What is FlyFin?

FlyFin is an AI-powered tax service that simplifies the process of filing self-employed taxes. It offers a user-friendly app that helps freelancers and small business owners organize their expenses, find deductions, and file their taxes effortlessly. With FlyFin, users can save time and money by automating the tedious tasks associated with tax preparation.

Key Features:

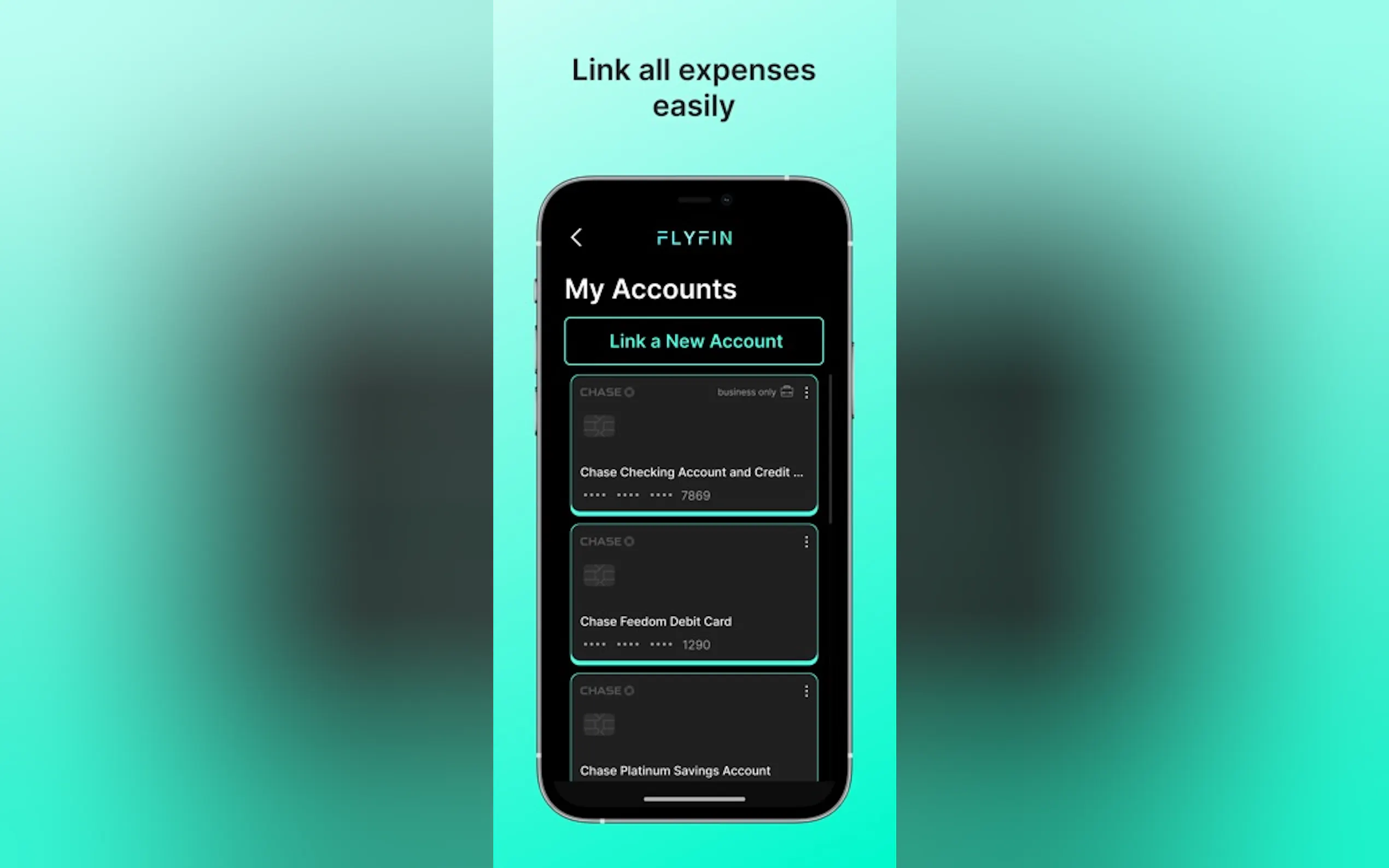

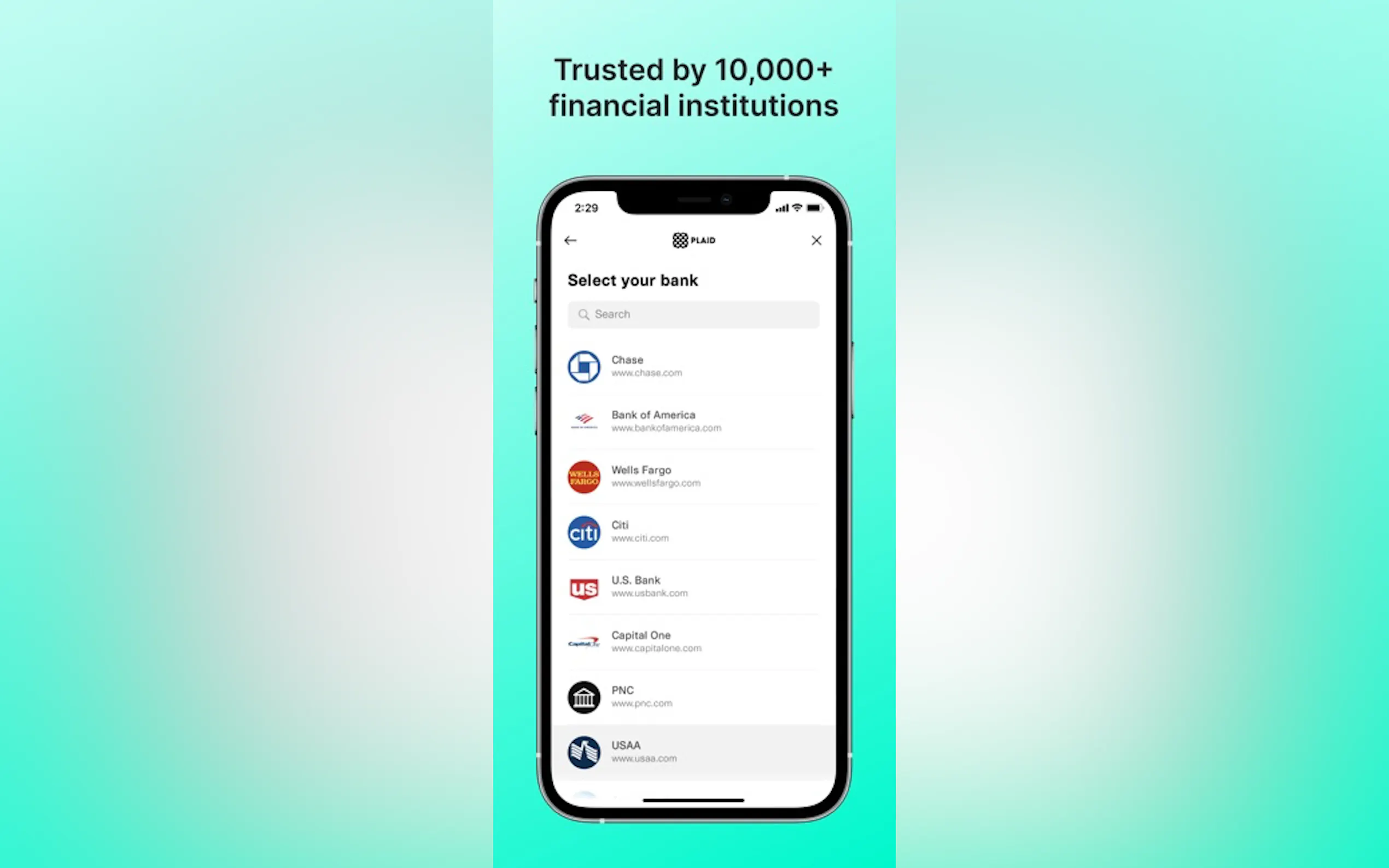

1. Expense Organization: The FlyFin app automatically categorizes and organizes expenses, making it easy for users to track their business-related transactions. By syncing with bank accounts or credit cards, the software captures all relevant financial data in one place.

