What is Numeral?

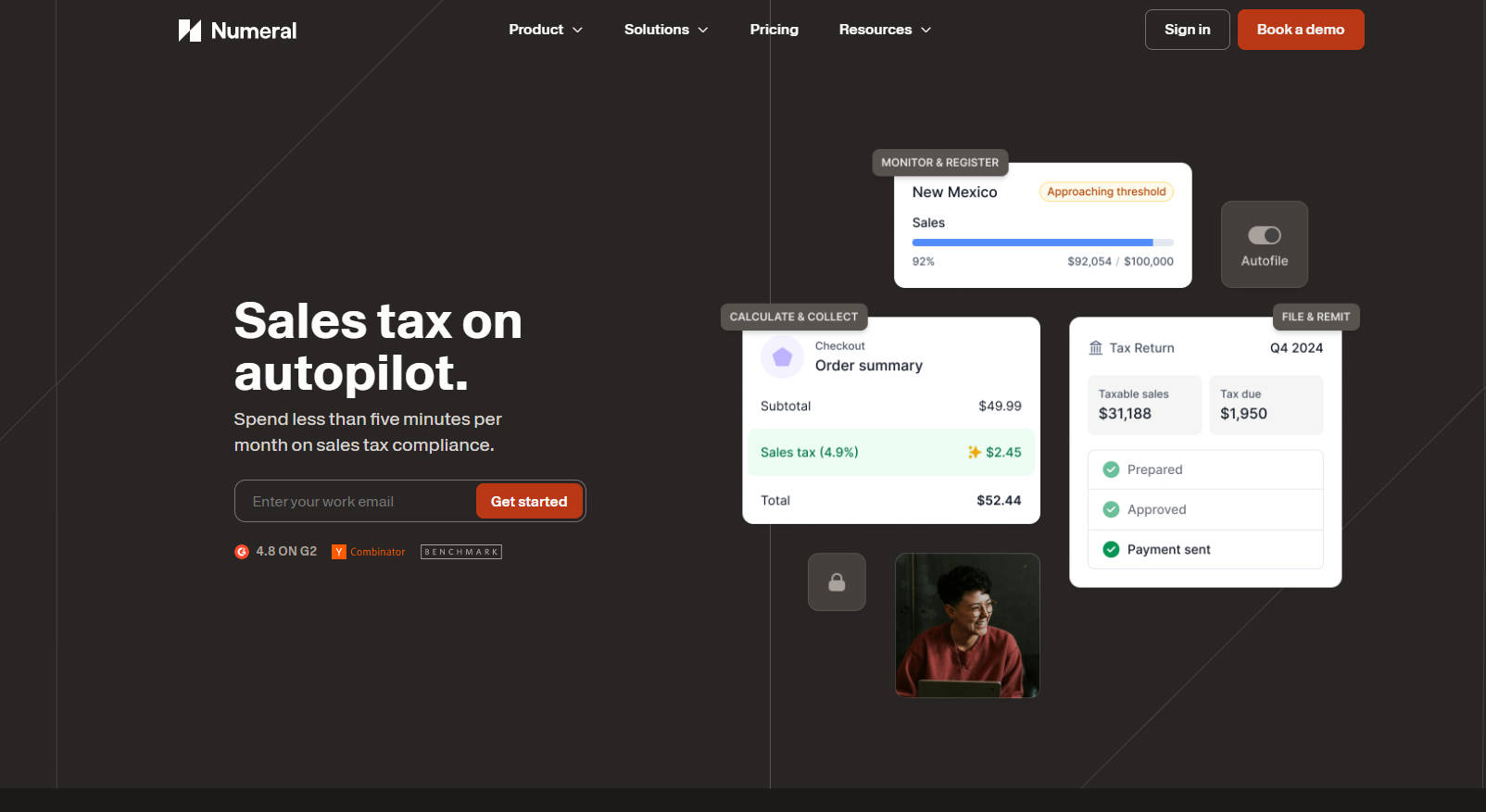

Are you tired of wrestling with sales tax compliance, pulling you away from what truly matters – growing your business? Sales tax is a complex web of rules, rates, and deadlines that can quickly become a major headache for Ecommerce and SaaS businesses. Imagine spending just minutes each month on sales tax, instead of hours. Numeral is designed to do exactly that. We take the burden of sales tax off your shoulders, automating everything from tracking nexus to filing returns, so you can refocus on your core business.

Key Features

📍 Smart Nexus Tracking: Confidently navigate the ever-changing landscape of sales tax nexus. Numeral automatically monitors economic and physical nexus thresholds across all states, alerting you when you're approaching or exceeding them, ensuring you're always compliant as you grow.

