What is Cushion.ai?

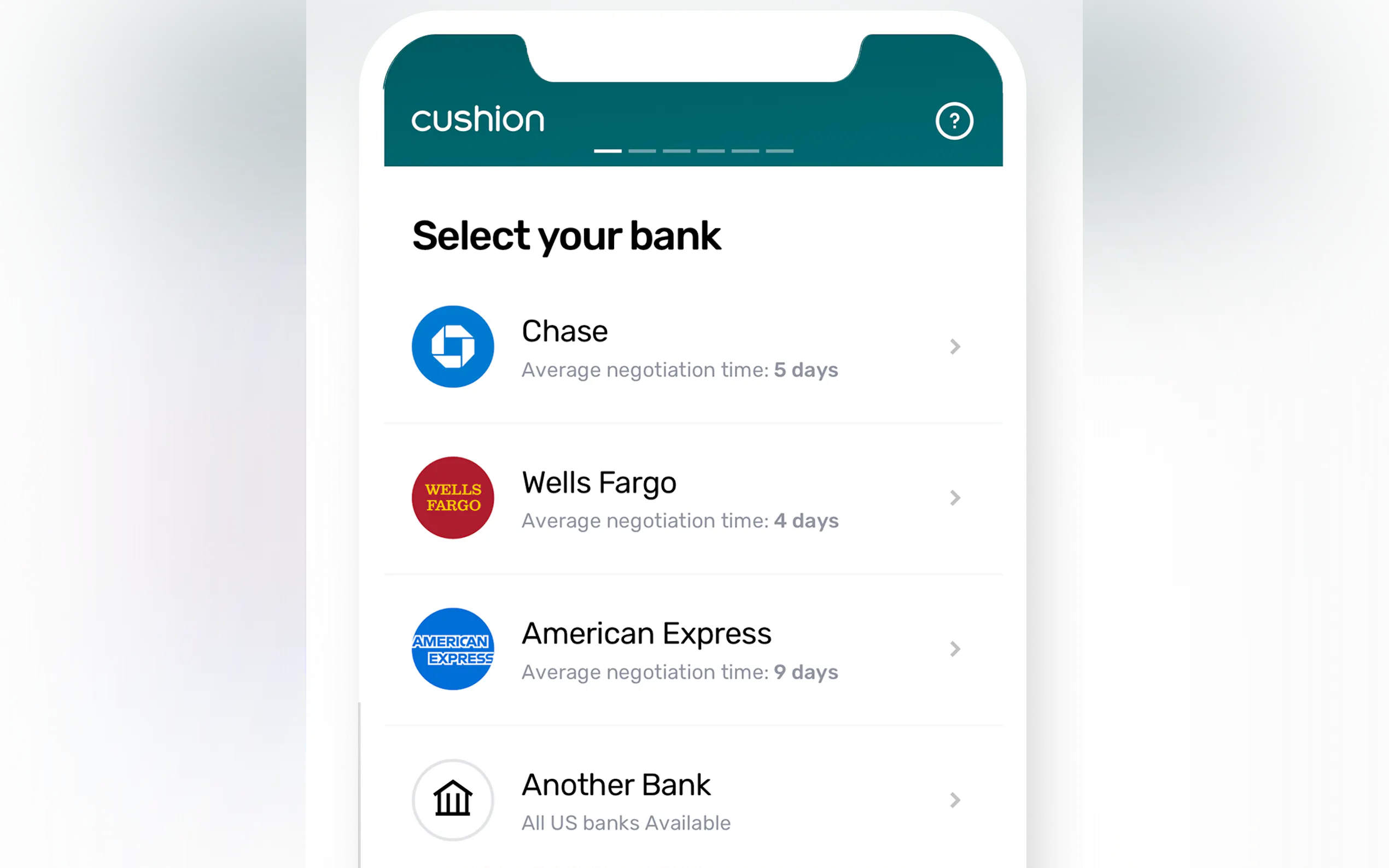

Cushion is an AI-powered tool that simplifies bill management, helps build credit, and provides insights for better budgeting. With Cushion, users can securely connect their accounts to automatically organize bills and Buy Now Pay Later (BNPL) payments in one place. The software also offers a virtual Cushion card for making payments and the ability to track credit scores.

