Navigating the Future of Finance: Top 10 AI Stock Trading Bots in 2023

The integration of artificial intelligence (AI) into the world of finance has revolutionized the way we approach stock trading. AI stock trading bots, utilizing machine learning algorithms, have become pivotal tools in automating trading processes, analyzing market data, generating trading signals, executing trades, and optimizing portfolios. They offer the potential to save time, reduce risk, and increase profits for traders of all levels.

The 10 Best AI Stock Trading Bots of 2023

1. Trade Ideas

Trade Ideas stands out as the best AI stock trading bot for finding and executing high-probability trades. Its setup includes several dozen investment algorithms, catering to all levels of investors. The AI-Holly bot provides statistically weighted entry and exit signals, tailoring to different risk management strategies for intraday trading.

2. TrendSpider

TrendSpider is renowned for its AI chart pattern recognition and backtesting capabilities. It allows users to convert their strategies into fully automated bots. These bots can trigger events based on specific strategy conditions, offering flexibility and customization for various trading needs.

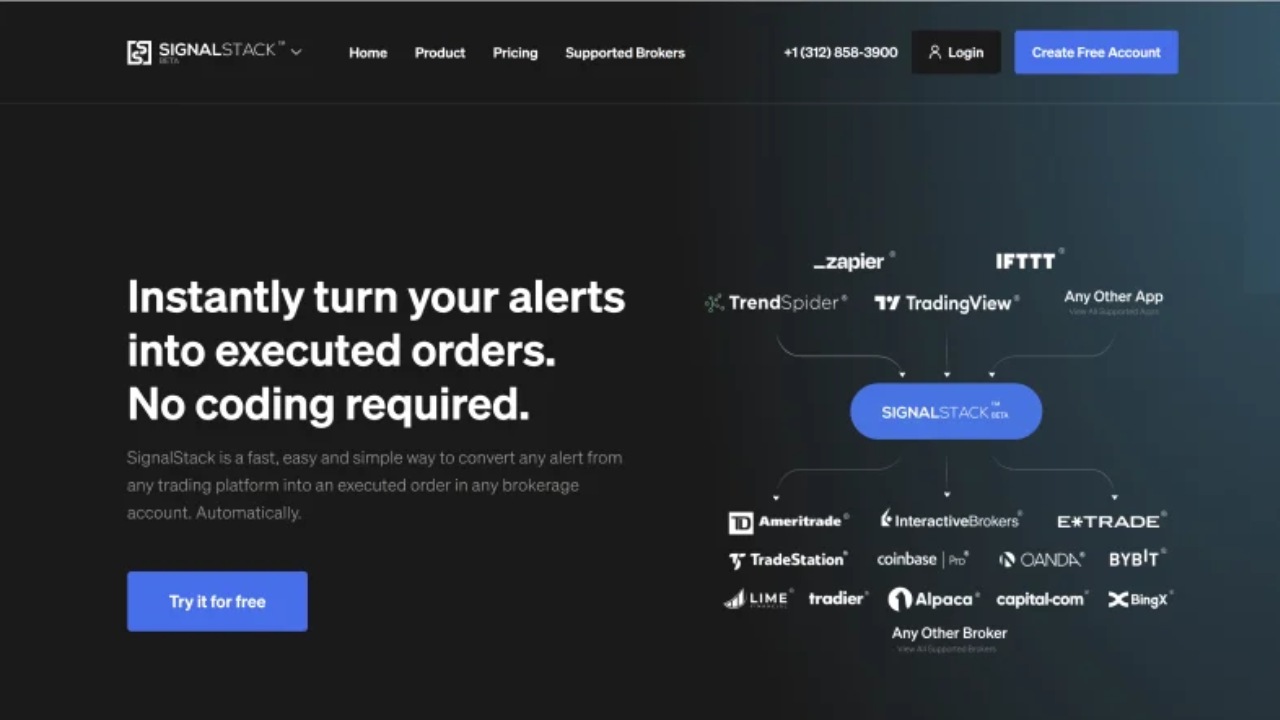

3. Signal Stack

Signal Stack is designed to convert alerts from any trading platform into executed orders in brokerage accounts. This enterprise-grade platform is highly reliable and can process signals into live orders swiftly, minimizing slippage and offering a level playing field for retail traders.

