What is PlusE?

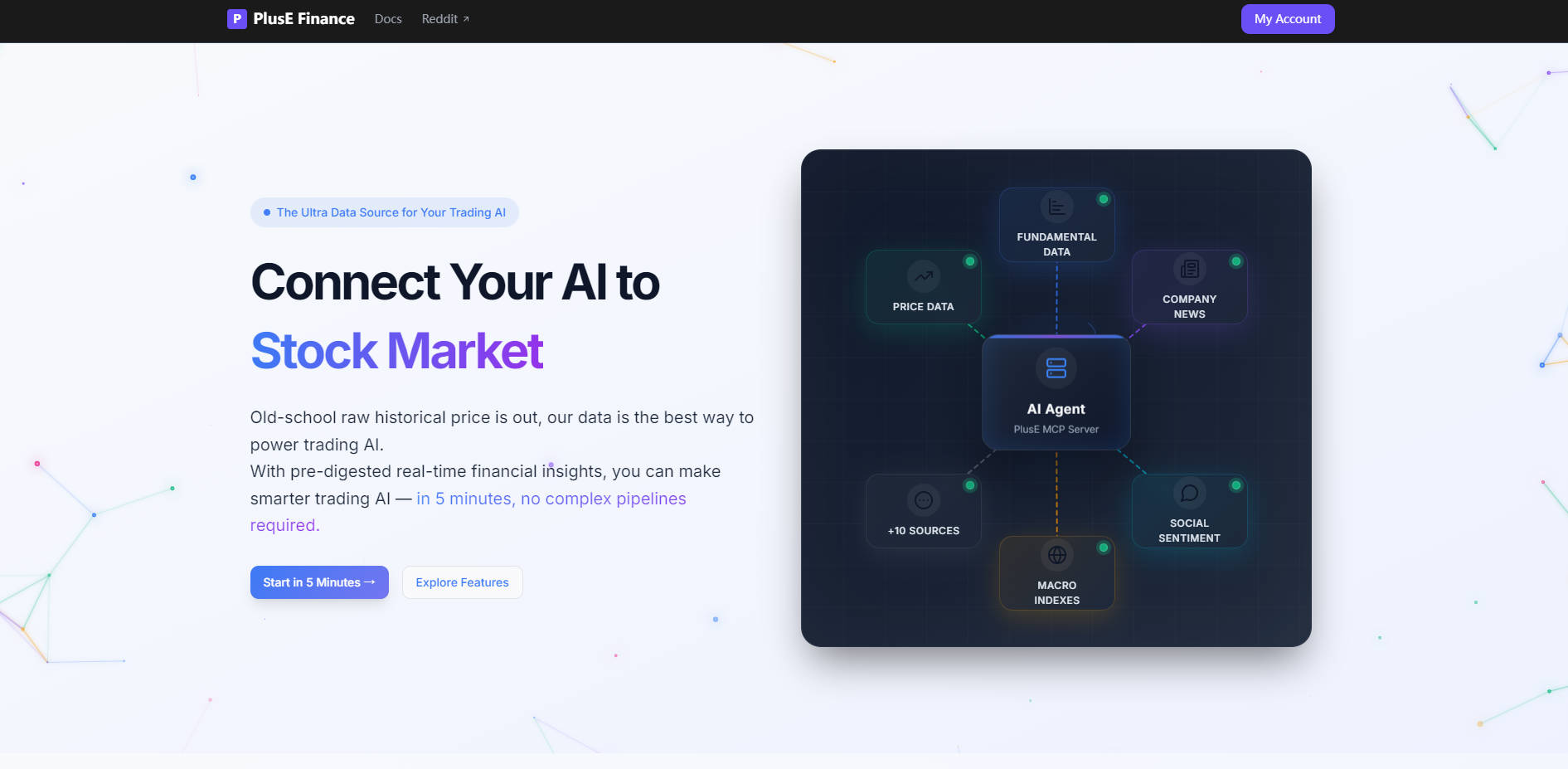

PlusE is an advanced, ML-powered financial intelligence service designed specifically as the "Ultra Data Source for Your Trading AI." It addresses the critical challenge faced by quant traders and hedge funds: converting massive, chaotic market data into high-density, AI-ready trading intelligence instantly. Leveraging its revolutionary Model Context Protocol (MCP), PlusE empowers developers to deploy smarter, faster, and more accurate trading models in minutes, bypassing complex, time-consuming data pipelines.

