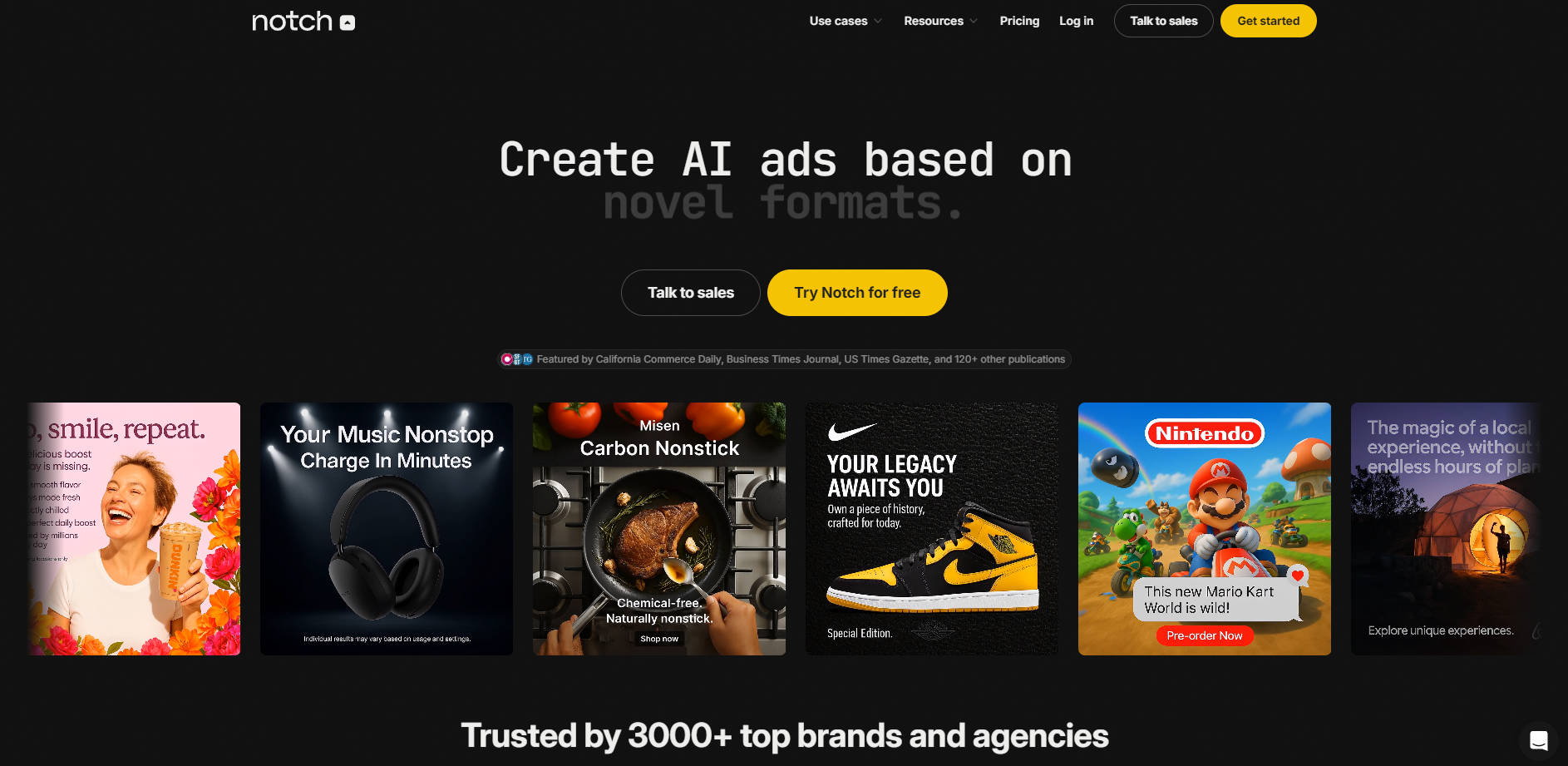

What is Notch ?

Driven.ai is your essential AI investing partner, grounded in trusted data and specialized analysis. It solves the critical problem of market noise and superficial data analysis by delivering fast, clear, and actionable insights, revealing what’s truly driving market momentum for serious investors and analysts.

Key Features

Driven.ai combines institutional-grade data ingestion with next-generation AI analysis to give you a decisive edge in market research.

📈 Real-time Global Quotes: Access free, real-time coverage for over 70,000 global stocks. We ensure you have immediate access to the necessary data points without delay, allowing for timely decision-making regardless of the market you follow.

📰 Wall Street–Grade News & Sentiment: Cut through the noise with high-quality coverage aggregated from over 5,000 news sources and social media streams. This system provides comprehensive context and surfaces timely market chatter and sentiment that often moves prices.