4. Stock Hero

Stock Hero provides a simulated paper exchange for risk-free strategy testing and easy deployment of bots. It offers features like backtesting in multiple time frames and a Bots Marketplace, where users can access bots created by experienced traders.

5. Tickeron

Tickeron offers AI Robots for real-time trade viewing, AI trend forecasting, and customizable confidence levels. Its AI Robots scan stocks and ETFs, providing trading opportunities based on real-time patterns. The platform is particularly beneficial for traders seeking advanced AI trading options.

6. Scanz

Scanz is an all-in-one market scanning platform, ideal for day and swing traders. It offers real-time streaming of trade opportunities, advanced news feed functionalities, and integration with multiple brokers. Scanz's comprehensive scanning capabilities cover a wide range of market variables.

7. Imperative Execution

Imperative Execution specializes in optimizing trading performance for U.S. Equities. It features the IntelligenceCross tool and ASPEN system for automated order management and near-continuous order matching, enhancing market efficiency.

8. Algoriz

Algoriz allows users to build, backtest, and automate trading strategies in equities and cryptocurrencies. It supports an intuitive interface, connection to various data vendors, and integration with broker accounts, making it accessible for traders with limited programming knowledge.

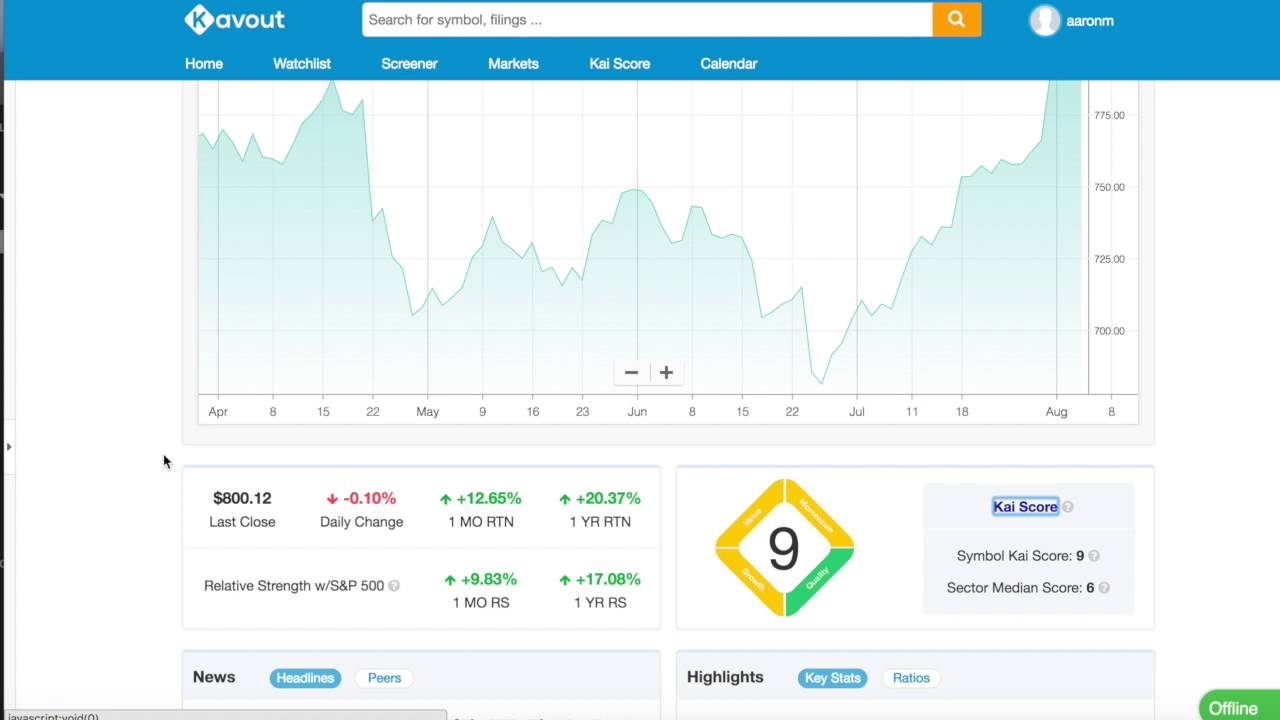

9. Kavout

Kavout's AI investing platform is anchored by its AI machine "Kai," which analyzes a vast array of data points. It offers features like a paper trading portfolio and a market analysis tool, providing predictive rankings for stocks and various assets.

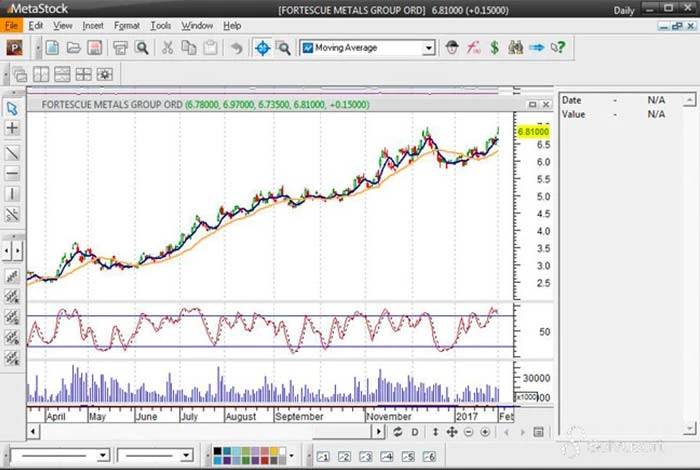

10.MetaStock

MetaStock is an AI-based charting tool that helps traders in analyzing various stock markets. This AI software for stock trading tool utilizes technical analysis to find the best securities to invest in via a methodical and systematic approach. With it, you can create and view charts for stocks, indices, bonds, currencies, etc.

Legal and Cost Considerations

