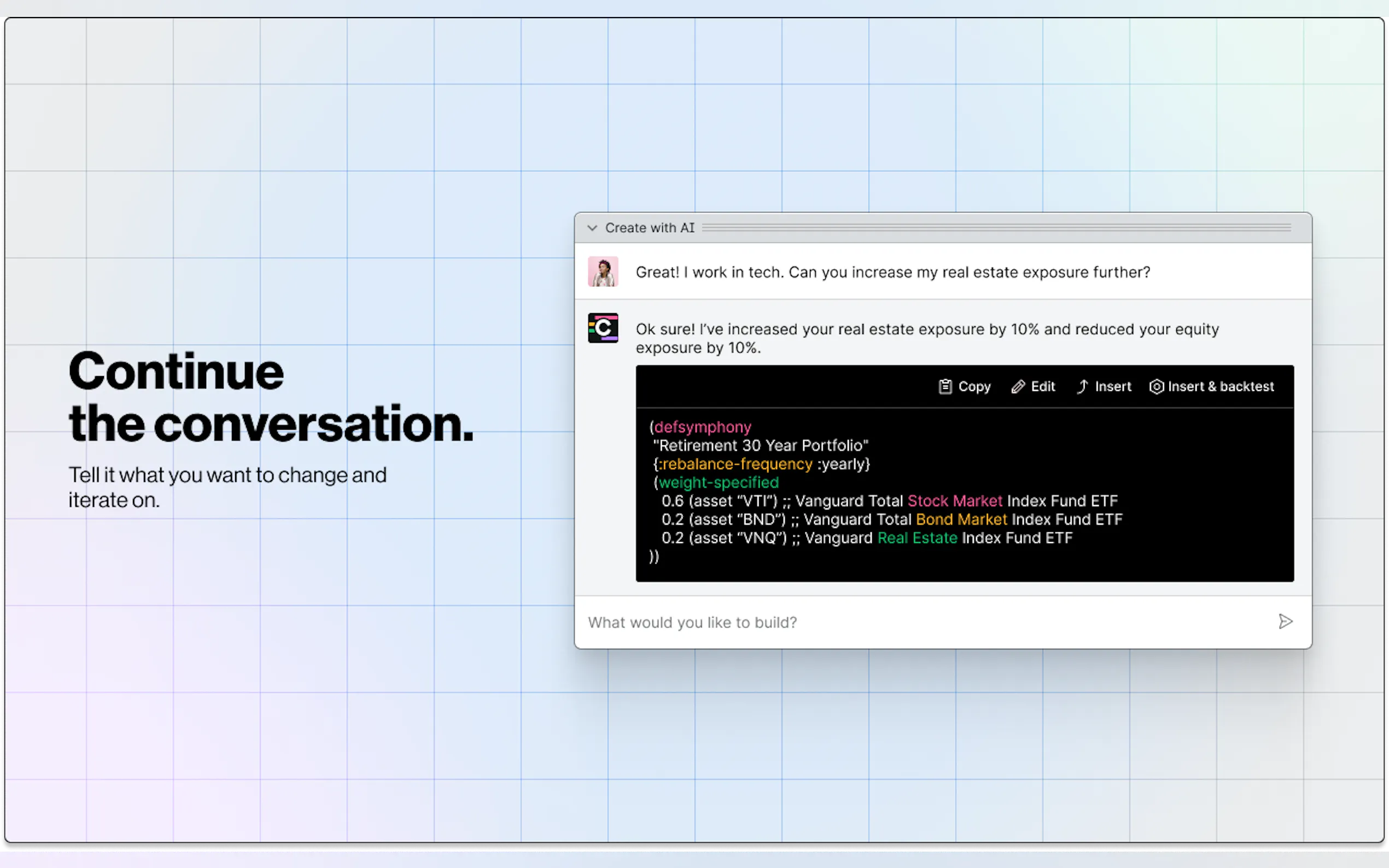

🧠 AI-Powered Strategy Creation

Explain your investment goals, desired strategy logic, and specific risk concerns using natural language. Composer’s AI-assisted editor interprets your input and instantly translates it into a functional trading strategy. This breakthrough capability allows you to rapidly prototype complex market theories and removes the technical barrier traditionally associated with quantitative trading.

