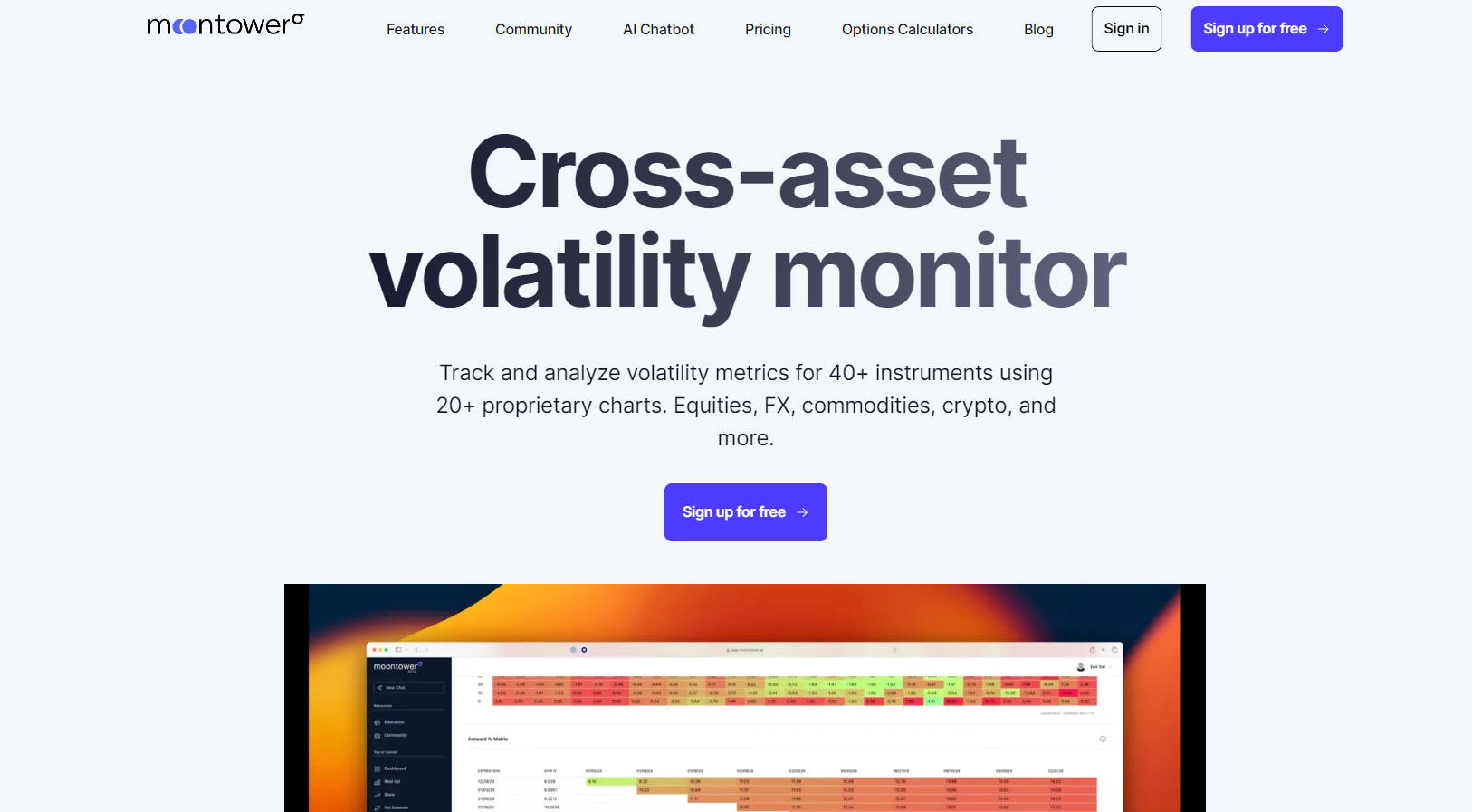

What is Moontower?

Moontower Analytics offers a sophisticated platform for tracking and analyzing volatility metrics across more than 40 instruments, including equities, FX, commodities, and cryptocurrencies. With over 20 proprietary charts, it provides a comprehensive view of the market, empowering users to make informed decisions based on real-time data.

Key Features

Cross-Asset Volatility Monitor🌐

Track and analyze volatility metrics for a diverse range of instruments.

Gain insights into market dynamics across different asset classes.

