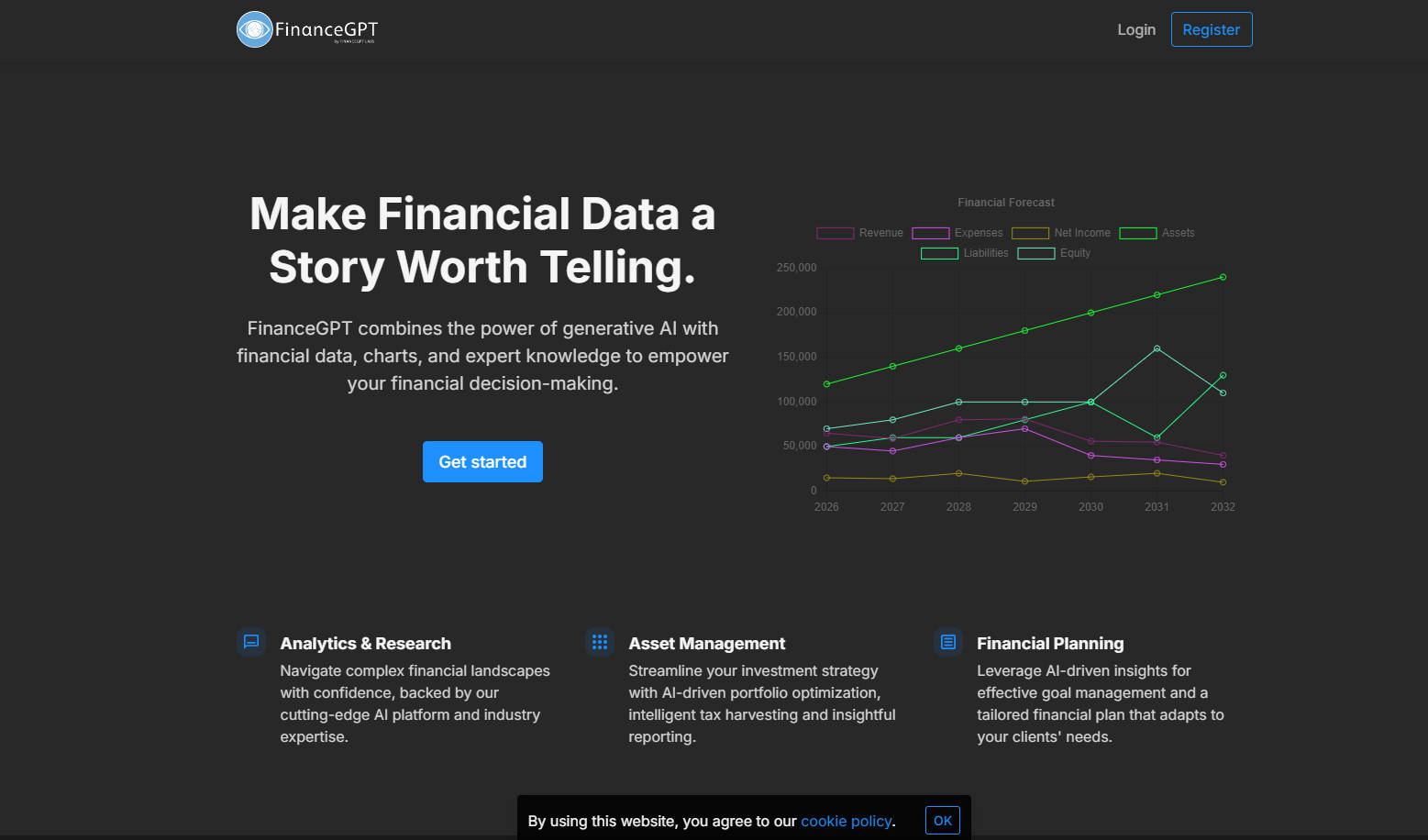

What is FinanceGPT?

The financial world is a whirlwind of data, trends, and ever-shifting landscapes. Staying ahead requires not just access to information, but the ability to quickly and accurately interpret it. FinanceGPT is designed to be your AI-powered co-pilot in this complex environment. It transforms raw financial data into clear, actionable insights, empowering you to make informed decisions with confidence.

