What is Kniru?

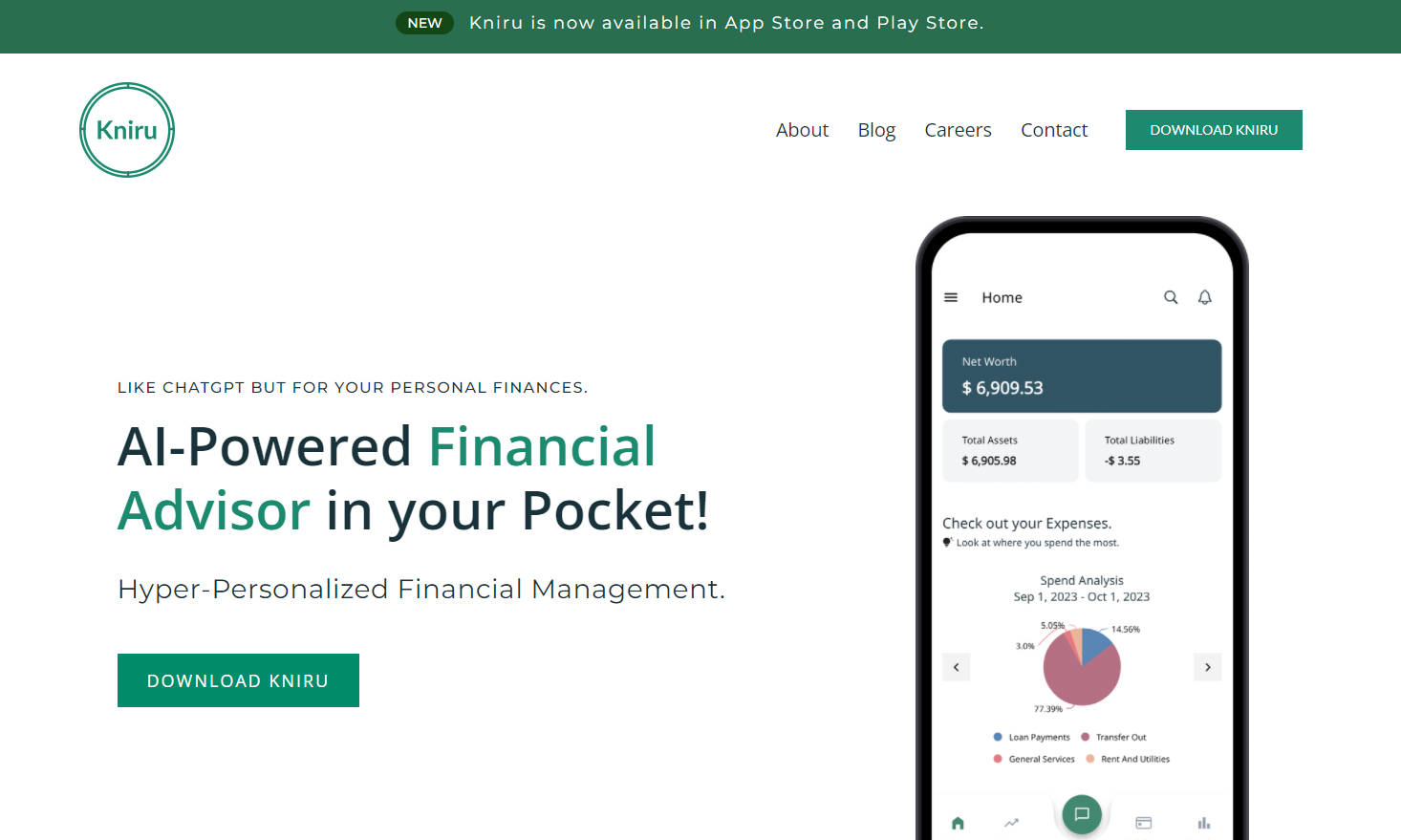

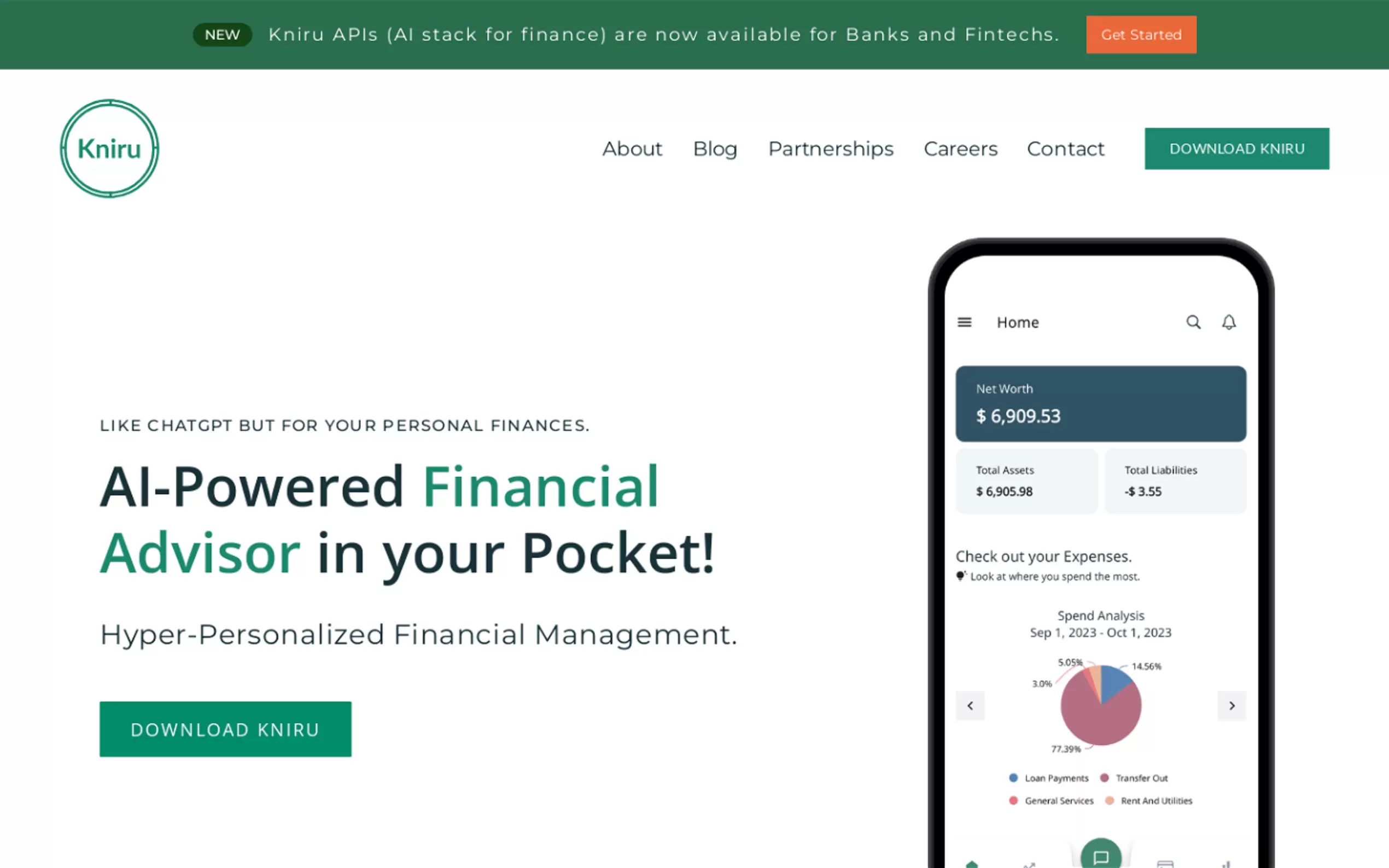

Kniru is an AI-powered finance software that offers enhanced visibility and insights into your assets, liabilities, and financial data. With its intuitive dashboards, you can easily track your bank accounts, investments, real estate properties, loans, and credit cards. Additionally, Kniru provides valuable spend analysis and subscription management features.

Key Features:

1. Assets Dashboard: Kniru's assets dashboard allows you to monitor all your financial holdings in one place. You can effortlessly keep track of your bank accounts, investment portfolios, and real estate properties.

2. Liabilities Dashboard: The liabilities dashboard enables you to stay on top of your debts by providing a comprehensive overview of your loans and credit card balances.

3. Insights: Kniru goes beyond basic tracking by offering insightful analysis tools. With spend analysis features, you can gain a deeper understanding of where your money is going and make informed decisions about budgeting and saving. Additionally, the software helps manage subscriptions efficiently.

Use Cases:

1. Personal Finance Management: Whether you're an individual or a family looking to streamline their finances, Kniru simplifies the process by consolidating all financial information in one place.

2. Investment Tracking: Investors can benefit from Kniru's asset dashboard as it allows them to monitor their investment portfolios' performance without having to navigate multiple platforms.

3. Debt Management: By utilizing the liabilities dashboard feature offered by Kniru software users can effectively manage their loan payments and credit card balances.

Kniru revolutionizes personal finance management with its AI-powered capabilities that provide unparalleled visibility into assets like bank accounts investments as well as liabilities such as loans & credit cards.The platform also offers valuable insights through spend analysis tools for better budgeting decisions.Additionally,Knirusubscription management feature ensures efficient handling of recurring expenses.With its user-friendly interfaceand powerful functionalities,Knirutransforms how individuals,families,and investors approach managing their finances.