🧠 Next-Gen Chart Interaction: Move beyond static visualization. Our interactive charts are purpose-built for investing, allowing new interactions that instantly trigger AI answers for deeper research. This integrated approach generates diverse contexts required by the AI to deliver profound, relevant answers.

📧 Personalized Market Wrap: Stay informed with tailored daily and weekly briefings. Receive concise summaries of key market events and critical updates specific to the companies and sectors on your personal watchlist, ensuring you start the day with focus.

Use Cases

Driven.ai is designed to integrate seamlessly into the demanding workflow of an active investor, transforming raw data into practical, investable insights.

Accelerate Due Diligence

When researching a new stock, use the Next-Gen Chart to identify a recent price movement, then instantly prompt the AI agent for underlying causes. Driven.ai will combine real-time filings (like SEC 10-K or 10-Q), relevant news, and social sentiment to provide a structured, analyst-level summary, immediately cutting days off traditional research time.

Validate Investment Theses

If you suspect management is overstating growth, task the AI with analyzing the latest earnings report. Driven.ai applies the Investible Insights Benchmark—connecting financials, competitive dynamics, and sentiment—to help you spot sustainable growth versus temporary margin boosts, providing a differentiated view that goes beyond surface-level summaries.

Monitor Real-Time Market Shifts

Leverage the integrated Social Signals feature to track timely chatter across X (Twitter) finance streams. Instead of relying solely on delayed news wires, you can monitor rapid shifts in market sentiment and emerging narratives, allowing you to react quickly to trends before they become widespread news.

Why Choose Driven.ai?

Driven.ai is purpose-built for financial analysis, delivering performance and reliability that general-purpose Large Language Models (LLMs) cannot match. Our advantage stems from specialized data sources, optimized parsing, and a rigorous, investor-centric evaluation framework.

Superior Performance Validated by Real-World Benchmarks

We don't just rely on general LLM benchmarks. Driven is tested against the proprietary Investible Insights Benchmark, a framework developed alongside Stanford researchers and industry veterans. This benchmark tests the AI’s ability to perform day-to-day tasks of a junior equity analyst, focusing on actionable investment decisions, not trivia.

| Benchmark Task | Driven Score | Comparative LLM Score | Advantage |

|---|---|---|---|

| Quantitative Retrieval | 62.64 | Perplexity: 42.34 | Greater precision in numerical data extraction. |

| Financial Modeling | 62.64 | Gemini 2.5: 44.57 | Stronger handling of complex financial data sets. |

| Analytical Precision | 62.64 | GPT-5 (Web): 60.65 | Outperforms in accuracy, speed, and cost for equity analysis. |

Direct Retrieval from SEC Filings

While most general AI models rely on secondary search results that often pull incorrect or outdated documents, Driven ensures accuracy by pulling data directly from regulatory sources like SEC 10-Ks and 10-Qs. This reliable document retrieval is fundamental to building credible investment models.

Expert-Level Interpretation and Context

Driven's analysis is structured around five core evaluation dimensions, ensuring the output is truly useful:

- Accuracy: Explicitly states the time range, fiscal quarter, and data source to enhance user trust and verifiability.

- Logical Coherence: Provides quantitative or qualitative support to substantiate its points, ensuring a clear, reasoned structure.

- Thoroughness: Interpretation goes beyond mere metrics listing, providing necessary broader context for decision-making.

Conclusion

Driven.ai provides the speed, accuracy, and depth required for modern financial research. By combining real-time data integration with an AI agent rigorously tested on the Investible Insights Benchmark, you gain access to actionable, differentiated perspectives that cut through market noise.

More information on Notch

Top 5 Countries

Traffic Sources

Notch 대체품

더보기 대체품-

-

Deeptracker는 잡음 속에서 유의미한 신호를 찾아내고자 하는 전문가들을 위해 개발된 세계 최초의 네이티브 AI 리서치 플랫폼입니다. 기업 이벤트부터 공급망 혼란, 정책 변화에 이르기까지, Deeptracker는 시장이 반응하기 전에 정보를 추적하고, 검증하며, 효과적인 조치를 취할 수 있도록 지원합니다.

-

Intellectia AI와 함께 시장을 자신 있게 누비세요. AI 기반 주식 및 암호화폐 인사이트, 매일의 추천 종목, 스윙 트레이딩 신호, 그리고 금융 분석을 만나보세요.

-

Boosted.ai는 AI 기반 투자 플랫폼입니다. 주식 선택, 포트폴리오 구성 및 리서치를 위한 도구를 제공합니다. 자산운용사들이 포트폴리오를 최적화할 수 있도록 지원하며, 업무 프로세스를 간소화하고 성과를 향상시킵니다.

-