What is LevelFields?

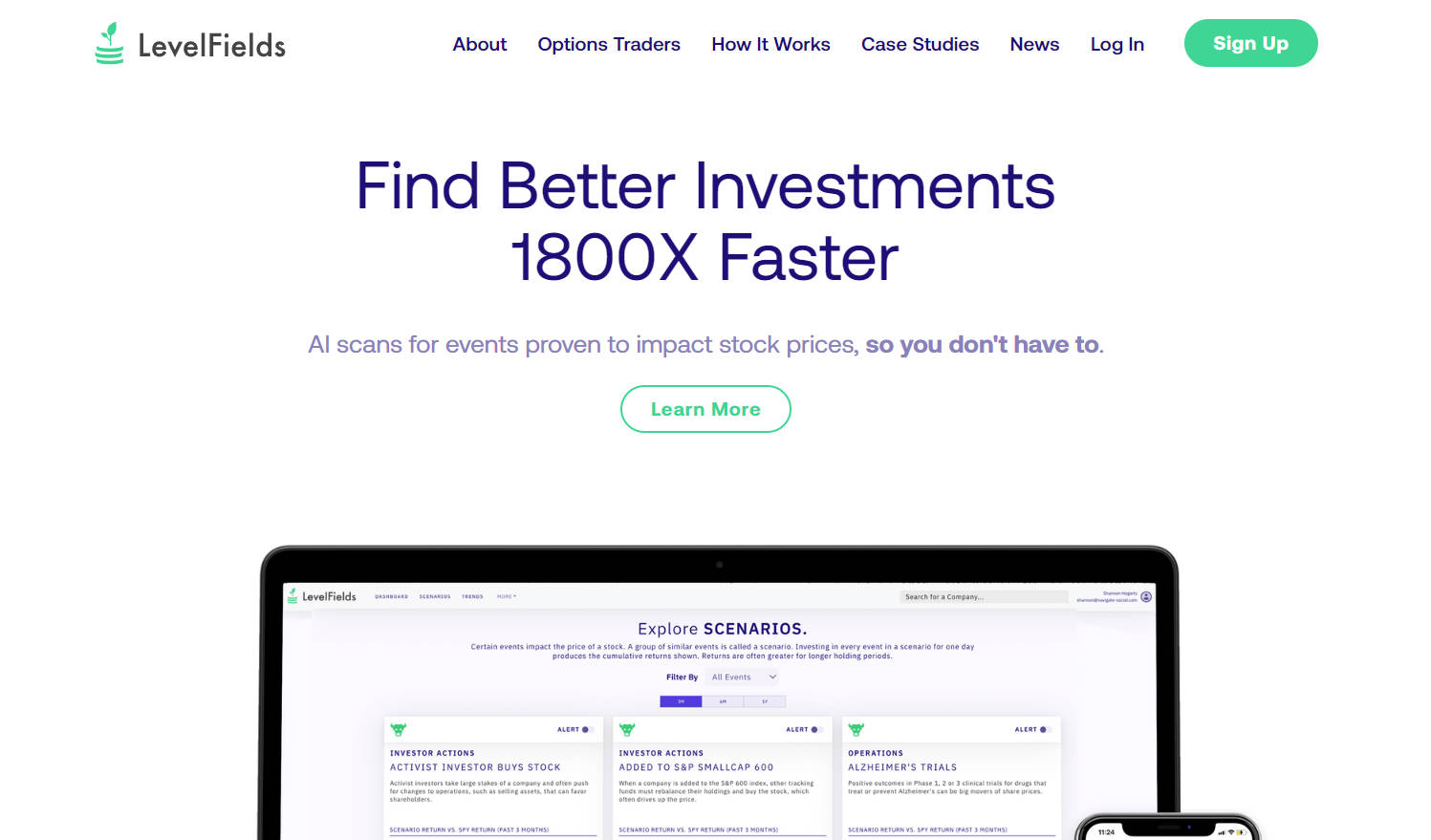

LevelFields AI revolutionizes how self-directed investors find opportunities in the stock and options markets. It leverages advanced artificial intelligence to scan millions of events, identifying those proven to impact stock prices with unparalleled speed and precision. This platform is designed for options and swing traders, as well as long-term investors seeking data-driven insights to make confident trading decisions.

