FinFloh

FinFloh

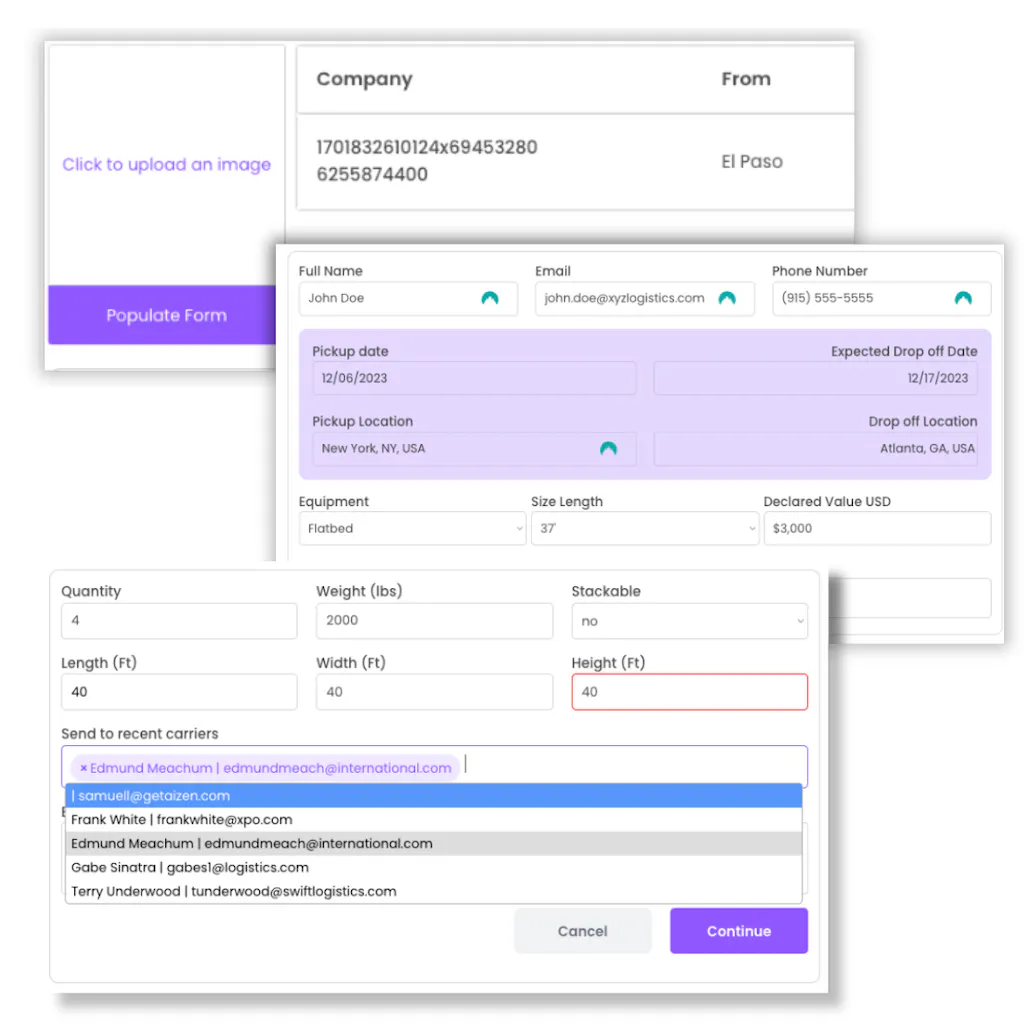

AizenFlow

AizenFlow

FinFloh

| Launched | 2022-5 |

| Pricing Model | Paid |

| Starting Price | |

| Tech used | Google Analytics,Google Tag Manager,Microsoft Clarity,Next.js,Vercel,Gzip,Webpack,HSTS |

| Tag | Data Analysis,Data Pipelines,Data Science |

AizenFlow

| Launched | 2023-4 |

| Pricing Model | Freemium |

| Starting Price | |

| Tech used | Google Analytics,Google Tag Manager,LinkedIn Insights,Webflow,Amazon AWS CloudFront,Google Fonts,jQuery,Gzip,OpenGraph,HSTS,YouTube |

| Tag | Lead Management,Data Analysis,Team Collaboration |

FinFloh Rank/Visit

| Global Rank | 2772649 |

| Country | India |

| Month Visit | 7474 |

Top 5 Countries

Traffic Sources

AizenFlow Rank/Visit

| Global Rank | 8114639 |

| Country | United States |

| Month Visit | 236 |

Top 5 Countries

Traffic Sources

Estimated traffic data from Similarweb

What are some alternatives?

Finto - Stop manual invoice processing. Finto brings AI automation to enterprise accounting, boosting accuracy & empowering your finance team.

Peakflo - Peakflo AI uses intelligent agentic workflows to automate complex finance & ops. Optimize AR/AP, cut costs, and eliminate 95% of manual tasks.

Cratoflow - Cratoflow is a no - code financial automation platform for growing businesses. Automate AP and AR, integrate with accounting systems, and enjoy AI - powered matching. Simplify finance operations, reduce costs.

Finlens - Finlens is your AI co-pilot for accounting. Built for founders and accountants who use QuickBooks and other legacy tools but still find themselves buried in receipts, spreadsheets, and slow month-end closes. We bring speed & sanity to your financial workflow.

Fin AI bot - Fin, the #1 AI agent for customer service, resolves complex queries others can't. Boost efficiency, reduce agent workload, and scale support.