What is Brex?

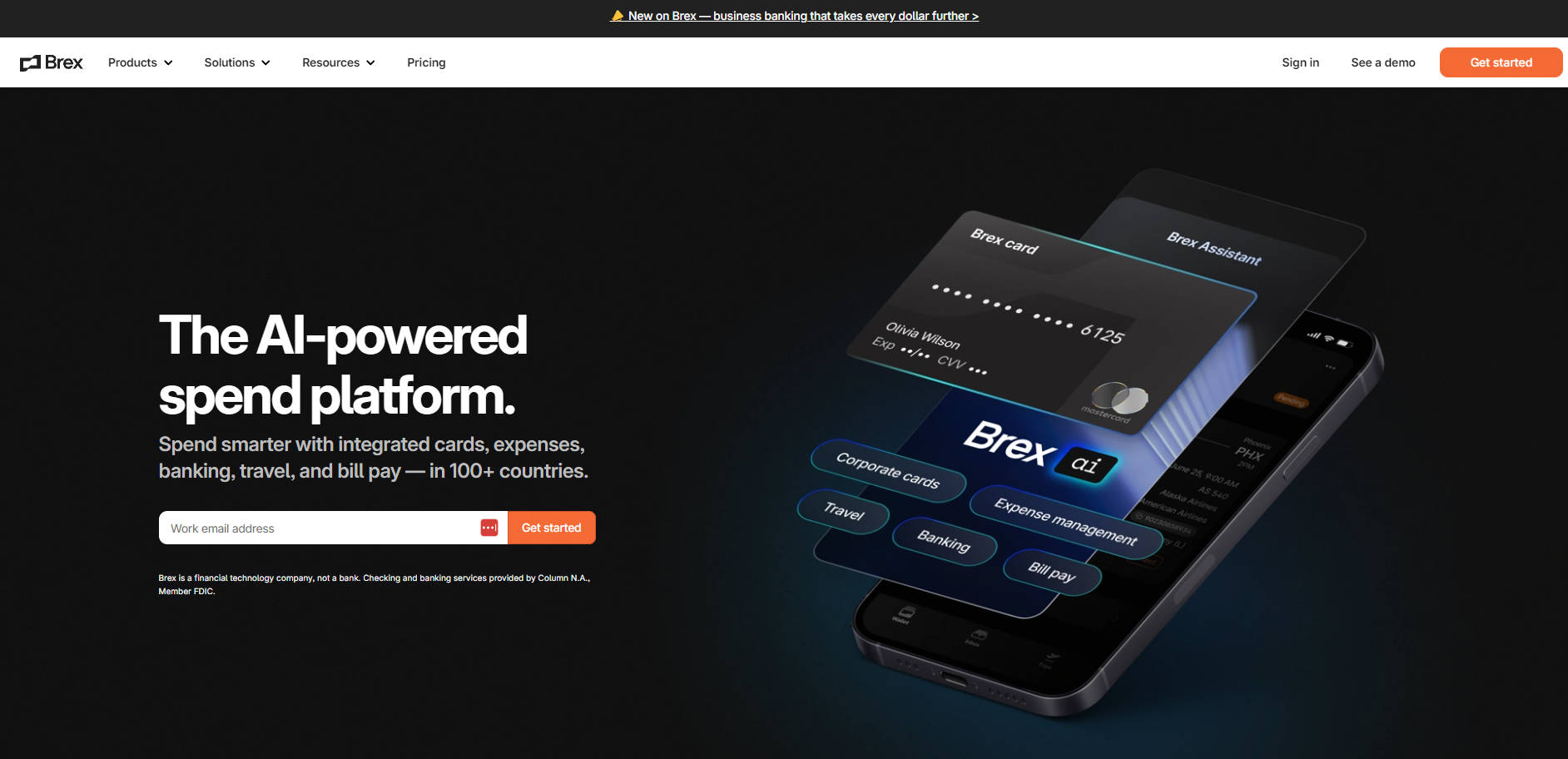

Imagine a world where your finance team gains superpowers, effortlessly managing spending, expenses, and growth with the touch of a button. Brex, an innovative spend management platform, makes it not just conceivable but a reality. By integrating AI into its suite of tools, including corporate cards, expense management, travel booking, bill pay, and banking services, Brex empowers businesses of all sizes to control spend, streamline accounts, and maximize every dollar spent. Enabled in over 100 countries, the platform offers a holistic financial stack catered to startups, mid-size firms, and enterprises, with savings, spending, and earning features that outshine traditional banking services.

Key Features: Brex's AI-Driven Acumen

-

Corporate Cards with Built-In Controls: Accelerate globally with enhanced spending power and enforceable controls, offering 20x higher credit limits and cash backs. Set budgets and allocate spend limits wisely.

-

AI-Powered Expense Management: Automate receipts and approvals with AI assistance, tracking expenses in real-time for seamless report generation. A five-star mobile app makes life easier for employees and managers alike.

-

Travel Simplification: Book and manage travel across the globe from the palm of your hand, ensuring compliance and ease of execution.

-

Bill Pay Automation: Save time and hassle with AI-driven invoice entry, approval, and payment processes. Issue vendor-specific cards for procurement with per-transaction limits.

-

Banking Services and High-Yield Earnings: Earn an impressive 4.90% yield with banking services that include savings, fast global payments, and up to $6 million in additional FDIC insurance. Safeguard capital and earn more, only with Brex.

Use Cases: Empower Every Business to Grow

-

Efficient T&E Management: Like DoorDash, gain efficiency for travel and expenses (T&E) with simplified employee guidance on spending.

-

International Expansion: For mid-size companies looking to go global, Brex offers comprehensive spend management tools that scale, ensuring financial visibility and control even as your horizons broaden.

-

Streamlined Corporate Accounting: Enterprises appreciate the ease of integration with their existing ERP systems, utilizing AI for accurate GL coding and creating a streamlined accounting process.

Conclusion: Unleash Your Financial Potential

Brex transforms the landscape of businesses through AI-enhanced financial management. The platform guarantees compliance, boosts capital, and saves significant time for finance teams. Start your journey with Brex today and unlock the full potential of your company's financial arsenal. Whether you're a startup looking for a complete financial stack or an enterprise wanting to simplify travel and expenses, Brex offers the solution you've been waiting for. Don't miss out; join the future of financial management now.

FAQs: Your Questions Answered

-

Q: What are the main benefits of using Brex's AI-powered platform? A: With Brex, users enjoy AI-powered automation saving on average 4,250 hours per year, a 4.90% yield on banking services, and a 99% policy compliance rate for employees on expense management.

-

Q: How does Brex ensure high compliance rates in expense reports? A: Brex employs AI to automate receipts, approvals, and expense tracking in real-time. The user-friendly design and centralized platform encourage proper spending and reduce errors.

-

Q: Can I trust the banking services provided by Brex? A: Banking and saving services through Brex are secure and high-yield, with up to $6 million in additional FDIC insurance offered through program banks. Your capital is safeguarded and your returns are optimized.