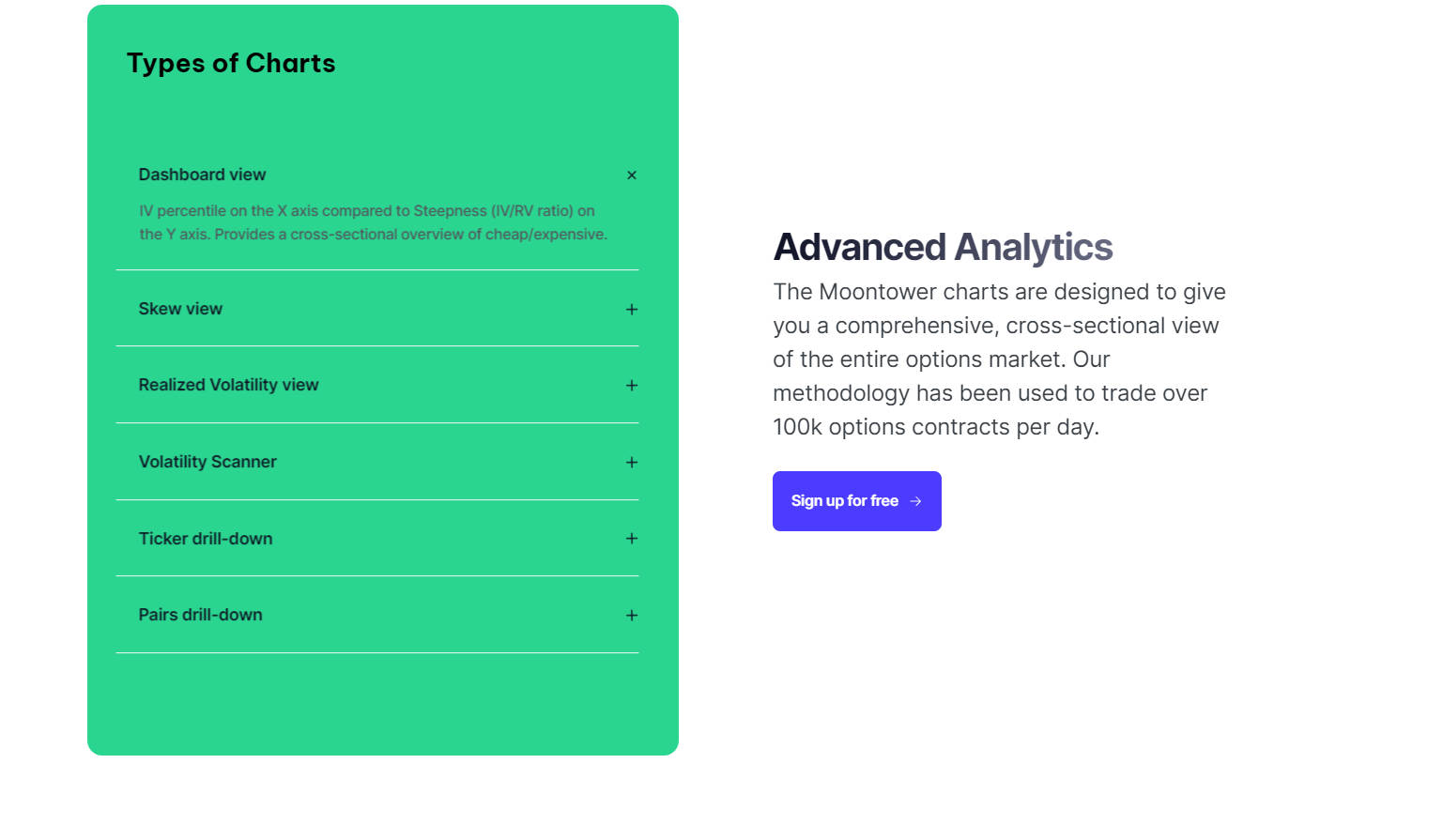

Advanced Analytics Charts📊

Utilize Moontower’s unique charts for a cross-sectional view of the options market.

Benefit from a methodology proven in trading over 100,000 options contracts per day.

360° Market View🌍

Coverage of major ETFs across key asset classes, with individual stocks coming soon.

XLK, QQQ, SPY, DIA, MDY, IWM, IJR, IWD, EEM, VWO, IWF, EFA, EWJ, EWW, EWZ, FEZ, FXI, CORN, WEAT, DBA, HYG, JNK, EMB, USO, XLE, XOP, XLF, FXA, FXB, FXC, FXE, FXY, GLD, SLV, GDX, GDXJ, TLT, IEF, IYR, XHB, XLP, XLU, BTC, BITO, ETH.

Moontower Primer📚

A comprehensive written course on trading options like a professional.

Includes 1-to-1 Zoom sessions with the Moontower team and access to an exclusive community.

Moontower GPT🤖

An AI knowledge agent providing reliable answers to options and trading queries.

Enhances learning and decision-making with links for further reading.

Use Cases

Options Traders📈

Analyze volatility metrics to make informed trading decisions.

Use Moontower’s charts and analytics for a professional edge.

Portfolio Managers🏦

Monitor cross-asset volatility for risk management.

Gain insights into market trends and adjust strategies accordingly.

Retail Investors🛍️

Understand market volatility and its impact on investments.

Access advanced analytics and educational resources for better decision-making.

Conclusion

Moontower Analytics provides a powerful toolset for anyone looking to understand and capitalize on market volatility. With its comprehensive charts, educational resources, and AI-powered knowledge agent, it offers a unique blend of data and insight. Whether you’re a seasoned trader or a curious investor, Moontower Analytics can help you navigate the markets with confidence. Sign up for free and experience the power of Moontower Analytics today!

More information on Moontower

Top 5 Countries

Traffic Sources

Moontower Alternatives

Load more Alternatives-

Trade smarter with AI-powered insights, real-time data, and advanced tools. Start for free and revolutionize your trading strategy today!

-

Deeptracker is the world’s first native AI research platform built for professionals who seek signals, not noise. From company events to supply chain disruptions and policy shifts, Deeptracker helps you track, verify, and act—before the market reacts.

-

Embrace the future of investing with cutting-edge Artificial Intelligence. Unleash your investment potential and navigate the crypto markets effectively.

-

AI market analysis that cuts the noise. Discover high-conviction trade ideas, track smart money, and get critical risk alerts 24/7.

-

LevelFields AI delivers event-driven stock & options trading insights. Scan millions of events 1800x faster for confident, data-backed investment decisions.