Key Features:

FinanceGPT offers a suite of AI-powered tools that streamline and enhance your financial analysis workflow. Here are some of its core capabilities:

📊 Generate Comprehensive Financial Analyses: Input your financial data (balance sheets, cash flow statements, etc.) and receive detailed reports, complete with insightful narratives and visualizations.

🔍 Conduct In-Depth Company Research: Analyze company financials, assess credit profiles, perform equity research, and estimate fair value with ease.

📈 Optimize Investment Strategies: Develop data-driven investment strategies, refine asset allocation, and explore diversification opportunities using AI-powered insights.

💰 Streamline Financial Planning: Whether it's for your business or your clients, create tailored financial plans, manage goals effectively, and adapt to changing market conditions.

🤖 Automate Time-Consuming Tasks: Access over 10 dedicated AI tools for tasks like balance sheet analysis, cash flow forecasting, credit analysis, and valuation, freeing up your time for strategic thinking.

🌍 Analyze Global Market Conditions: Provide information on specific regions and market conditions (e.g., interest rate hikes, energy crises) to receive tailored analysis.

🧑🤝🧑 Share and Collaborate: Easily share your analyses with colleagues or clients, granting access to the insights you've generated.

Use Cases:

Let's see how FinanceGPT can make a tangible difference in your daily work:

Investment Portfolio Review: Imagine you're reviewing a client's portfolio. Instead of manually sifting through spreadsheets, you input the portfolio data into FinanceGPT. Within moments, you receive a comprehensive report highlighting potential risks, areas for diversification, and projected performance under various market scenarios. You can then confidently advise your client on the best course of action.

Mergers & Acquisitions Due Diligence: You're evaluating a potential acquisition target. FinanceGPT's Balance Sheet Analysis, Cash Flow Analysis, and Valuation Analysis tools allow you to quickly assess the target company's financial health, identify potential synergies, and estimate a fair value, significantly accelerating the due diligence process.

Startup Fundraising: A startup is seeking your advice on fundraising. By inputting their financial data, you can use FinanceGPT to generate a compelling valuation analysis, optimize their cash flow projections, and create a robust fundraising strategy, increasing their chances of securing funding.

Conclusion:

FinanceGPT isn't about replacing human expertise; it's about amplifying it. It's a powerful tool that empowers investors, financial managers, and accountants to navigate the complexities of the financial world with greater speed, accuracy, and confidence. By transforming data into clear, actionable insights, FinanceGPT helps you make smarter decisions and achieve better financial outcomes.

FAQ:

Q: How does FinanceGPT ensure the accuracy of its analyses?

A: FinanceGPT utilizes advanced AI/ML algorithms trained on a vast dataset of financial information. While AI provides powerful insights, it's crucial to remember that the output is based on the input data provided. Always review the results and apply your professional judgment.

Q: What types of financial data can I input into FinanceGPT?

A: FinanceGPT accepts various financial data inputs, including balance sheets, income statements, cash flow statements, market conditions, and regional information. The more comprehensive your input, the more detailed and accurate the analysis will be.

Q: Can I share the analyses generated by FinanceGPT with others?

A: Yes, FinanceGPT allows you to easily share your analyses with colleagues or clients by granting them access via email.

Q: How is FinanceGPT different from traditional financial analysis software?

A: Traditional software often requires manual analysis and interpretation. FinanceGPT leverages AI to automate much of this process, providing not just data, but also insightful narratives and visualizations, saving you time and effort.

Q: What kind of support does FinanceGPT provide? A: FinanceGPT offers a guide to assist users. This guide gives a comprehensive understanding of how to use FinanceGPT's suite of generative AI tools for financial analysis and strategy.

More information on FinanceGPT

Top 5 Countries

Traffic Sources

FinanceGPT Alternatives

Load more Alternatives-

Build personalized AI co-pilots for financial insights with FinanceGPT Chat. Generate reports, ask questions, and make smarter financial decisions.

-

-

-

Stock Market GPT is the most advanced AI powered investment researcher. Get your personal Investment Researcher powered by advanced AI. Use AI to get a more in-dept understanding of your future investments.

-

Google Finance: AI-driven insights, real-time market data & advanced charts. Make smarter investment decisions and navigate markets with confidence.