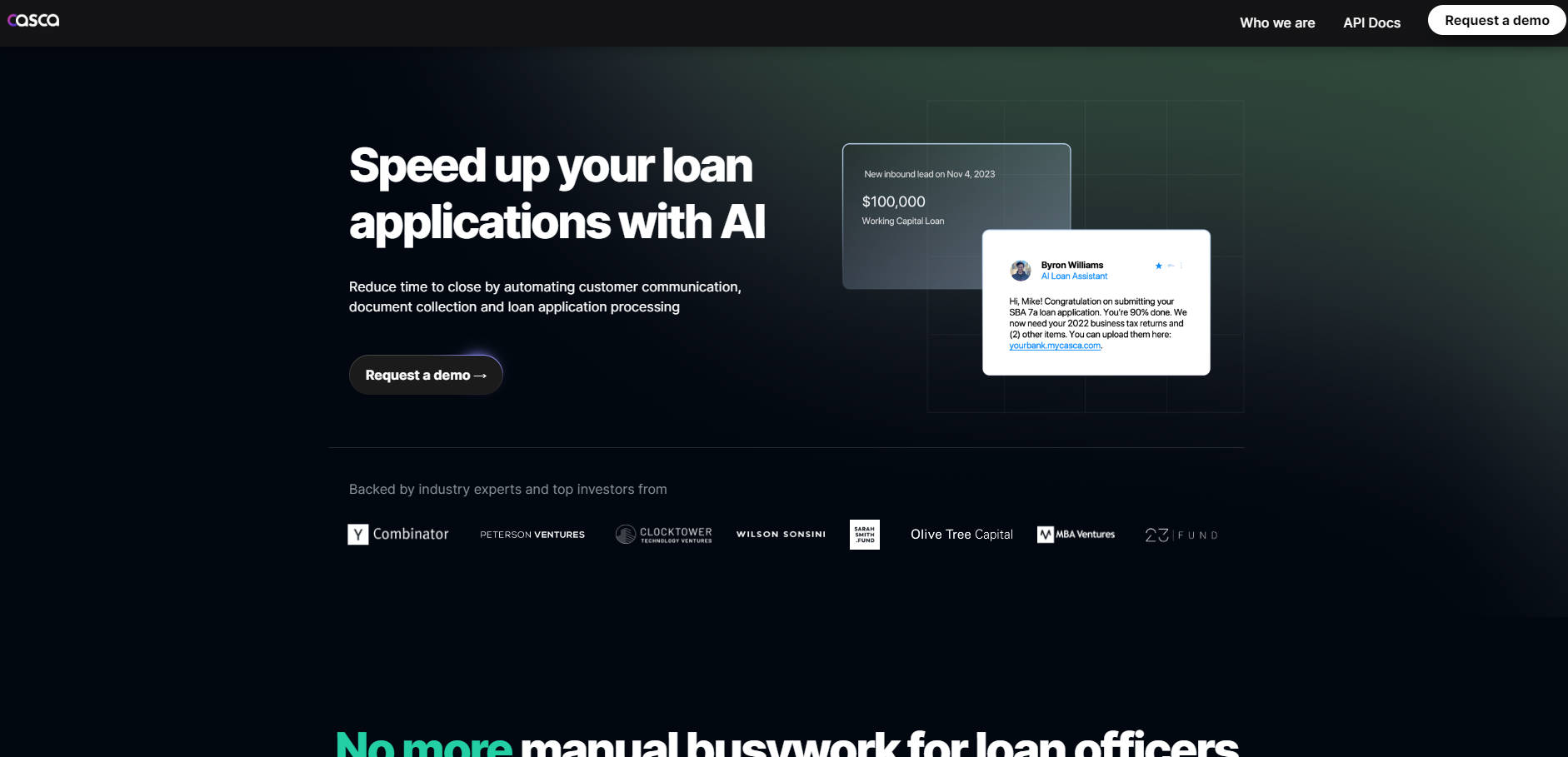

What is Cascading AI?

Cascading AI is an AI-powered software that streamlines loan application processes, reducing the time it takes to close loans. It automates customer communication, document collection, and loan application processing. With Cascading AI, loan officers no longer have to spend hours on manual tasks.

Key Features:

1. AI Loan Assistant: Casca uses generative AI to promptly respond to loan applicants within 2-3 minutes. This feature ensures that leads are not lost due to delayed contact from loan officers.

2. Digital Loan Application: The software provides a secure and customizable digital application portal where customers can easily submit their information. This feature allows for branding and design customization according to the lender's preferences.

3. Loan Origination System (LOS): Cascading AI offers a compliant LOS that enables efficient processing of commercial loan applications. It includes features such as a comprehensive digital loan file, multi-role decision making capabilities, and integration with third-party APIs.

Use Cases:

- Lead Conversion: By leveraging the AI Loan Assistant feature, lenders can convert more leads by providing prompt responses and guidance throughout the application process.

- Simplified Application Process: The Digital Loan Application feature simplifies the collection of customer information through a modern user interface (UI), eliminating paperwork and enhancing the overall customer experience.

- Streamlined Document Collection: Cascading AI automates reminders for applicants to upload necessary documents like financial statements or tax returns via email or an upload portal, saving significant time for both borrowers and lenders.

- Efficient Loan Processing: The LOS functionality ensures compliance while efficiently managing commercial loan applications in a streamlined manner using advanced automation tools.

Cascading AI revolutionizes the lending industry by significantly reducing manual workloads for loan officers while improving efficiency in lead conversion, document collection, and overall loan processing speed. By utilizing artificial intelligence technology effectively across various stages of the lending process, this software enhances customer satisfaction by providing quick responses, simplifying the application process, and ensuring secure document handling. With Cascading AI, lenders can streamline their operations and close loans faster than ever before.