Key Features

PlusE transforms raw financial feeds into immediate, actionable context, allowing your AI to focus on strategy rather than data processing.

🧠 LLM-Optimized Signals and Formats

PlusE delivers pre-digested insights in formats your AI and LLMs can understand immediately. Rather than feeding raw, token-intensive data, PlusE condenses complex market dynamics into natural language signals and high-density abstractions. This optimization not only accelerates processing but also achieves significant cost savings by reducing token consumption by up to 80%.

🛡️ Noise-Free Intelligence with Confidence Scoring

Raw market data is often filled with noise that can derail automated trading decisions. PlusE employs multiple machine learning layers to filter out irrelevant fluctuations and highlight genuine signals. Every abstraction is accompanied by predictive secondary indicators, including confidence scores and risk assessments, ensuring the intelligence fed to your AI is validated and trustworthy.

⚡ Real-Time Signal Detection and Summarization

The service continuously monitors trends, volatility, and volume, providing intelligent data summarization in real time. Advanced anomaly detection models continuously scan for unusual market behavior, ensuring your AI is immediately alerted to potential opportunities or rapidly evolving risks, enabling faster response times than manual pipeline processing.

📊 Integrated Analytical and Sentiment Tools

PlusE includes built-in analytical capabilities that deliver immediate value. It aggregates and processes multi-source sentiment analysis—combining news, social media feeds, and analyst reports—into actionable emotional indicators. This integrated sentiment-driven intelligence, alongside technical analysis and trend prediction, is instantly available to your models without requiring additional integration steps.

Use Cases

PlusE is built to streamline the development lifecycle and enhance the performance of automated trading systems.

1. Rapid AI Agent Deployment (5-Minute Integration) Instead of spending weeks building custom data ingestion and preprocessing pipelines, you can integrate PlusE's Model Context Protocol (MCP) server directly into your existing AI workflow in as little as five minutes. This plug-and-play capability allows individual quant developers to move from idea to live testing with unprecedented speed, drastically reducing the time-to-market for new trading strategies.

2. Enhancing Model Accuracy and Reducing Hallucination PlusE directly addresses two critical issues in AI trading: false signals (hallucinations) and suboptimal decision quality. By supplying ML-filtered, validated data abstractions instead of noisy raw indicators, users report up to a 75% reduction in AI false signals and a 50% boost in overall trading signal quality, leading to more reliable and profitable strategies.

3. Seamless Integration of Financial Data Tools The HTTP Streamable MCP standardizes how financial data tools connect to AI models. This means developers can seamlessly connect diverse data sources (e.g., specific technical indicators, specialized news feeds) directly to their LLMs or trading agents via a unified protocol, simplifying the architecture and improving system maintainability.

Unique Advantages

PlusE is designed from the ground up to serve the unique needs of AI, providing quantifiable benefits that go beyond traditional data feeds.

| Metric | PlusE Advantage | Traditional Manual Pipeline | Value Proposition |

|---|---|---|---|

| Data Processing Speed | 2.3 seconds (for 1,000 tickers, TA, and sentiment) | 45 seconds (Polygon + TA Lib) | 90% Faster Signal Delivery: Provides real-time context before market opportunities vanish. |

| Token Consumption | Up to 80% Token Saving | High raw data volume | Significant Cost Reduction: Pay for intelligent insights, not raw data volume, lowering LLM processing costs. |

| Integration Time | 5-Minute Integration (via MCP) | Weeks (custom API and pipeline development) | Accelerated Development: Focus engineering resources on strategy, not infrastructure. |

| Signal Quality | 50% Accuracy Boost | Standard raw indicators | Superior Performance: ML filtering ensures higher quality, more reliable trading decisions. |

| False Signal Reduction | 75% Less Hallucination | High risk due to noisy data | Increased Trust: Reliable data abstractions reduce AI errors and improve trust in automation. |

Conclusion

PlusE shifts the paradigm from simple raw data ingestion to intelligent context delivery. By providing pre-digested, noise-free, and highly efficient financial signals, you can focus entirely on refining model logic and achieving superior trading performance with unprecedented efficiency. Explore the free Trial plan and see how PlusE transforms your AI trading workflow today.