Key Features

⚡️ AI-Powered Event Discovery: LevelFields AI rapidly scans millions of financial events—from leadership changes to government actions—1800x faster than manual research. This capability identifies crucial catalysts proven to influence stock prices, delivering high-probability trade ideas directly to you.

📈 Pattern-Based Trade Insights: Gain clarity on how specific event types historically impact stock prices. LevelFields visualizes these patterns, enabling you to determine optimal buy and sell points based on verifiable data and historical reactions, moving beyond speculative guesswork.

🔔 Personalized Event Alerts: Configure real-time alerts for events that align with your investment strategy and profit goals. LevelFields delivers these opportunities directly to your inbox, ensuring you're always informed and ready to act on material events as they unfold.

📊 Integrated Watchlists: Keep a close eye on your current holdings and potential investments by adding companies to customizable watchlists. This feature allows you to effortlessly monitor performance, news, financials, and upcoming events that could impact your portfolio.

Use Cases

Identify High-Probability Swing Trades: Quickly pinpoint stocks likely to experience significant price movements based on recent, impactful events. For instance, you can identify a stock responding positively to a "Return of Capital" event and capitalize on the immediate momentum.

Optimize Long-Term Entry Points: For investors focused on growth, LevelFields helps you discover companies experiencing major event catalysts—like a new product launch or a strategic restructuring—that could signal strong long-term appreciation, allowing for strategic and timely entry.

Inform Options Strategies: Options traders can leverage LevelFields' event-driven insights to anticipate volatility or directional moves. Understanding why a stock is likely to react to an event allows for more informed options contract selection and enhanced risk management.

Why Choose LevelFields?

LevelFields offers a distinct advantage for investors by transforming complex market analysis into actionable insights:

Unparalleled Speed and Efficiency: LevelFields' AI cuts stock research time from hours to seconds, scanning millions of events 1800x faster than manual methods. This allows you to focus on strategy and execution, not tedious data sifting.

Data-Driven Decisions, Free from Bias: Move beyond subjective opinions and market hype. LevelFields provides verifiable patterns of how events affect stock prices, enabling you to act on facts and make confident decisions, even in volatile markets.

Discover Hidden Opportunities: The platform helps you uncover emerging, under-the-radar companies and niche bull markets that traditional research might miss. This allows you to spot events with the potential for significant returns.

Proven Impact: Recent LevelFields alerts have demonstrated substantial gains post-event, such as Nexgel (NXGL) with +36.7% in 1 week following a Return of Capital event, and Gaotu Techedu (GOTU) with +140.2% in 1 month for the same event type, showcasing the power of event-driven analysis.

Conclusion

LevelFields empowers self-directed investors with advanced AI to transform complex market data into actionable insights. By focusing on event-driven catalysts, it provides a distinct advantage for making faster, smarter, and more confident investment decisions.

More information on LevelFields

Top 5 Countries

Traffic Sources

LevelFields Alternatives

Load more Alternatives-

Deeptracker is the world’s first native AI research platform built for professionals who seek signals, not noise. From company events to supply chain disruptions and policy shifts, Deeptracker helps you track, verify, and act—before the market reacts.

-

Uptrends.ai is an AI - powered tool for investors. It offers a real - time trending stock dashboard, AI - generated event summaries, and customizable alerts. Save time, spot trends, and make informed investment decisions.

-

MarketAlerts.ai is your go-to for smarter investing. AI-powered, it monitors stocks, offers personalized alerts, and features like smart screening. Empower yourself with real-time insights.

-

-