What is Tendi?

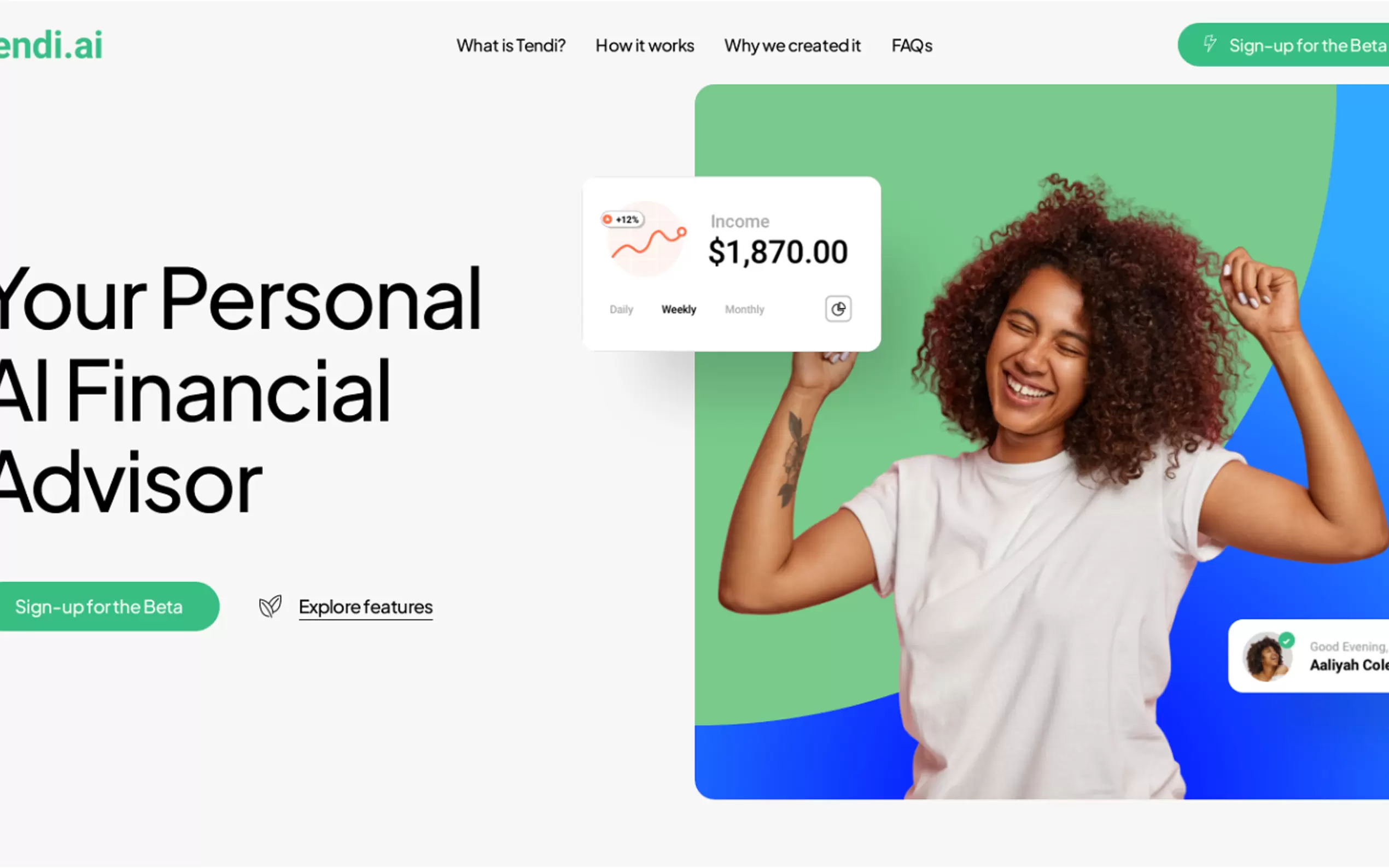

Tendi is a financial AI tool designed to empower individuals with accessible and powerful financial tools, regardless of their background. It enables users to manage their finances, with or without linking bank accounts, and ensures data security through advanced encryption. Tendi caters to various financial goals and is user-friendly, offering both free and premium subscription options.

Key Features:

Personal Finance Management:Tendi helps users track income, expenses, debts, and investments, providing valuable financial advice and insights.

Flexible Data Input:Users can manually input financial information or connect their bank accounts for more accurate financial planning.

Data Security:Tendi prioritizes user data security with advanced encryption and strict privacy protocols, ensuring protection against digital threats.

Use Cases:

Goal-Oriented Savings:Tendi assists users in achieving specific financial objectives, such as saving for a car, vacation, or retirement planning.

Financial Education:It's an ideal tool for beginners, offering easy-to-understand financial advice and educational resources to boost financial knowledge and confidence.

Affordable Financial Planning:Tendi provides a free basic version with essential features and offers a competitively priced premium subscription for personalized advice and comprehensive analytics.

Conclusion:

Tendi, developed by a team of AI and finance experts, empowers individuals to take control of their financial future. It offers user-friendly financial management, data security, and support for various financial goals, making it accessible to both beginners and experienced users. With Tendi, financial empowerment and a better financial future are within everyone's reach.

More information on Tendi

Top 5 Countries

Traffic Sources

Tendi Alternatives

Tendi Alternatives-

Trouvai, an advanced AI financial advisor, offers tailored debt management. Build credit, reduce debt, save smart with automated payments and 24/7 support. Manage finances easily for a debt-free future.

-

Unlock market opportunities with TrendFi's AI. Detect trend changes, manage risk, and get clear insights for smarter stock & crypto investments.

-

Take control of your finances with FinWise, a user-friendly personal finance management software. Budget, plan, and analyze your way to financial success.

-

Tendery simplifies the tender discovery and bidding process with AI-driven insights. We ensure you never miss an opportunity and always submit your best bid.

-

Fina is a flexible financial tracking tool that helps people gain control over their money. Welcome to money management made easy!