What is Imperative Execution?

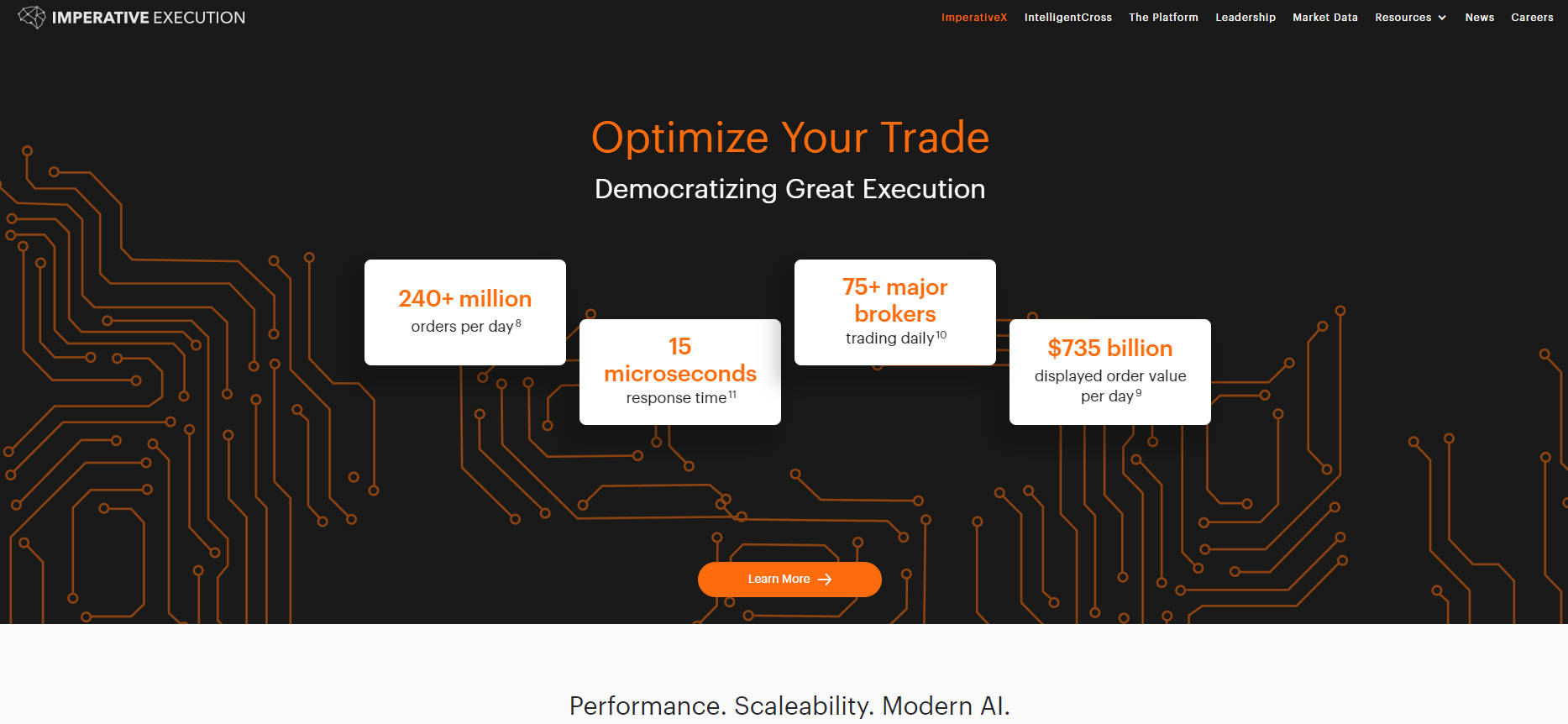

Imperative Execution is a financial technology company that owns IntelligentCross, a SEC-registered US equities Alternative Trading System (ATS). IntelligentCross uses AI to optimize price discovery and matches orders near-instantaneously, resulting in better displayed prices and tighter spreads. The software operates two matching models - Midpoint and ASPEN - which do not interact with each other. It accepts various order types, including market orders, limit orders, primary peg orders, and market peg orders.

Key Features:

1. AI-driven Price Optimization: IntelligentCross leverages artificial intelligence to optimize price discovery and achieve maximum price stability after trades. By continuously matching orders within microseconds of arrival, it improves the efficiency of the market by providing better displayed prices and narrower spreads.

2. Two Matching Models: The software operates two distinct matching models - Midpoint book and ASPEN book. The Midpoint book only accepts non-displayed midpoint peg orders while the ASPEN book is a full limit order book with optional displayed capability. Subscribers can choose between three different fee structures within the ASPEN book.

3. Versatile Order Types: IntelligentCross supports various order types such as market orders, limit orders, primary peg orders (with or without a limit price), and market peg orders (with or without a limit price). Only certain order types are eligible for display in the ASPEN books.

Use Cases:

1. Financial Institutions: Banks, hedge funds, asset managers, and other financial institutions can benefit from using IntelligentCross to execute their equity trades more efficiently by leveraging its AI-powered optimization capabilities.

2. Broker-Dealers: Registered broker-dealers can become subscribers of IntelligentCross to access its ATS platform for executing US equities trades on behalf of their clients.

3. Market Participants Seeking Better Prices: Traders who prioritize obtaining better displayed prices with tighter spreads can utilize IntelligentCross' matching process to improve their trading outcomes.

IntelligentCross, powered by Imperative Execution's advanced technology, offers a cutting-edge solution for optimizing price discovery and executing equity trades efficiently. With its AI-driven matching process and versatile order types, it provides market participants with better displayed prices and tighter spreads. Whether you are a financial institution or a broker-dealer, IntelligentCross can enhance your trading experience by improving price stability and execution efficiency in the US equities market.

More information on Imperative Execution

Top 5 Countries

Traffic Sources

Imperative Execution Alternatives

Load more Alternatives-

Navigate markets confidently with Intellectia AI. Get AI-powered stock & crypto insights, daily picks, swing trading signals & financial analysis.

-

10XTraders.AI empowers you to build, customize, and implement trading algorithms effortlessly

-

-

-

Capital Companion is an AI-powered stock analysis platform for US & Canadian traders. Offers real-time insights, trend predictions & risk management tools. Empower your trading with 10 free AI requests/month.