What is Pinegap?

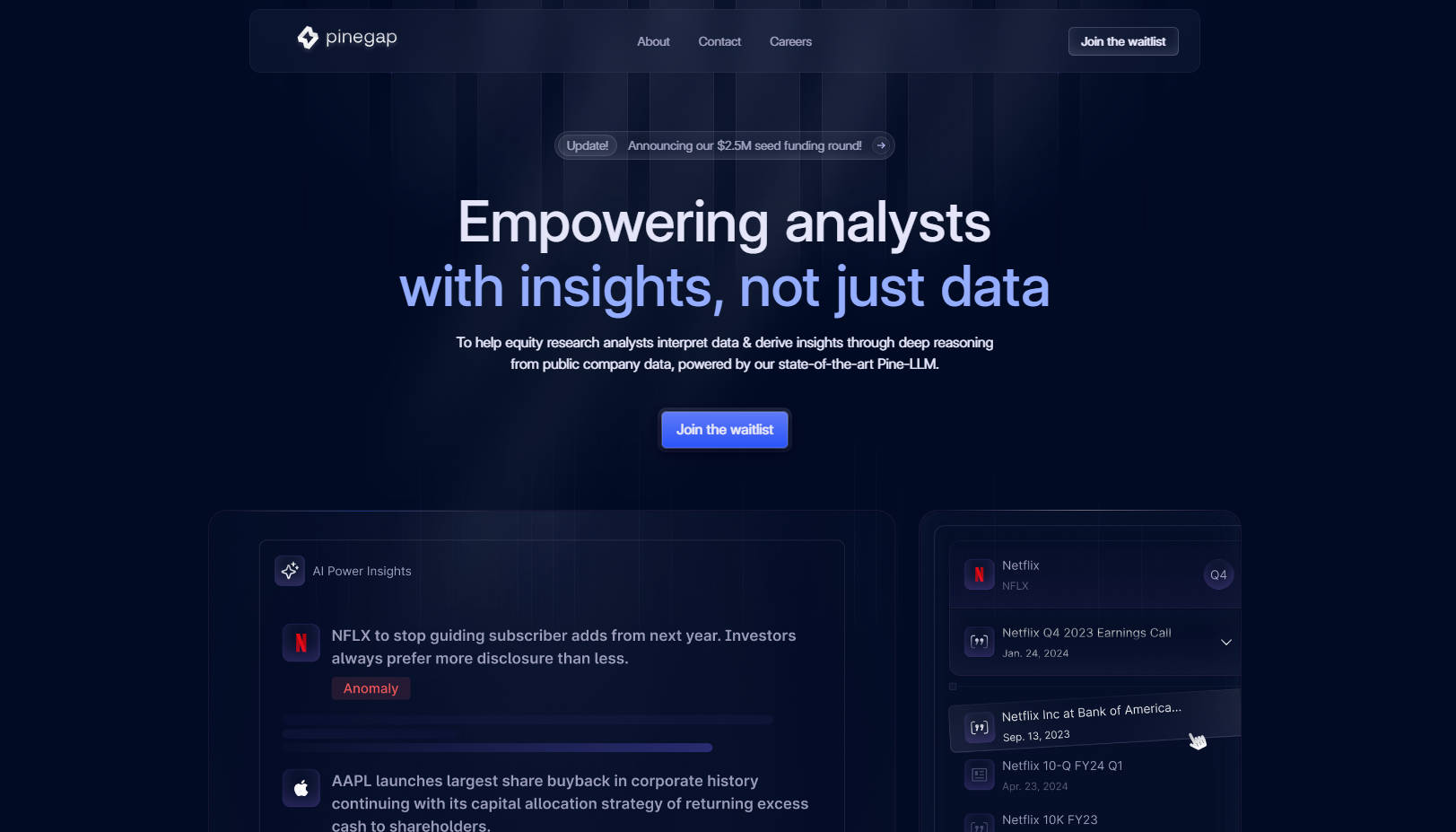

Pinegap is an innovative AI-powered equity research platform designed for professionals in Hedge funds, Mutual funds, and Investment Banks. By leveraging our proprietary Pine-LLM (Large Language Model), Pinegap transforms raw financial data into actionable insights. It doesn’t just hand you data—it provides deep reasoning and analysis, enabling equity research analysts to make informed decisions quickly and efficiently. With next-gen backtesting screeners and anomaly detection, Pinegap helps uncover hidden opportunities and risks that traditional methods might miss.

Key Features:

📊 Next-Gen Backtesting Screeners

Pinegap’s advanced screeners are backtested to deliver verified alpha, going beyond standard quantitative screening to find profitable investment opportunities.🧠 AI-Powered Deep Dive Analysis

Using our state-of-the-art Pine-LLM, Pinegap identifies anomalies in company filings compared to historical data and competitors, offering unparalleled financial reasoning.🔍 Contextual Data Comparison

Extract and compare contextual data not just from company filings but also across competitors and supply chain partners to gain a comprehensive view of the market landscape.⚡ Time-Saving Insights

Pinegap generates turbocharged analysis from a wide range of stocks, saving analysts 10-15 hours per week and allowing them to cover more stocks or dive deeper into research.

Use Cases:

Hedge Fund Analyst

Sarah, an equity research analyst at a hedge fund, uses Pinegap to run deep dive analyses on company filings. By comparing historical data and identifying anomalies, she uncovers red flags in a potential investment that traditional screeners missed, saving her fund from a costly mistake.Mutual Fund Manager

John, managing a team of analysts at a mutual fund, integrates Pinegap’s next-gen backtesting screeners into their workflow. The screeners identify undervalued stocks with verified alpha, allowing John’s team to make data-driven investment decisions that outperform the market.Investment Bank Associate

Emily, working in an investment bank, leverages Pinegap to compare contextual data across company filings and supply chain partners. This comprehensive analysis helps her team provide clients with robust insights for mergers and acquisitions, enhancing their advisory services.

Conclusion:

Pinegap is more than just a data platform—it’s a game-changer for equity research analysts. By harnessing the power of AI and advanced financial reasoning, Pinegap empowers users to interpret complex data, save valuable time, and uncover insights that drive better investment decisions. If you’re looking to elevate your equity research, Pinegap is the platform you’ve been waiting for.

More information on Pinegap

Top 5 Countries

Traffic Sources

Pinegap Alternatives

Load more Alternatives-

Stock Market GPT is the most advanced AI powered investment researcher. Get your personal Investment Researcher powered by advanced AI. Use AI to get a more in-dept understanding of your future investments.

-

FinanceGPT: AI financial analysis for investors & accountants. Research companies, plan investments, automate tasks. Try it now!

-

-

-

Hudson Labs AI for investors: Get high-precision insights from public markets. Analyze forensic risk & transform unstructured data into actionable alpha.