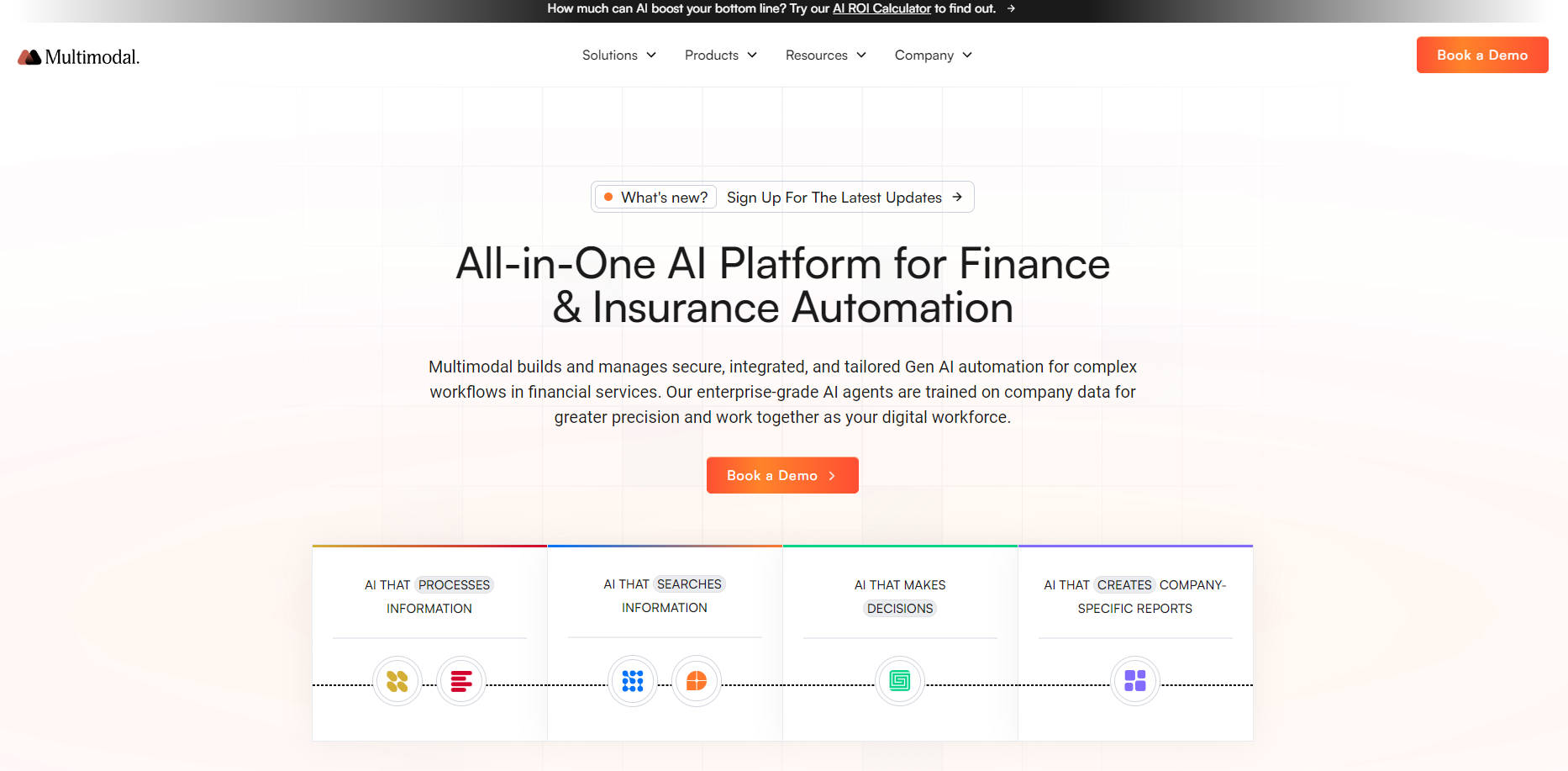

What is Multimodal?

Multimodal is an enterprise-grade AI platform designed to automate complex middle and back-office workflows in finance and insurance. By deploying AI agents trained on your company’s data, Multimodal processes unstructured documents, queries databases, makes data-driven decisions, and generates company-specific reports. This reduces operational costs, speeds up decision-making, and enhances client experiences, all while ensuring data security and compliance.

Key Features:

📄 Document AI

Trained on your schema, this feature extracts, labels, and organizes data from loan applications, claims, PDF reports, and more, ensuring accuracy and efficiency.🤖 Conversational AI

Acts as your in-house chatbot, accessing unstructured internal data to provide instant customer and employee support, reducing response times.📊 Database AI

Queries and interprets company databases to deliver actionable insights, helping teams make informed decisions faster.✅ Decision AI

Ingests internal manuals and guidelines to provide accurate, data-driven decisions for loans, underwriting, claims, and more, minimizing risk and maximizing ROI.📝 Report AI

Generates compliant, company-specific documents like loan agreements, policies, and messages, saving time and ensuring consistency.

Use Cases:

Loan Origination in Banking

Multimodal automates the extraction and processing of loan application data, reducing approval times by 20x and freeing up staff to focus on high-value tasks like customer engagement.Claims Processing in Insurance

The platform processes claims documents, cross-references internal guidelines, and generates compliant reports, cutting processing times by 4x and improving accuracy.Customer Support in Financial Services

Conversational AI handles customer queries by accessing internal databases, providing instant, accurate responses, and reducing the workload on support teams.

Conclusion:

Multimodal transforms how finance and insurance companies operate by automating repetitive, time-consuming tasks with AI agents tailored to your workflows. By reducing manual effort, improving decision-making, and ensuring compliance, Multimodal empowers your team to focus on strategic initiatives. Ready to see how it works? Book a demo today and experience the future of workflow automation.