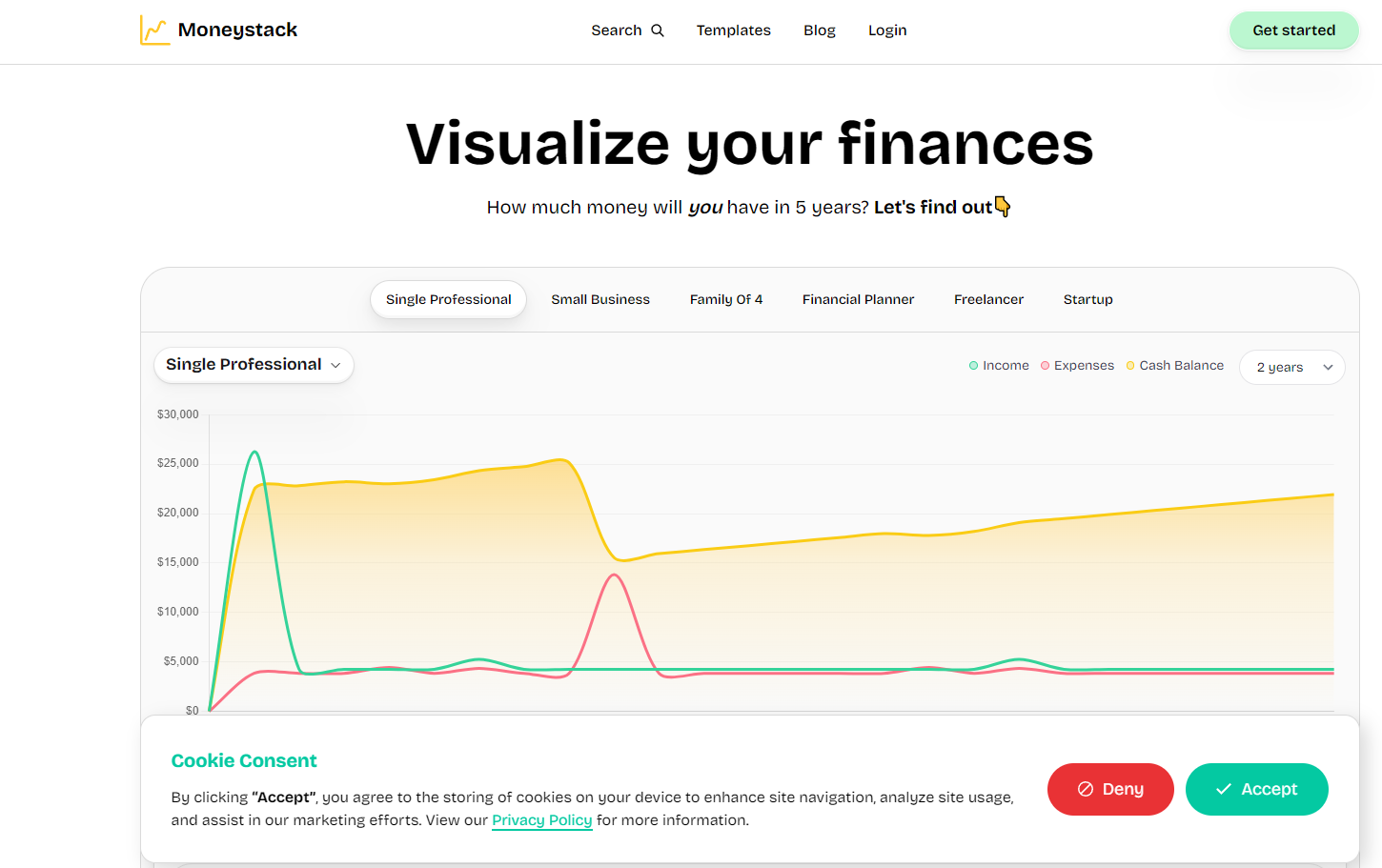

What is Moneystack?

Moneystack is a straightforward and intuitive financial planning tool that helps users of all kinds, from single professionals to growing families and entrepreneurs, to visualize and plan their financial future. With its emphasis on simplicity and security, Moneystack offers a user-friendly alternative to complex spreadsheet software, making financial planning accessible to everyone.

Key Features

Income Tracking📈

Input various sources of income and watch your cash balance grow over time.

Ideal for monitoring salary, side projects, online sales, and more.

Expense Management📉

Categorize expenses into ‘needs’ and ‘wants’ to understand spending patterns.

Set financial goals and see when you can afford them.

Customizable Templates📄

Choose from a range of templates suited to different financial situations.

Easily adapt templates to personal, business, or family financial planning needs.

Use Cases

Personal Budgeting🏠

A single professional uses Moneystack to plan monthly expenses, save for a vacation, and track progress towards buying a car.

Small Business Cash Flow🚀

A small business owner inputs monthly revenue and expenses to forecast cash flow, plan for tax payments, and make informed decisions about business growth.

Family Financial Planning👨👩👧👦

A family of four uses Moneystack to budget for household expenses, plan for their children’s education, and save for a family vacation.

Conclusion

Moneystack offers a clear, simple, and secure way to visualize and plan your financial future. Whether you’re managing personal finances, running a business, or planning for your family’s needs, Moneystack provides the tools you need to make informed financial decisions. Sign up for a free account and start understanding your financial situation in under 5 minutes. Experience the ease of financial planning with Moneystack.