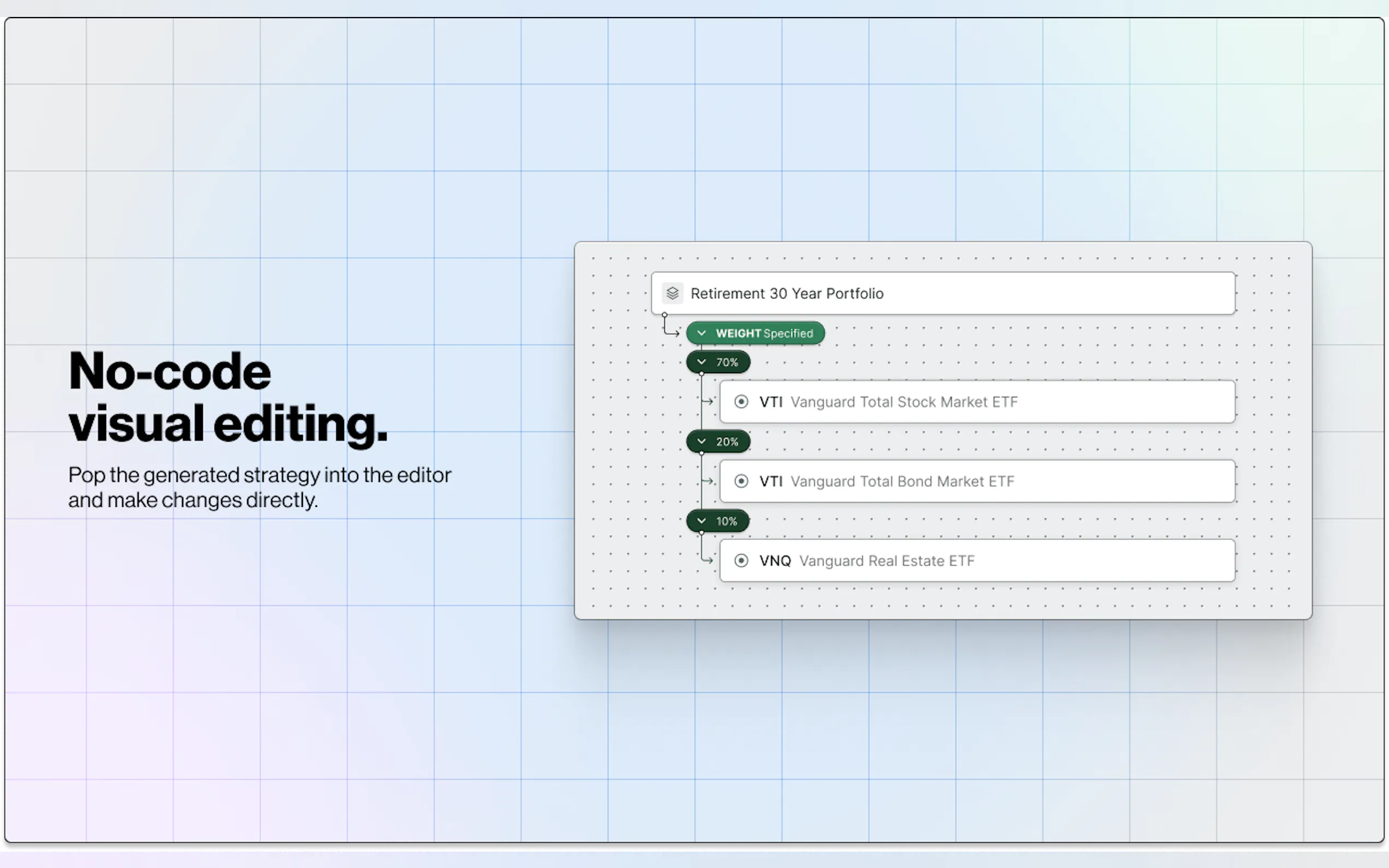

🎛️ No-Code Visual Strategy Editor

Modify existing strategies or build new ones from scratch using an intuitive, visual editor. Leverage drag-and-drop conditional statements ("If this, then that"), dynamic sorting and filtering tools, and advanced weighting applications (like inverse volatility or market cap) to precisely control your algorithm’s behavior, ensuring your strategy logic is executed exactly as intended.

