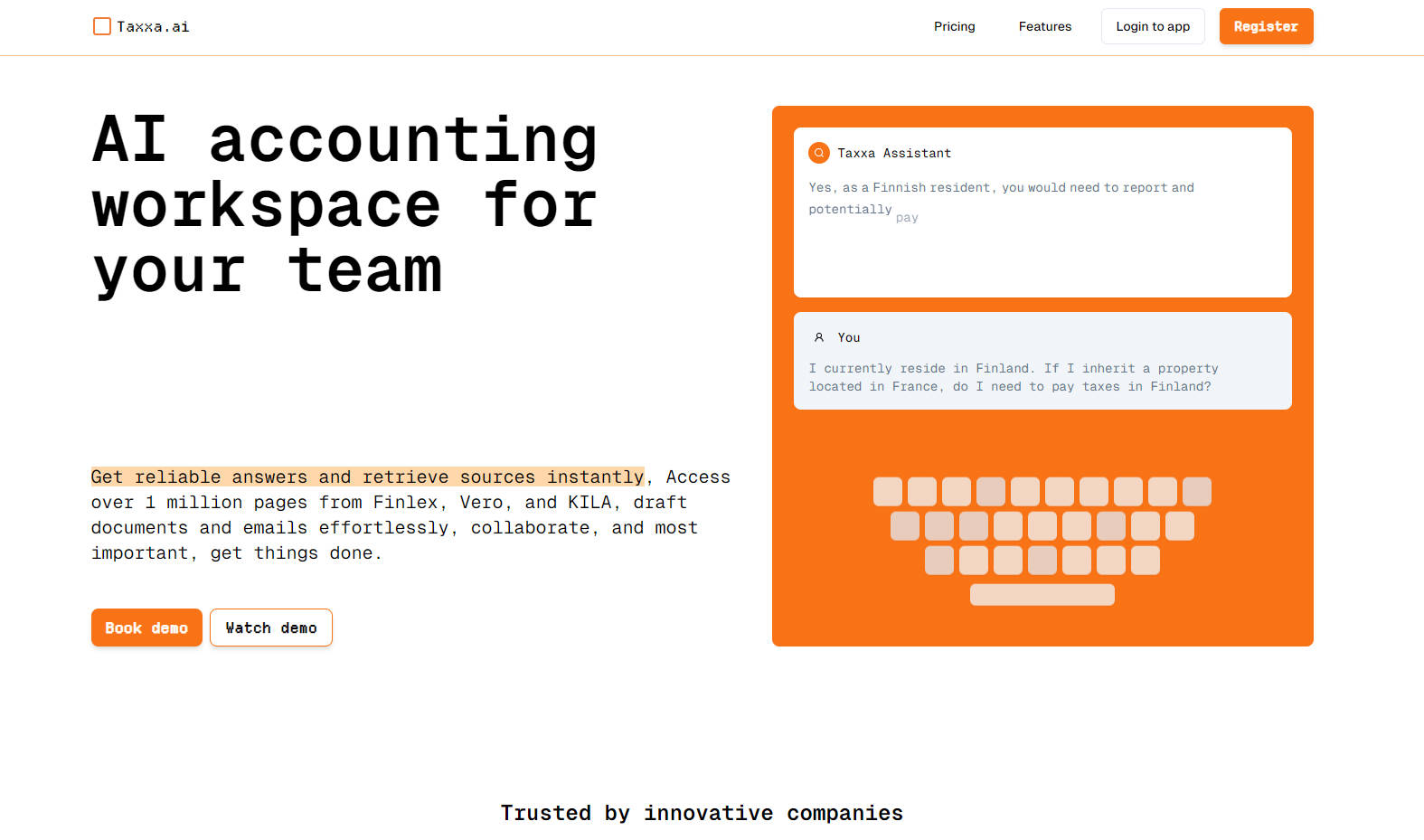

What is Taxxa.ai?

Are you spending too much time sifting through tax regulations and guidelines? Meet Taxxa, the AI-powered workspace designed specifically for accountants, auditors, and payroll professionals. With Taxxa, you can transform hours of research into minutes, ensuring you always have the most accurate and up-to-date information at your fingertips.

Key Features 🚀

Comprehensive Tax Knowledge Base

Access over 1 million pages from authoritative sources like Finlex, Vero, and KILA.

Stay updated with daily refreshes to ensure you have the latest tax regulations and guidelines.

Multilingual Support

Supports Finnish, Swedish, and English to help you communicate effectively with clients in any language.

Enhance your writing and communication with AI-assisted proficiency in multiple languages.

Instant and Verifiable Answers

Get precise answers in seconds to even the most complex tax questions.

Every answer comes with verifiable sources and direct citations to official tax regulations and guidelines.

AI Safeguards for Accuracy

Advanced safeguards to eliminate the risk of AI-generated fabrications or unreliable information.

Verification system ensures 100% citation accuracy, giving you confidence in every response.

Use Cases

Scenario 1: Drafting a Client Email on Inheritance Tax

Imagine you need to draft an email to a client about inheritance tax. With Taxxa, you can:

Quickly find the relevant information and get a concise summary.

Draft the email effortlessly using the AI’s assistance, ensuring it is clear and accurate.

Verify the sources instantly to provide your client with reliable and up-to-date information.

Scenario 2: Analyzing an Income Report

When analyzing an income report for January, Taxxa helps you:

Rapidly process and analyze the data to identify key trends and insights.

Generate a detailed report with accurate and verifiable information.

Save hours of manual analysis and focus on providing expert advice to your clients.

Scenario 3: Preparing for a Board Meeting

Preparing for a board meeting can be daunting, but with Taxxa, you can:

Generate a task list for follow-up actions based on the meeting notes.

Summarize the meeting notes to capture all the important points.

Ensure that every detail is accurate and well-documented, making your preparation seamless and efficient.

Conclusion

Taxxa is more than just a tool; it's a game-changing solution for accounting professionals. By reducing research time, enhancing accuracy, and providing multilingual support, Taxxa empowers you to serve more clients, grow your revenue, and deliver exceptional service. Trust in Taxxa to handle your toughest tax queries with speed and precision.

Frequently Asked Questions

Q: How often do you refresh your database?

A: Our database is updated once a week, ensuring all our knowledge base is always up to date.

Q: What is the main difference between Taxxa and ChatGPT?

A: Taxxa provides answers and citations sourced exclusively from thousands of authoritative documents published by the Finnish Tax Authority and the government, ensuring 100% reliability and accuracy.

Q: What have you indexed?

A: We have indexed the entire knowledge base of Vero.fi, specific business, employment, and tax-related laws from the Finnish government, as well as instructions and statements from the Accounting Board (KILA).

Q: What is your pricing structure?

A: At the moment, the application is free to use for early adopters. We will soon charge a monthly subscription fee to access the tool.

Q: How do I access the tool?

A: To access the tool, simply go to https://www.taxxa.ai/register and register your account (email, company name). You will then be asked to create a password. Once you have completed those steps, you will have access to the Taxxa online interface.

Q: Who owns the data entered in the tool and the responses provided?

A: As an end-user, you own the inputs and outputs provided by the Taxxa tool. The data and our service are currently hosted by Microsoft in highly secured data centers located in Europe. Please note that your prompts (inputs) and completions (outputs) are NOT available to other customers, are NOT available to OpenAI, and are NOT used to improve OpenAI models or any foundation models.