AI stock trading bots are legal in most countries, provided they comply with local regulations and exchange rules. The cost of these bots varies, with some offering free trials or freemium plans, while others require a subscription fee.

Conclusion

AI stock trading bots represent a significant leap in financial technology, offering enhanced trading efficiency, accuracy, and profitability. While they vary in features and specialties, each bot listed here brings unique advantages to the table, catering to different trading styles and objectives. As the landscape of AI-driven finance continues to evolve, these tools are set to play an increasingly pivotal role in shaping the future of stock trading.

FAQ:

- How Do AI Stock Trading Bots Work?

AI Stock Trading Bots use algorithms based on artificial intelligence and machine learning to analyze market data, identify trading signals, and execute trades automatically. They can process large volumes of data and react to market changes much faster than humans.

- Are AI Stock Trading Bots Safe to Use?

Generally, AI Stock Trading Bots are safe if they are from reputable providers. However, like any trading tool, they carry risks and should be used with an understanding of the market and the specific bot's functionality.

- What are the Benefits of Using AI Stock Trading Bots?

The main benefits include increased efficiency in trading, the ability to analyze vast amounts of data rapidly, reduced emotional decision-making, and the potential for improved profitability. They also allow for 24/7 trading, capitalizing on opportunities even when the trader is not actively monitoring the markets.

- Can AI Stock Trading Bots Adapt to Market Changes?

Yes, many AI trading bots are designed to adapt to changing market conditions. They learn from market patterns and can adjust their trading strategies accordingly. However, the level of adaptability varies among different bots.

- How to Get Started with an AI Stock Trading Bot?

To get started, choose a reputable AI trading bot, create an account, and connect it to your trading platform. It's important to start with a clear understanding of your trading goals and risk tolerance. Many bots offer demo versions or simulation modes, which are great for practicing before live trading.