📈 Integrated Multi-Asset Trading and Hybrid Strategies

Manage stocks, ETFs, crypto, and options within a single interface. Composer features industry-first technology allowing you to build hybrid strategies that combine traditional securities (stocks/ETFs) and cryptocurrencies. This allows for diversification and the creation of rules that react to signals across otherwise siloed markets.

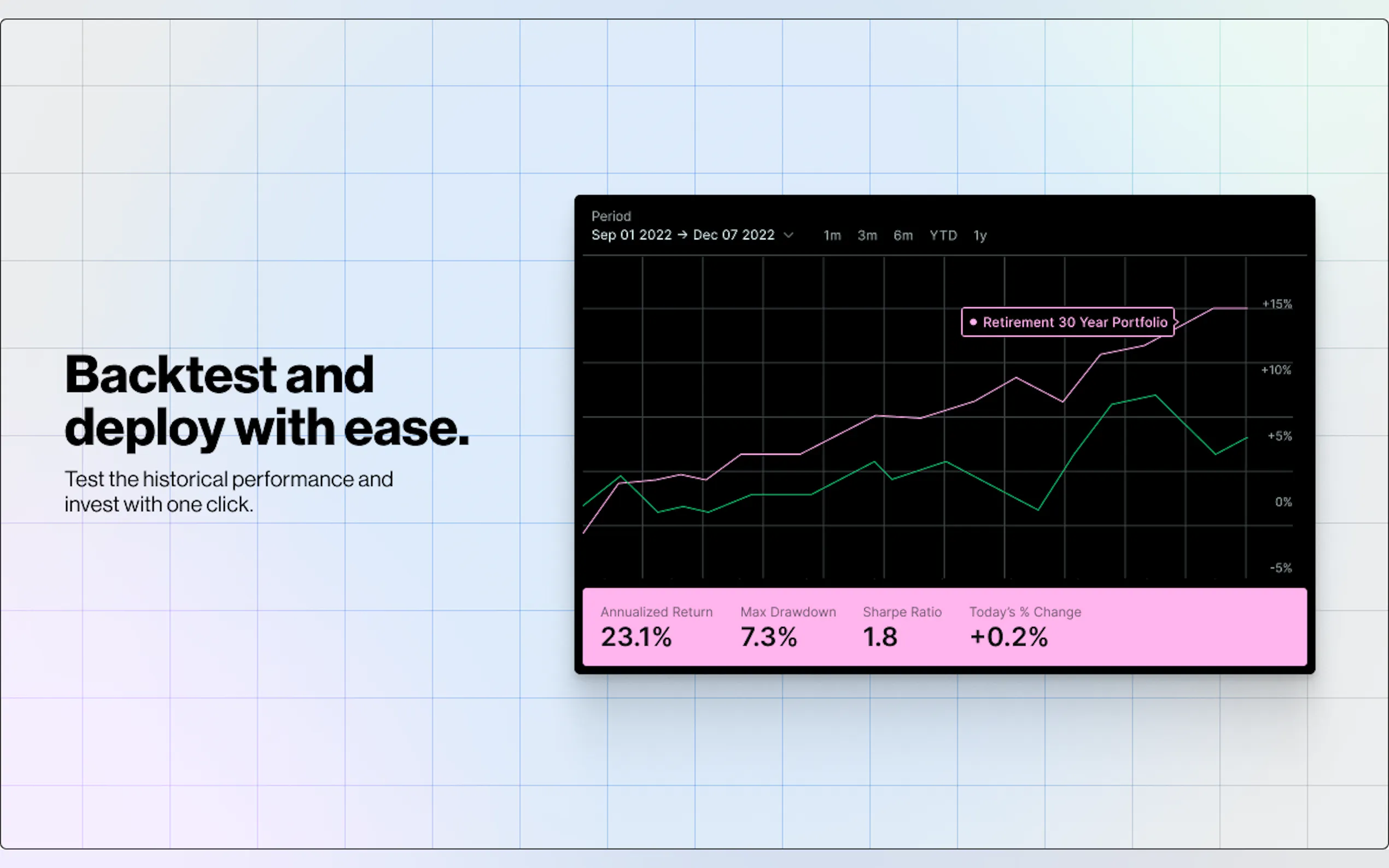

🧪 Detailed Backtesting and Advanced Analytics

Validate your strategies before deploying capital. The integrated backtesting engine simulates historical performance, calculating estimated fees, slippage, and final value. For hybrid strategies, the system models all calendar days, T+1 stock settlement, and the 7-day-a-week crypto trading schedule, providing highly detailed, realistic performance simulations.

⚙️ Fully Automated Trading Execution

Once a strategy is activated, Composer acts as your integrated brokerage, handling all necessary trade execution and portfolio rebalancing automatically. This end-to-end automation ensures your rules-based strategy remains disciplined and emotion-free, executing trades during the appropriate market periods based on your defined logic.

Use Cases

Composer is built to serve a diverse range of users looking to leverage automation and data-driven decision-making.

1. Empowering Professional Fund Management

Hedge funds, family offices, and prop traders can utilize Composer as an all-in-one quant shop. Instead of requiring a large development team, managers can rapidly build, test, and deploy diversified algorithm portfolios in minutes. The platform supports complex US-based entity accounts (LLCs, partnerships, corporations) and offers API access for integrating trading and reporting capabilities into existing systems, streamlining compliance and tax reporting.

2. Eliminating Emotional Trading Decisions

For individual investors and retirement advisors, Composer provides a crucial defense against market volatility and emotional decision-making. By codifying investment beliefs into automated, rules-based strategies, users ensure that trades are executed based purely on objective data and market movements, maintaining portfolio discipline regardless of short-term market noise.