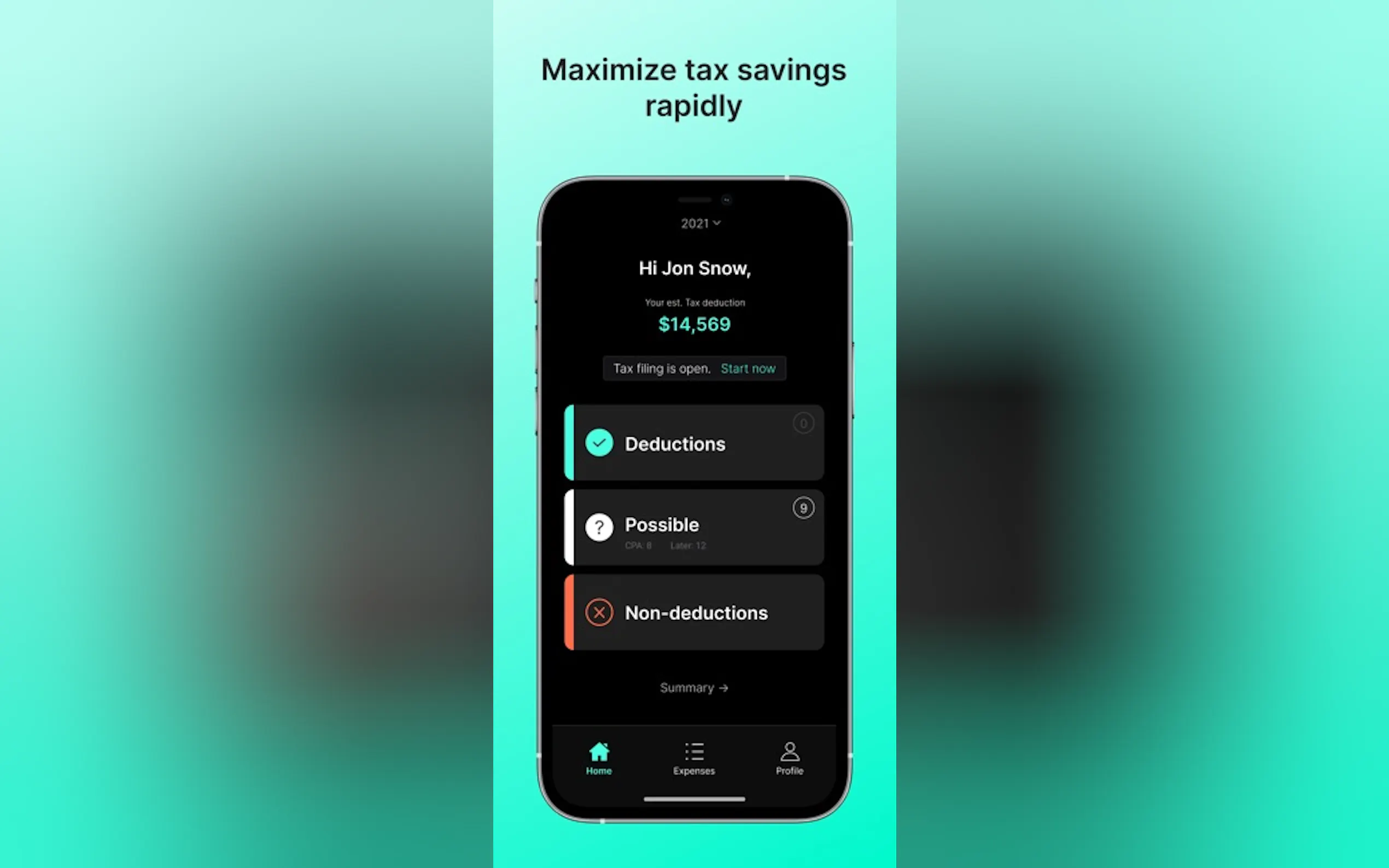

2. Deduction Identification: One of FlyFin's standout features is its ability to identify potential tax deductions specific to self-employment. The AI technology analyzes expense patterns and industry standards to uncover deductible items that might have been overlooked otherwise.

