What is Dovly AI?

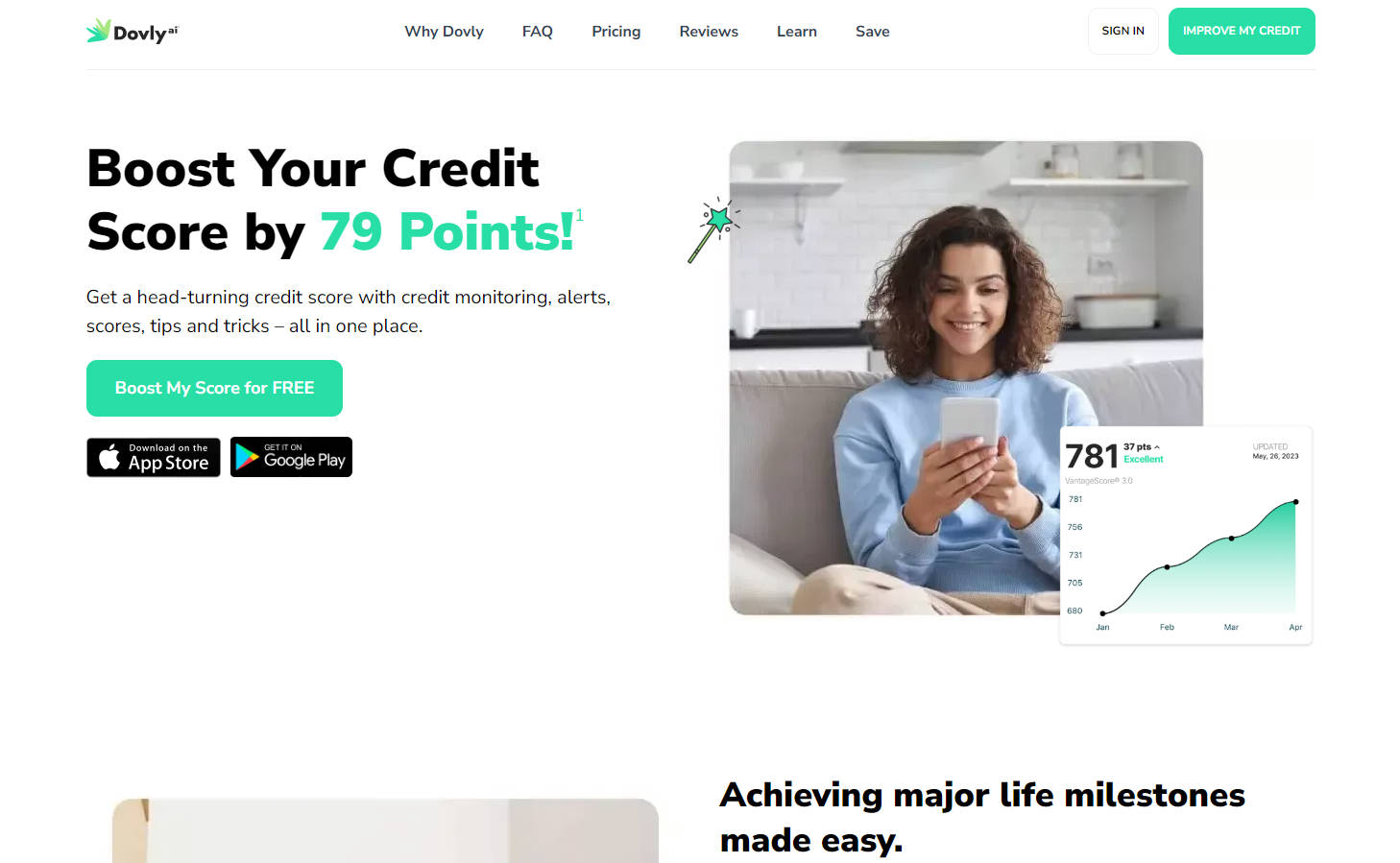

Dovly AI is a sophisticated AI product designed to elevate your credit score significantly by providing comprehensive credit monitoring, dispute resolution, and personalized tips. With its smart AI credit engine, Dovly AI not only identifies issues affecting your credit score but actively works to rectify them, leading to an average increase of 79 points for premium users. It combines weekly credit reporting with enhanced monitoring and identity theft alerts, all aimed at securing your financial future.

Key Features:

Smart AI Credit Engine: Utilizes advanced algorithms to analyze and improve credit scores efficiently.

Weekly Credit Reports: Supplies regular TransUnion credit reports and scores to keep you informed.

Enhanced Credit Monitoring: Offers round-the-clock monitoring with ID theft alerts for superior account protection.

Personalized Credit Tips: Delivers tailored advice to help users make informed financial decisions.

Comprehensive Insurance: Includes $1M in ID theft insurance to safeguard your identity.

Use Cases:

Mortgage Approval: Secure a mortgage with a better credit score, enabling more favorable loan terms.

New Credit Card: Qualify for a new credit card with improved creditworthiness.

Financial Planning: Achieve financial milestones like buying a car or starting a business with a higher, more stable credit score.

Conclusion:

Dovly AI is your partner in the journey towards financial freedom, offering not just a boost to your credit score but peace of mind with continuous monitoring and protection. Ready to unlock endless possibilities with a head-turning credit score? Try Dovly AI for free and take the first step towards a brighter financial future.

More information on Dovly AI

Top 5 Countries

Traffic Sources

Dovly AI Alternatives

Load more Alternatives-

Dispute AI is an artificial intelligence software solution that specializes in credit repair and helping consumers sidestep hard inquiries, ineffective disputes and exorbitant fees.

-

-

AI Credit Repair simplifies credit management. Generate dispute letters, remove public records, and get payment reminders. Build and maintain a strong credit score.

-

-