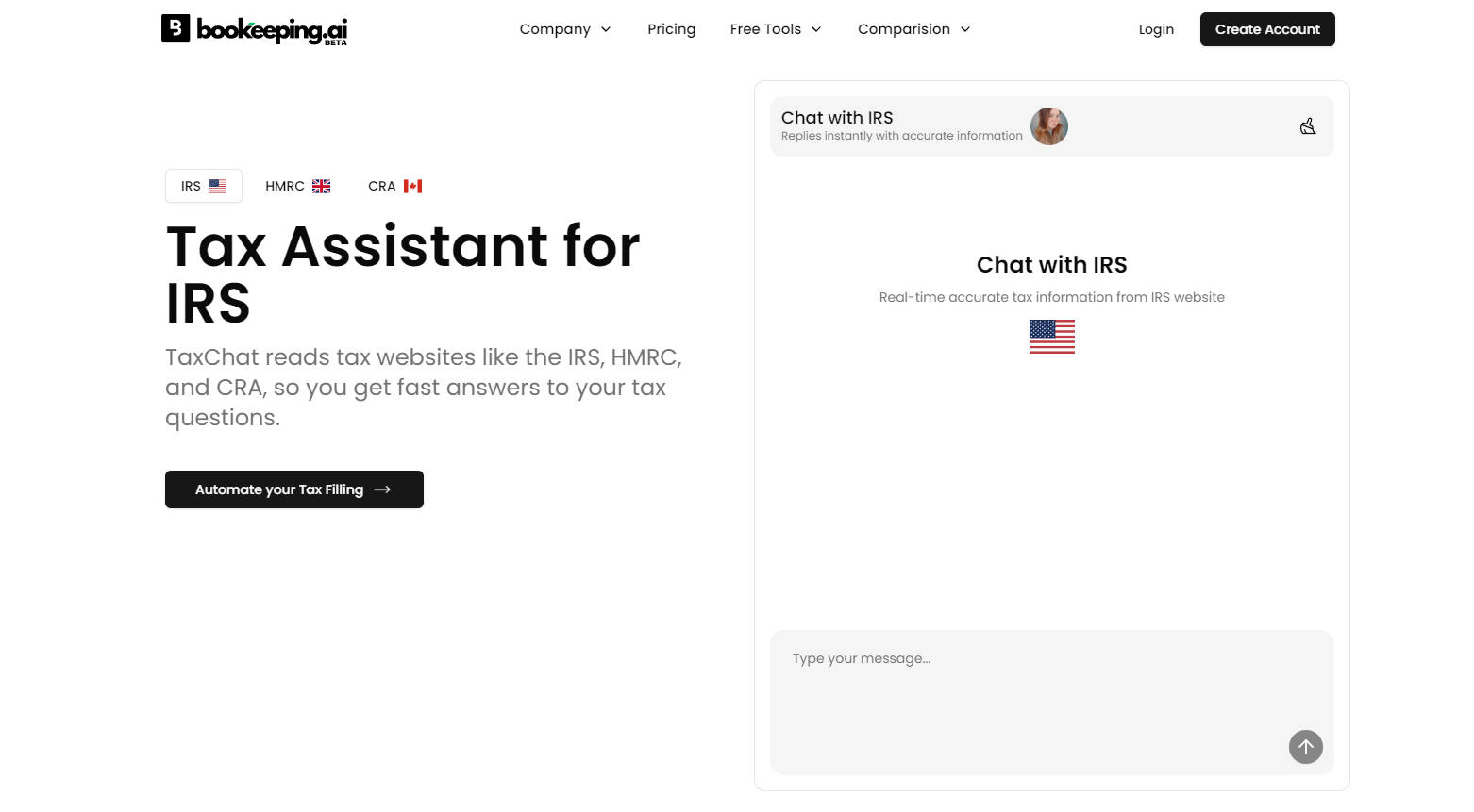

What is Free IRS AI Chatbot?

Understanding tax rules can often feel complex, and finding quick answers shouldn't involve long waits or high costs. If you have questions about IRS guidelines, forms, or procedures, getting straightforward information when you need it is essential. The Free IRS AI Chatbot offers a direct line to tax information, simplifying how you find answers.

Think of it as a helpful assistant specifically trained on the official IRS website. It reads the publicly available information there to provide responses to your tax-related questions, saving you time and effort.

How It Helps You

✅ Direct IRS Sourcing: Your answers are drawn directly from information published on the official IRS website, providing a reliable foundation for the responses.

🔄 Daily Information Refresh: The chatbot's knowledge base, sourced from the IRS website, is updated every 24 hours to ensure the information reflects recent updates.

🕒 Immediate Responses: Ask your question and receive an answer promptly. Avoid waiting on hold or navigating through multiple web pages.

🌐 Accessible Anytime: Tax questions don't always arise during business hours. This tool is available 24/7, whenever you need quick clarification.

💰 Completely Free: Access tax information derived from the official source without any fees or subscriptions.

See It In Action: Practical Examples

How might you use the Free IRS AI Chatbot? Here are a few scenarios:

Clarifying Deductions: You're self-employed and wondering about the general rules for deducting home office expenses. Ask the chatbot, "What are the basic requirements for deducting a home office?" to get information based on IRS guidelines.

Understanding Tax Credits: Perhaps you're a student curious about education-related tax benefits. You could inquire, "Can you explain the American Opportunity Tax Credit?" for a summary based on IRS details.

Checking Filing Status Info: It's late Sunday evening, and you're unsure which filing status applies to your situation this year. Ask the chatbot, "What are the different tax filing statuses?" for a quick overview sourced from IRS.gov.

Get Straightforward Tax Information

The Free IRS AI Chatbot provides a simple, cost-free way to access tax information derived directly from the official IRS website. It offers immediate responses around the clock, helping you find answers to many common tax questions quickly and efficiently.

More information on Free IRS AI Chatbot

Top 5 Countries

Traffic Sources

Free IRS AI Chatbot Alternatives

Free IRS AI Chatbot Alternatives-

TaxBotGPT is your dedicated AI tax assistant designed to simplify your tax-related queries. Powered by LLM technology

-

Get quick and accurate answers to your tax questions with ZeroTax.ai's revolutionary AI-powered tax assistance tool. Try it risk-free today!

-

Using Artificial Intelligence and Machine Learning Technology to Prepare and File Your Taxes.

-

Get reliable answers and retrieve sources instantly, Access over 1 million pages from Finlex, Vero, and KILA, draft documents and emails effortlessly, collaborate, and most important, get things done.

-

Get your questions answered in seconds for free with our proprietary AI.