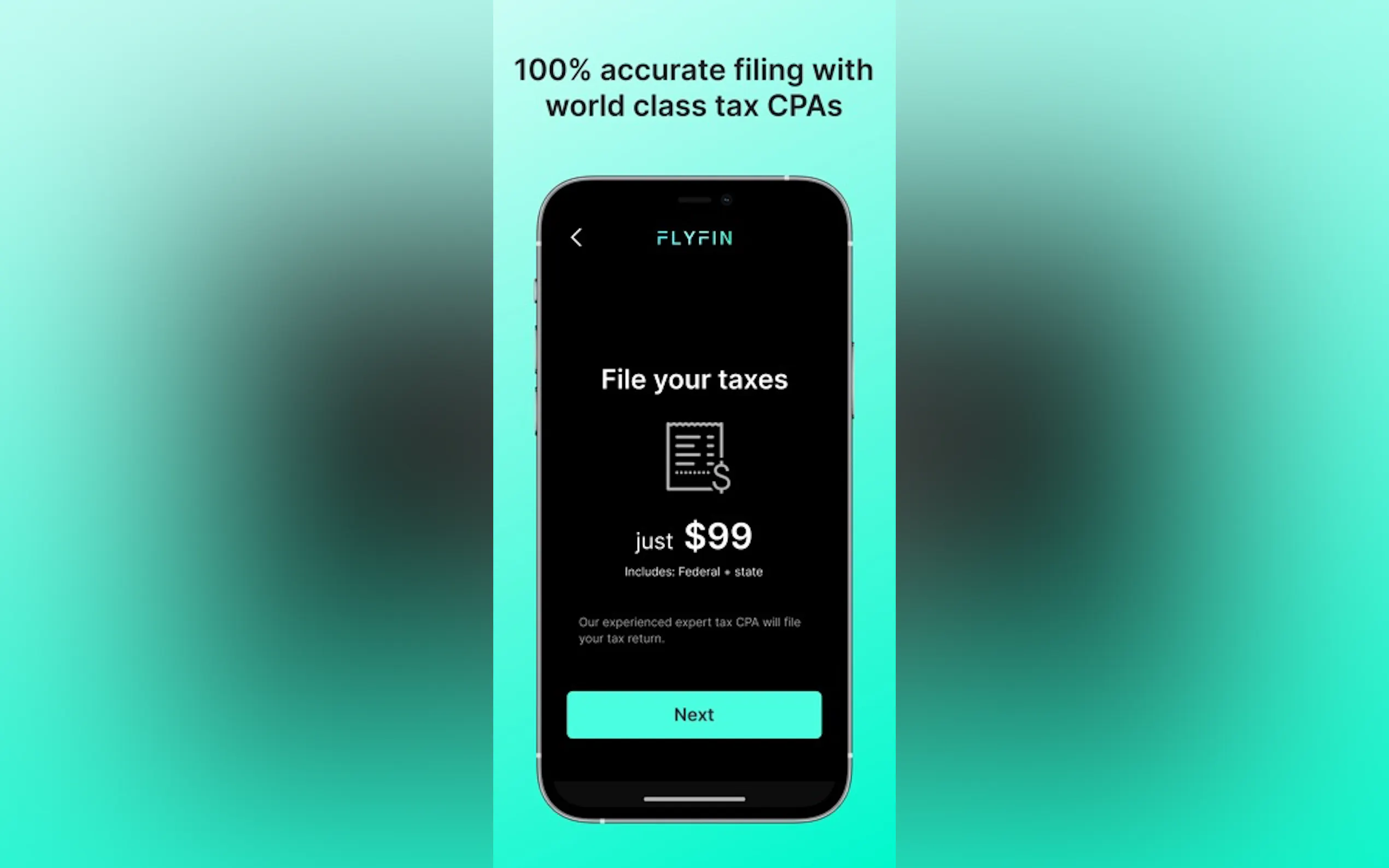

3. Tax Filing Assistance: FlyFin goes beyond just organizing expenses; it also provides expert assistance in filing taxes accurately and efficiently. Users can rely on a team of certified CPAs who are available to answer questions, review returns, and ensure compliance with tax regulations.

Use Cases:

1. Freelancers: For freelancers working across various industries such as writing, design, or consulting services, FlyFin streamlines the process of tracking income and expenses related to their work. It identifies deductions unique to each profession while providing personalized support from CPAs familiar with freelance taxation.

2. Small Business Owners: Entrepreneurs running small businesses can benefit from FlyFin's comprehensive expense organization system tailored specifically for self-employed individuals like themselves. By automating expense tracking and deduction identification processes, they can focus more on growing their business rather than getting lost in paperwork during tax season.

3. New Self-Employed Individuals: Those new to self-employment often struggle with understanding what qualifies as a deductible expense or how best to navigate complex tax forms correctly without professional help.FlyFin simplifies this process by providing an intuitive app and access to a team of tax experts who can guide them through the filing process.

Conclusion:

FlyFin is revolutionizing the way self-employed individuals manage their taxes. By leveraging AI technology, it offers a user-friendly solution that automates expense organization, identifies deductions, and provides expert assistance in tax filing. Whether you're a freelancer or small business owner, FlyFin saves time and money while ensuring accurate and compliant tax returns. Say goodbye to the stress of tax season with FlyFin's effortless approach to self-employed taxes.

More information on FlyFin

Top 5 Countries

Traffic Sources

FlyFin Alternatives

FlyFin Alternatives-

Taxly.ai is an advanced AI Powered tax app for individuals, freelancers, and self-employed professionals, streamlining tax filing with AI-automated estimations.

-

Fiskl is the most advanced mobile invoicing software for small businesses and freelancers. Track time, mileage, expenses and manage products, services, tasks and clients.

-

Finlens is your AI co-pilot for accounting. Built for founders and accountants who use QuickBooks and other legacy tools but still find themselves buried in receipts, spreadsheets, and slow month-end closes. We bring speed & sanity to your financial workflow.

-

Finpilot is an AI copilot for finance to speed up investment research. Financial analysts can use it to scour financial data, analyze companies, write reports, and visualize data — all from verifiable sources.

-

Keeper simplifies freelance & self-employed taxes. AI finds deductions, experts review your return. File confidently, maximize savings.