What is Omni:us?

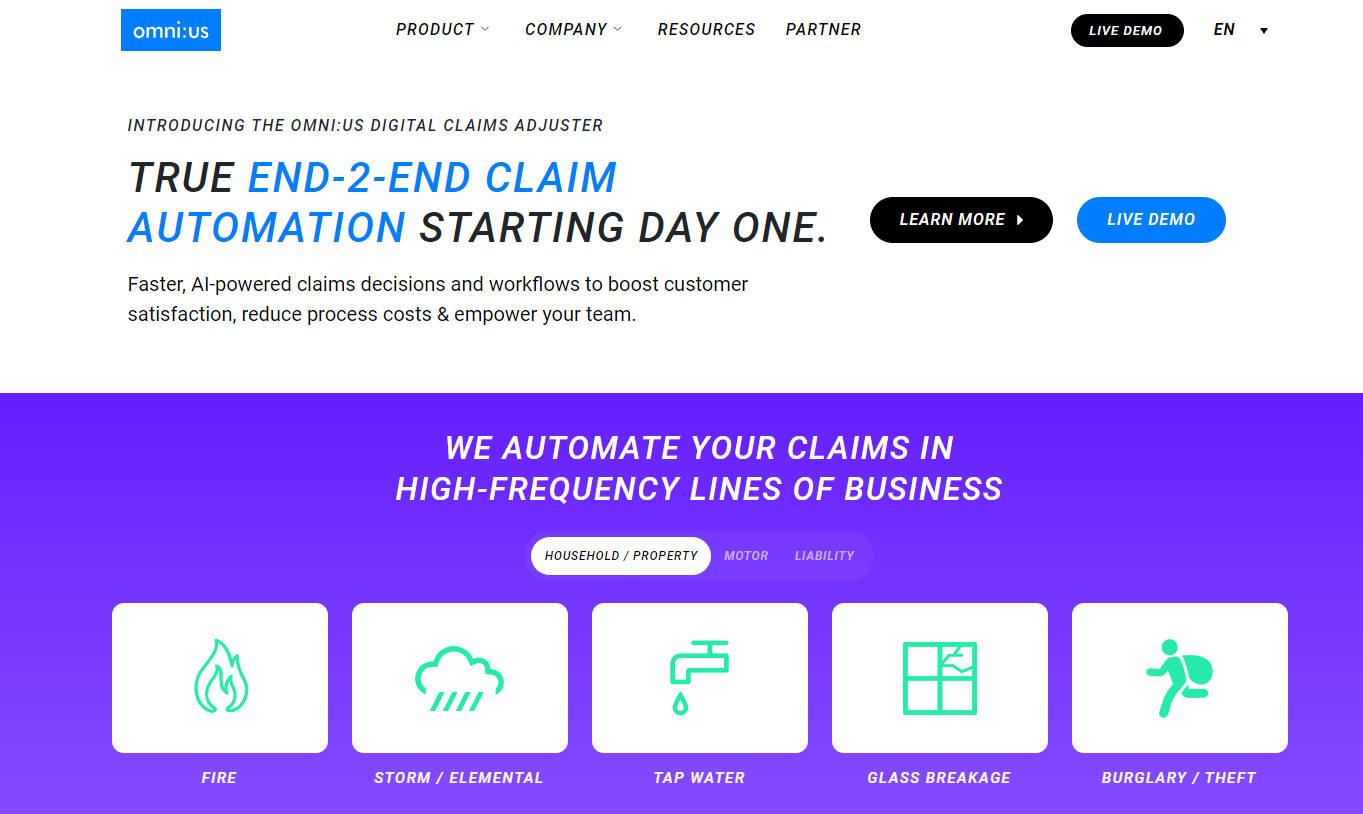

omni:us Digital Claims Adjuster is an AI-powered tool that automates insurance claims processes, resulting in faster decisions and workflows, improved customer satisfaction, and reduced costs. It seamlessly integrates with existing insurance systems and offers reference claims processes, an AI-powered claims decision catalogue, and easy access to relevant policy and claims information.

Key Features:

1. Reference Claims Processes: The software provides out-of-the-box reference processes for rapid implementation and optimized claims processing.

2. Claims Decision Catalogue: Pre-trained AI models automate complex settlement decisions while alerting adjusters to red flags that require human attention.

3. Integration with Core Systems: The tool easily integrates with major core and legacy systems to access relevant policy and claims information.

Use Cases:

1. Streamlined Claims Processing: omni:us enables insurers to automate low to medium severity claims from First Notice of Loss (FNOL) to payment creation without human intervention, improving efficiency.

2. Complex Claim Assistance: For more complex claims, the software takes over tedious tasks so that human adjusters can focus on damage assessment.

3. Transformation Process Support: omni:us helps insurers become data-driven organizations by expanding their skills through deep domain expertise, new technologies, stakeholder involvement, process awareness, and continuous learning.

Conclusion:

The omni:us Digital Claims Adjuster revolutionizes insurance claim automation by providing end-to-end automation solutions that enhance customer satisfaction while reducing costs for insurers. With its seamless integration into existing systems, pre-trained AI models for complex settlement decisions, and easy access to relevant data sources, this tool empowers insurers to streamline their claim processes efficiently. By leveraging advanced AI technology combined with industry expertise through partnerships with leading consultants worldwide,

omni:us delivers transformative success stories in the insurance industry.