3. Creating Cross-Market Investment Opportunities

Leverage Composer’s unique hybrid strategy capability to capture opportunities that span traditional and digital assets. For instance, you could design a strategy where a spike in Bitcoin price acts as a signal to adjust allocations within a related basket of technology ETFs, or build custom crypto strategies that automatically adapt to real-time DeFi growth metrics.

Unique Advantages

Composer provides a distinct competitive edge by unifying complexity and accessibility, supported by institutional-grade infrastructure.

Zero Barrier to Entry: Build and deploy sophisticated trading algorithms with zero coding skills required. Utilize natural language input to generate strategies instantly.

All-in-One Trading Hub: Eliminate the need to juggle multiple platforms. Trade stocks, ETFs, options, and crypto with AI assistance, all within a single integrated environment.

Cost-Efficient Crypto Trading: Benefit from some of the lowest crypto trading fees in the US, saving up to 93% compared to many competitors (based on current fee estimates). You can trade cryptocurrencies directly without relying on fee-laden crypto ETFs.

Infrastructure and Scale: Rely on a purpose-built automated trading infrastructure that powers over $215 million of automated trades per day and has executed over 12 million orders lifetime.

Full IP Ownership: Every strategy you create on Composer is fully owned by you, ensuring your intellectual property remains proprietary.

Tax-Smart Retirement Investing: Utilize Composer’s automation capabilities within Traditional and Roth IRA accounts to implement tax-smart active trading strategies.

Conclusion

Composer is more than just an investment app; it is a powerful platform that grants you the ability to harness the power of AI and automation for disciplined, data-driven investing. By providing sophisticated, no-code tools and supporting a wide range of accounts—from individual retirement plans to complex business entities—Composer empowers you to move beyond manual trading and build a truly automated, rules-based portfolio.