🚀 Autopilot Registrations: Say goodbye to tedious state registration processes. Numeral handles sales tax registrations for you, communicating directly with state agencies and even automatically registering you in new states when you trigger nexus, saving you countless hours and frustrating paperwork.

🧾 Automated Filing & Remittance: Never miss a sales tax deadline again. Numeral integrates with your billing systems to accurately calculate, prepare, and file your returns on time, every time. We even remit payments and provide detailed reports, all on autopilot.

🧮 Precise Tax Calculation API: Integrate accurate, real-time sales tax calculations directly into your billing platform or custom checkout with Numeral’s robust API. Ensure your customers are always charged the correct tax rate, down to the city and district level, for a seamless and compliant transaction process.

🛡️ Streamlined Exemption Certificate Management: Effortlessly manage customer exemption certificates. Numeral simplifies collection, validation, and verification, protecting your business during audits and ensuring you avoid accidental sales tax exposure from invalid exemptions.

✉️ Virtual Mailbox for Tax Mail: Stop drowning in sales tax paperwork. Numeral sets up a virtual mailbox to handle all your sales tax mail from state and local governments. We scan, read, and even respond on your behalf, keeping you organized and informed without the administrative hassle.

🤝 White-Glove Expert Support: Get expert guidance every step of the way. Numeral provides dedicated support via chat, email, or phone. Whether you have a quick question or need in-depth assistance, our team is here to help you navigate sales tax with confidence.

💯 On-Time Filing Guarantee: We stand by our service. Numeral guarantees your sales tax is filed on time, or we'll cover the penalties and interest. That's peace of mind you can count on.

Use Cases

Expanding Your Ecommerce Empire: Imagine your online store is booming, and you're now shipping products to several new states. Numeral's nexus tracking proactively alerts you to potential new sales tax obligations. With Autoregister, you can seamlessly register in these new states without lifting a finger, ensuring compliance as you grow your reach.

Scaling Your SaaS Globally: As your SaaS platform gains international traction, managing sales tax across different jurisdictions becomes overwhelming. Numeral's API integrates with your billing system, automatically calculating the correct sales tax for each customer, regardless of location or currency, ensuring accurate billing and compliance from day one.

Preparing for an Audit with Confidence: The thought of a sales tax audit can be daunting. Numeral's comprehensive platform provides a clear audit trail of all filings, payments, and exemption certificates. With everything meticulously managed and documented, you can face audits with confidence, knowing you're fully compliant and prepared.

Conclusion

Numeral isn't just another sales tax software; it's your dedicated sales tax autopilot. We understand the complexities and frustrations of sales tax compliance, and we've built Numeral to eliminate them. Reclaim your time, reduce your stress, and ensure accuracy with a solution designed to grow with your business. Stop letting sales tax hold you back. Start focusing on your growth, and let Numeral handle the rest.

FAQ

Q: How quickly can I get started with Numeral?

A: You can simplify your sales tax in less than 30 days. Day 1 involves signing up, connecting your billing platforms, and reviewing your free tax analysis. By Day 30, you'll be experiencing automatic tax filings and payments, staying compliant with ease.

Q: What if I already have existing sales tax registrations?

A: No problem at all. Numeral's onboarding process includes seamlessly transferring your existing registrations into our system, ensuring a smooth transition and comprehensive management from day one.

Q: Is the Tax Calculation API easy to integrate?

A: Yes! Numeral's API is developer-friendly and designed for fast integration. We also offer SDKs in Java, Python, and Ruby, along with comprehensive documentation to make the process as straightforward as possible, regardless of your tech stack.

Q: How does the On-Time Filing Guarantee work?

A: We are so confident in our automated filing system that we guarantee on-time filing. If, due to an error on our part, your sales tax isn't filed on time, Numeral will pay any resulting penalties and interest charges. This is our commitment to your peace of mind.

More information on Numeral

Top 5 Countries

Traffic Sources

Numeral Alternatives

Numeral Alternatives-

Kintsugi's AI automates sales tax compliance end-to-end. Eliminate complexity, proactively track nexus, & file returns to grow confidently.

-

Numeric is an AI-driven accounting platform. Simplify month-end close with close management, smart subledgers & AI analysis. Streamline processes, enhance accuracy. Trusted by leading companies.

-

Numra is an AI - powered platform for finance teams. It automates manual tasks, saves 70% of your team's time, slashes AP costs by 82%, and scales capacity. Secure, easy - to - integrate. Book a demo to streamline finance operations!

-

Nominal is an AI finance automation platform. Streamline workflows, accelerate consolidation, enhance reporting. Say goodbye to manual tasks. Book a demo!

-

april uses revolutionary AI to enhance and improve tax filing, estimation and preparation by integrating into any app or platform, driving new user interactions