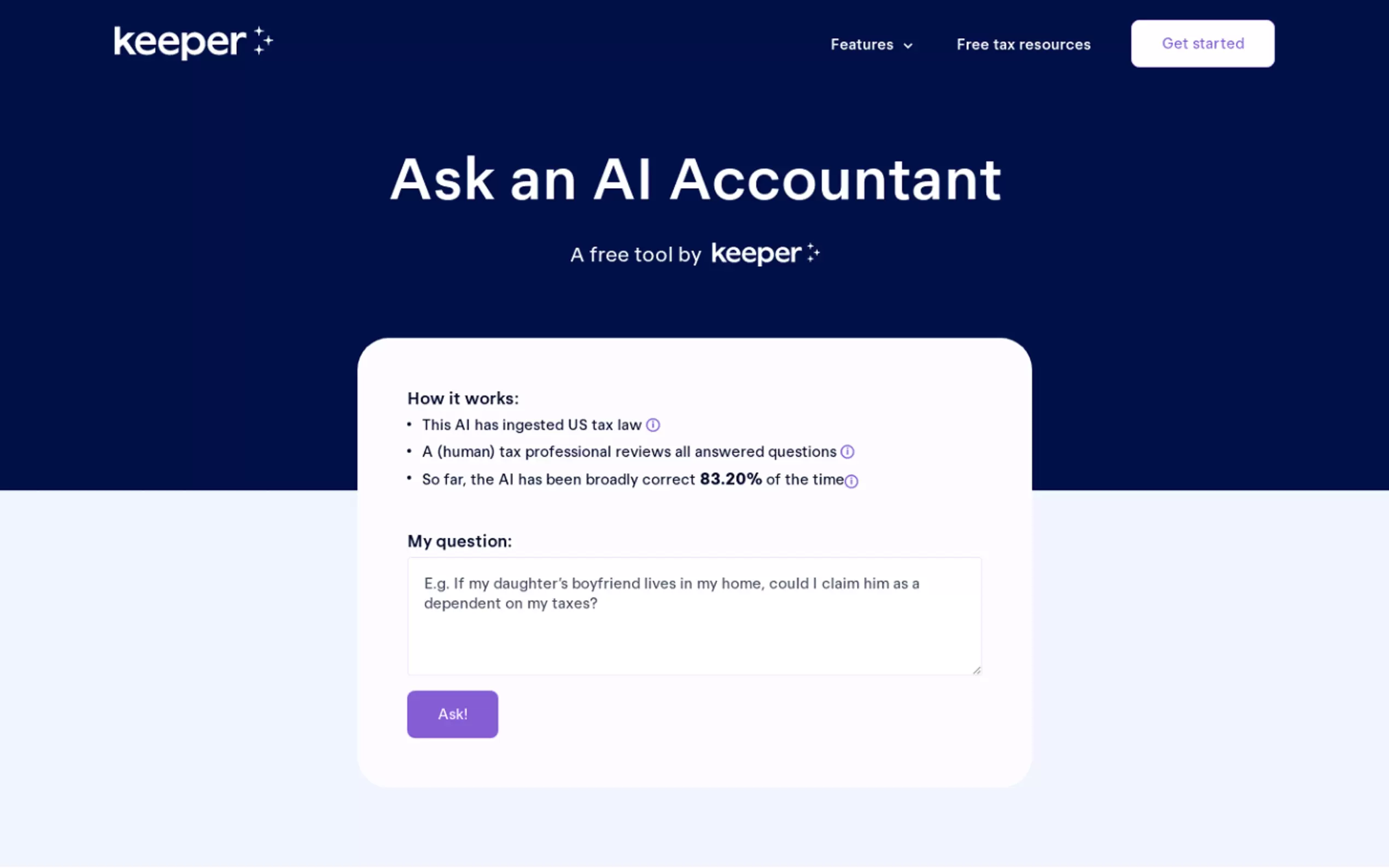

What is Ask an AI Accountant?

Ask an AI Accountant is a powerful software tool that provides users with instant answers to their tax-related questions. The latest version, V2.0, has undergone significant technical updates and improvements to enhance its accuracy and reliability. With this tool, users can quickly access up-to-date information on tax regulations and receive expert guidance without the need for extensive research or consulting with a human accountant.

Key Features:

1. Comprehensive Tax Knowledge: Ask an AI Accountant V2.0 is equipped with comprehensive embeddings that cover all federal US tax codes, state tax codes, and IRS announcements from the past ten years. This vast knowledge base allows the software to provide accurate and relevant responses to a wide range of tax-related queries.

2. Chain-of-Reasoning Retrieval System: The software utilizes a sophisticated chain-of-reasoning retrieval system to identify the most relevant vector embeddings for each question posed by the user. By analyzing these embeddings, it generates suitable responses based on sound reasoning and expertise.

3. Rigorous Evaluation System: To ensure high-quality answers, V2 underwent rigorous evaluation during its development phase. Dozens of human accountants provided expert grading of answers to establish correct responses accurately. This extended training period significantly improved the accuracy and relevancy of the software's output.

Use Cases:

1. Individual Tax Planning: Individuals can use Ask an AI Accountant V2.0 for personalized tax planning purposes by asking specific questions about deductions, credits, or any other aspect related to individual taxation in the United States.

Example Question: "Can I claim my gym membership fee as a deduction if I work as a basketball referee?"

Response (AI): "No, you cannot claim your gym membership fee as a deduction since it does not meet the criteria for ordinary and necessary business expenses."

2.Business Tax Compliance: Business owners can rely on the software to ensure compliance with tax regulations and make informed decisions regarding deductions, payroll taxes, and other business-related tax matters.

Example Question: "Can I claim per diem rates for business travel on a cruise ship?"

Response (AI): "No, you cannot claim per diem rates for business travel on a cruise ship due to specific IRS cruise conventions laws."

3. Tax Education and Research: Students, researchers, or anyone seeking to expand their knowledge of US tax law can utilize Ask an AI Accountant V2.0 as a valuable educational resource. The software provides accurate information based on extensive tax code embeddings.

Ask an AI Accountant V2.0 is a game-changer in the field of taxation. Its advanced features and comprehensive knowledge base empower individuals and businesses alike to navigate complex tax regulations with ease and confidence. With instant access to accurate answers from this reliable tool, users can save time, reduce errors, and make well-informed financial decisions. Whether it's individual tax planning or ensuring business compliance, Ask an AI Accountant V2.0 is your go-to solution for all your taxation needs.

More information on Ask an AI Accountant

Top 5 Countries

Traffic Sources

Ask an AI Accountant Alternatives

Load more Alternatives-

Explore a diverse range of AI chatbots on this platform, from tax advice to thought-provoking discussions. Find your perfect AI-powered experience.

-

Using Artificial Intelligence and Machine Learning Technology to Prepare and File Your Taxes.

-

Get quick and accurate answers to your tax questions with ZeroTax.ai's revolutionary AI-powered tax assistance tool. Try it risk-free today!

-

Taxly.ai is an advanced AI Powered tax app for individuals, freelancers, and self-employed professionals, streamlining tax filing with AI-automated estimations.

-

Your own AI Q&A,powered by ChatGPT,with only your content,in under 3 mins.Share it anywhere.