Key Features:

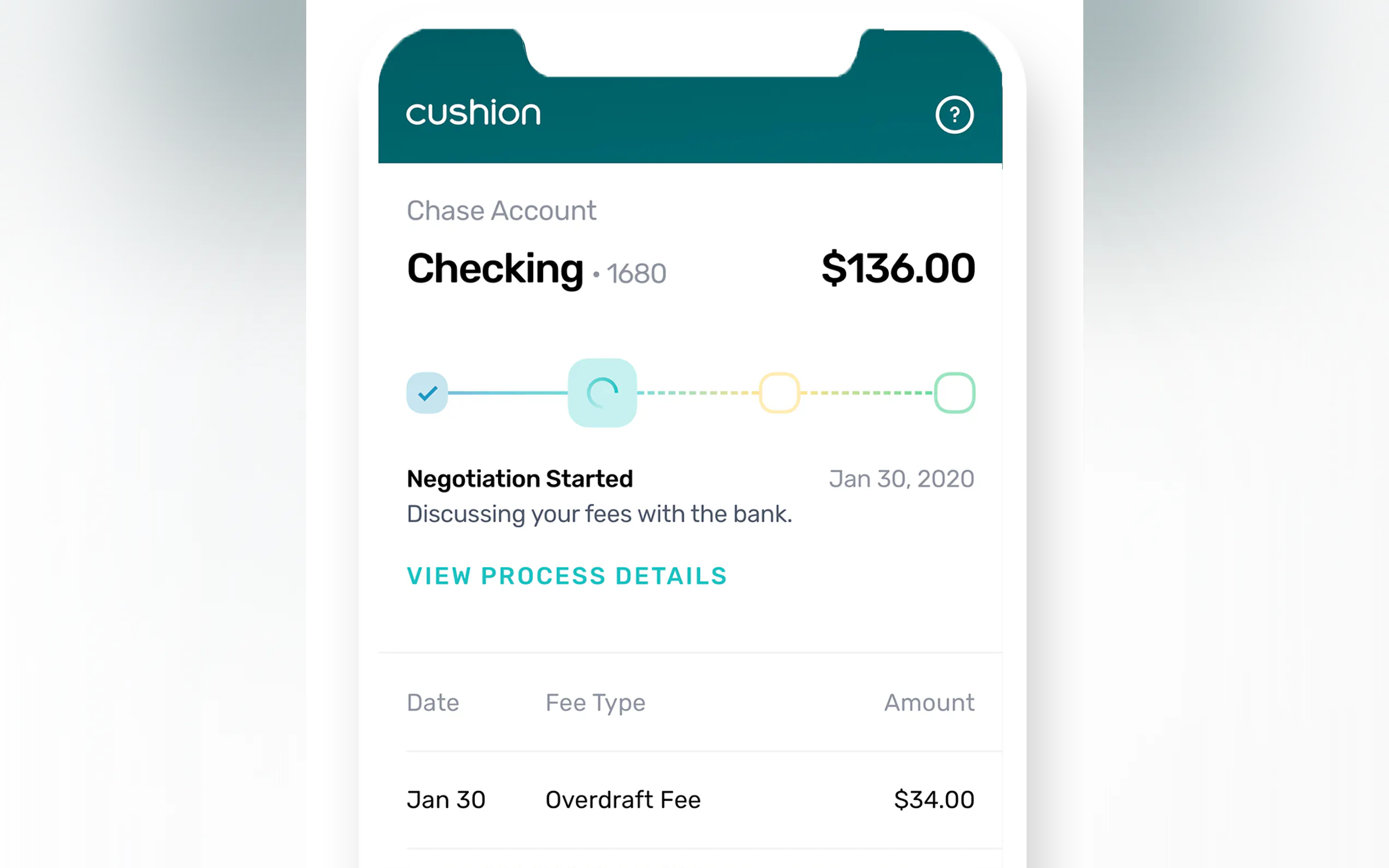

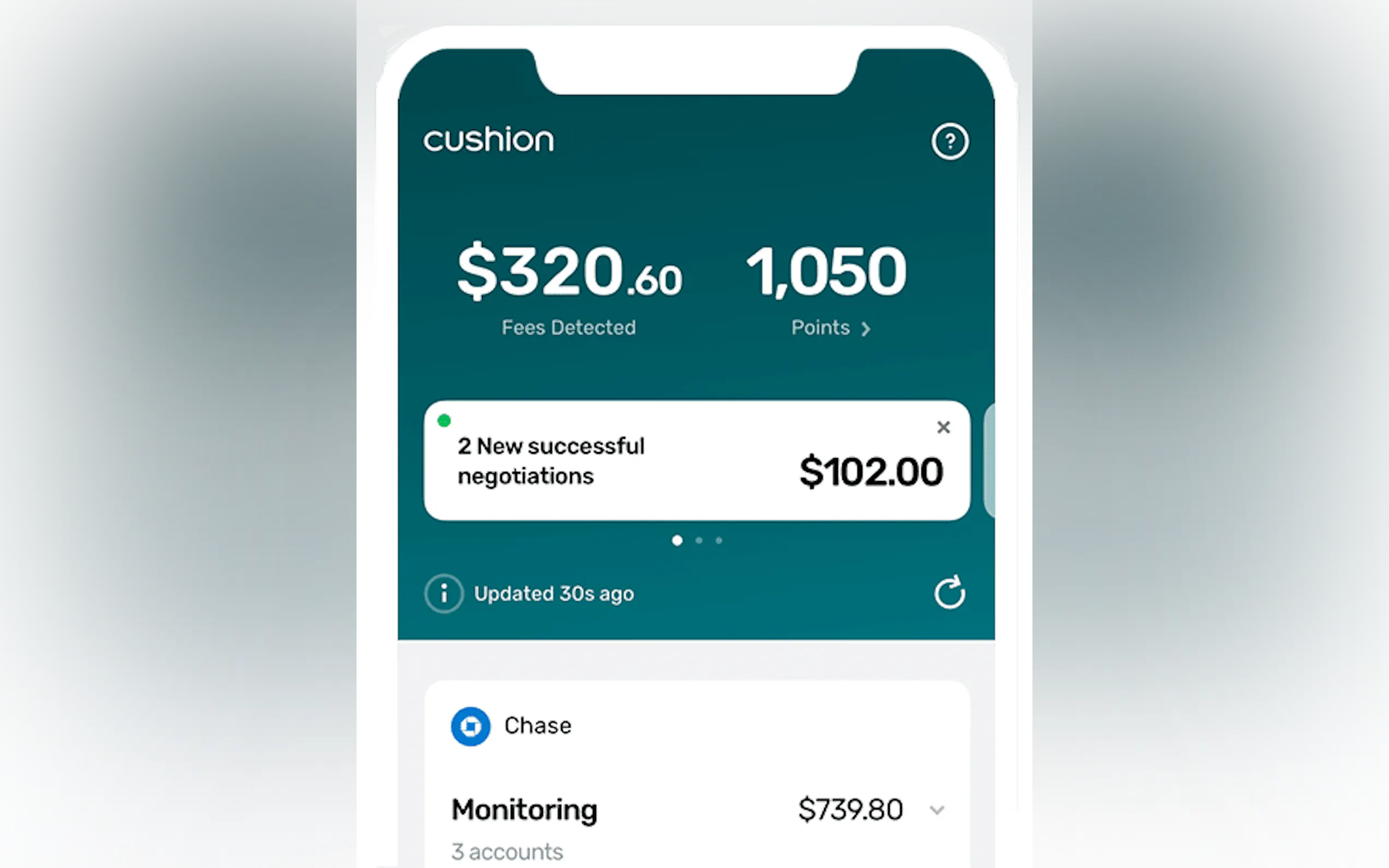

1. Organize Bills & BNPL: Cushion automatically finds and organizes all of your bills and BNPL payments, providing a clear overview of what's been paid or due next.

2. Build Credit History with BNPL Payments: By using the virtual Cushion card to make payments on subscriptions, utilities, and more, users can establish a positive credit history.

3. Track Credit Score (coming soon): Soon, users will be able to monitor their credit score directly within the platform.

Use Cases:

1. Simplified Bill Management: Users can easily keep track of all their recurring bills in one dashboard without the hassle of manually organizing them.

2. Building Credit with Ease: Individuals looking to improve their credit history can leverage Cushion's virtual card feature to make regular payments that are reported to credit bureaus.

3. Enhanced Financial Insights: With access to payment progress tracking and upcoming bill notifications, users gain valuable insights into their financial situation for better budgeting.

Conclusion:

Cushion streamlines bill management by automating organization processes while offering tools for building credit through regular payments made with its virtual card feature. Additionally, upcoming features like tracking credit scores further enhance its value proposition as a comprehensive financial management solution.

More information on Cushion.ai

Top 5 Countries

Traffic Sources

Cushion.ai Alternatives

Load more Alternatives-

-

-

-

Unique helps B2B companies get paid faster and close cash flow gaps. With AI insights, it automates receivables, eliminates errors, and reduces manual tasks. No integration needed—Unique works alongside your software to optimize payments and boost cash flow

-

AI Credit Repair simplifies credit management. Generate dispute letters, remove public records, and get payment reminders. Build and maintain a strong credit score.