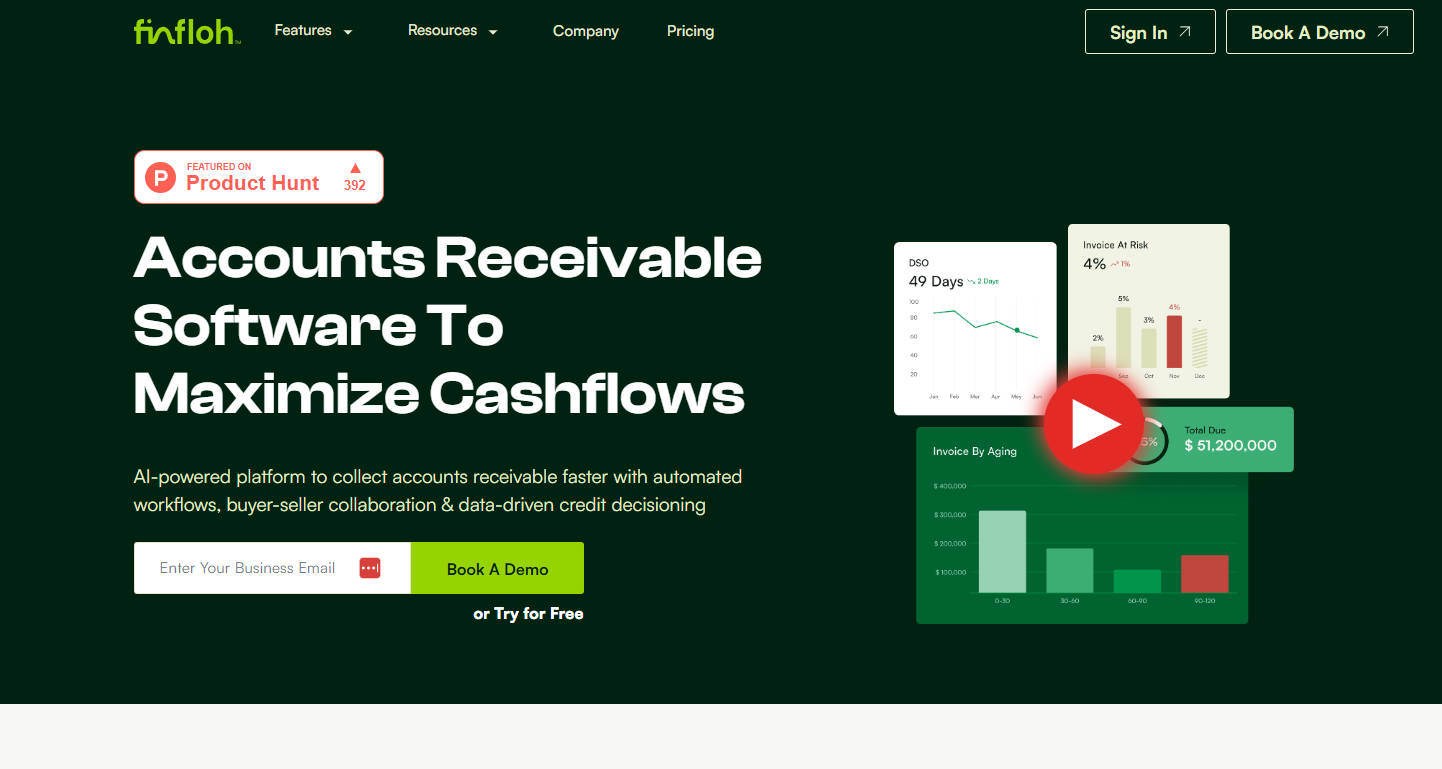

What is FinFloh?

FinFloh is an AI-powered accounts receivable software that helps businesses collect payments faster, reduce decision-making time, and improve overall collections efficiency. Its features include automated workflows, buyer-seller collaboration, data-driven credit decisioning, and seamless integration with existing ERP and accounting systems.

Key Features:

🔄 Automated Workflows: Streamline your accounts receivable process with AI-powered automation, reducing manual effort and improving efficiency.

🤝 Buyer-Seller Collaboration: Resolve disputes and issues faster by building collaborative workflows between internal teams and buyers, ensuring clear ownership and timely resolution.

💰 Data-Driven Credit Decisioning: Leverage market insights and receivables data to make informed credit decisions using AI, improving cash flow and reducing bad debt.

Use Cases:

Scenario: A business is struggling with late payments and disputes, affecting their cash flow. Solution: FinFloh's automated workflows and collaborative platform help resolve disputes efficiently, ensuring faster payments and improved cash flow.

Scenario: A company wants to make more accurate credit decisions and forecast cash flows. Solution: FinFloh uses AI to analyze buyer data and behavior, enabling businesses to make informed credit decisions and predict payments based on actual trends.

Scenario: An organization needs to integrate their existing ERP and accounting systems seamlessly. Solution: FinFloh offers out-of-the-box integration with ERP, accounting software, CRM, and other tools, making it easy to manage accounts receivable without any coding efforts.

Conclusion:

FinFloh revolutionizes accounts receivable management by providing automated workflows, buyer-seller collaboration, and data-driven credit decisioning. With the ability to integrate with existing systems and improve collections efficiency, FinFloh empowers businesses to collect payments faster, reduce disputes, and enhance overall cash flow. Begin your accounts receivable transformation journey with FinFloh today and experience the benefits it brings

More information on FinFloh

Top 5 Countries

Traffic Sources

FinFloh Alternatives

FinFloh Alternatives-

Stop manual invoice processing. Finto brings AI automation to enterprise accounting, boosting accuracy & empowering your finance team.

-

Peakflo AI uses intelligent agentic workflows to automate complex finance & ops. Optimize AR/AP, cut costs, and eliminate 95% of manual tasks.

-

Cratoflow is a no - code financial automation platform for growing businesses. Automate AP and AR, integrate with accounting systems, and enjoy AI - powered matching. Simplify finance operations, reduce costs.

-

Finlens is your AI co-pilot for accounting. Built for founders and accountants who use QuickBooks and other legacy tools but still find themselves buried in receipts, spreadsheets, and slow month-end closes. We bring speed & sanity to your financial workflow.

-

Fin, the #1 AI agent for customer service, resolves complex queries others can't. Boost efficiency, reduce agent workload, and scale support.